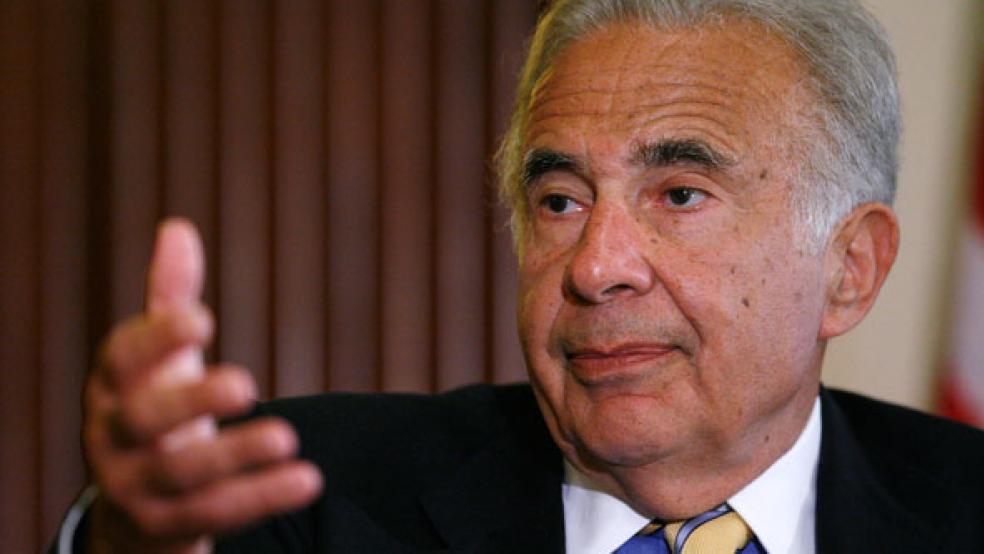

The very public temper tantrum of Bill Ackman may be casting activist investors in a negative light these days, but that hasn’t stopped Apple’s (NASDAQ: AAPL) stock from rallying more than 7 percent to above $500 a share on a couple of tweets from Carl Icahn:

We currently have a large position in APPLE. We believe the company to be extremely undervalued. Spoke to Tim Cook today. More to come.

— Carl Icahn (@Carl_C_Icahn) August 13, 2013

Had a nice conversation with Tim Cook today. Discussed my opinion that a larger buyback should be done now. We plan to speak again shortly.

— Carl Icahn (@Carl_C_Icahn) August 13, 2013

Icahn is hardly alone in drawing the conclusion that Apple is “extremely undervalued.” Veteran mutual fund manager Bill Miller of Legg Mason has owned Apple for more than a year now, betting that investors would recognize how absurdly low its valuation is relative to fundamentals, including the company’s famously large mountain of cash. Icahn has an idea of what he wants to see happen to that cash, which he disclosed in his tweets: “Discussed my opinion that a larger buyback should be done now” in a chat with Apple CEO Tim Cook.

The problem? Apple’s slump in value isn’t due to Cook’s reluctance to share the wealth with shareholders, but to the fact that the company’s margins have been under pressure for more than a year. Its product line is maturing, and Google’s (NASDAQ: GOOG) rival Android operating system has eroded Apple’s former dominance in the smartphone market.

On the horizon? Well, the company reportedly plans to launch a new, lower-priced version of its iPhone. But so far, there are few signs of another game-changing device emerging from Apple’s R&D wizards to follow in the footsteps of the iPod, the iPhone and the iPad.

So all that Icahn can offer, really, is a chance of putting pressure on the company to unlock the value of the cash. That’s not nothing, but it’s not the kind of business turnaround that you’d want as a long-term owner of Apple stock. Moreover, yet another tug of war between Cook and an activist investor – following hard on the heels of the similar campaign waged by David Einhorn – isn’t going to help the company’s leadership focus its collective attention on finding a way to boost margins.

That challenge may be tricky: The reality is that Apple has slowly morphed from being a cutting-edge technology company to a retailer of high-end technology devices. And those margins may never be quite as alluring again, unless Icahn finds a way to unlock not only the company’s cash reserves but also a stream of creativity and technological innovation.