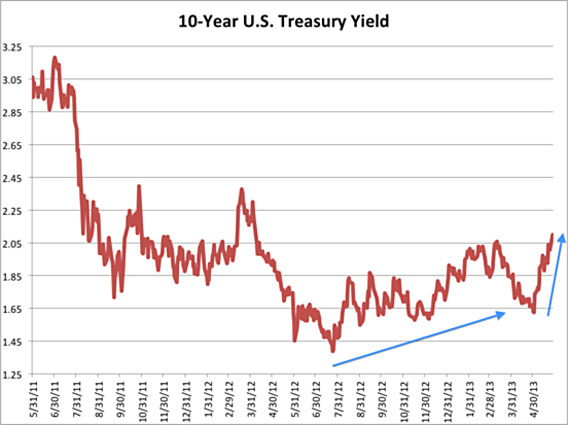

The bond market has been hammered this week by rising interest rates. The chart below from Business Insider, however, shows that rates are rising from a very low level.

The primary cause appears to be concerns about the end of the Federal Reserve’s quantitative easing program, under which it has been purchasing $85 billion per month of bonds.

When demand for bonds is high, they rise in price. When the price of a bond rises, the effective interest rate falls. Thus, falling interest rates means rising bond prices and rising interest rates mean falling bond prices.

According to the Federal Reserve, total credit market debt in the U.S. is about $57 trillion. Thus any rise in interest rates threatens to impose severe capital losses on bond holders. There are also concerns that interest-sensitive sectors of the economy, especially housing, will suffer if rates rise.

However, one cannot solely focus on interest rates divorced from the economic circumstances in which they occur. There are lots of reasons why interest rates rise, some good, some bad. At the moment, I am inclined to think that the reasons for rising rates are mostly positive.

In theory, interest rates are just a measure of the discount between present consumption and future consumption. They measure how much compensation people would need to put off consumption today in return for being able to consume more at some point in the future.

But of course, market rates embody many more considerations. The supply and demand for saving is critical. On the demand side, government borrowing is important. On the supply side, the Federal Reserve is important – the Fed buys bonds, notes and bills as part of its monetary policy and injects funds into credit markets when it does so.

The propensity of households and businesses to save also affects the supply of funds available to borrow, with investment being the main driver of demand. Businesses borrow to invest in new plant and equipment, while households borrow to buy homes, cars and other durable goods, as well as for consumption.

In recent years, saving has been high as businesses and households have been worried about the future and wanted more precautionary saving as a cushion against risk. At the same time, weak consumer demand has reduced the need for business investment and falling home prices reduced the demand for mortgages.

Thus a rising economy will necessarily raise interest rates. Businesses will borrow more for investment, households will borrow to buy houses and cars, and both businesses and households will reduce their saving. This is a good thing up to a point.

Another key factor affecting market interest rates is expectations of inflation. Generally speaking, a one percent rise in expected inflation will raise long-term interest rates by one percent.

But for some time, our economy has been suffering from deflation, with prices for many things such as houses falling in price. Many commodity prices are still showing weakness.

Deflation obviously lowers market interest rates, but also reduces growth, investment and employment. On balance, deflation is bad, economically. Most economists believe that a small rise in inflation would be highly beneficial to the economy. But one consequence would be higher interest rates. Again, this would be a good thing.

Finally, it’s obvious that interest rates have been well below “normal” for some time. Pick any period of time in which the economy was doing well that you care to and look at and you will see that interest rates were considerably higher than they are today. Therefore, higher interest rates are not incompatible with an improving economy.

On the flip side, rising rates are highly beneficial to savers who have suffered from low interest income for years and encouraged seniors to take on more risk than they would like to get a decent return. Rising rates benefit defined-benefit pension funds because low rates inflate their liabilities. And rising rates may spur potential homebuyers to get off the fence and commit to buying a house now before rates rise further.

Keep in mind also that when people sell bonds to avoid losses from rising rates, they have to buy something else. That something else will be stocks, in many cases, which will push the stock market higher as investors rotate out of bonds and into stocks. Rising stock prices will also allow businesses to issue stock for investment and to retire their bonds.

In short, there are pluses and minuses to rising rates and they depend a great deal on the reason why rates are rising. Insofar as the Fed is concerned, everyone has known that the Fed would not continue quantitative easing forever and that the end would likely come sooner than later. But that is only one economic factor affecting interest rates. On balance, I think rising rates are a good thing and we should focus on the potential benefits, rather than dwelling on the negative consequences.