(Reuters) - The Philadelphia Federal Reserve on Monday named Patrick Harker, one of its directors and the head of the University of Delaware, as its president and the newest U.S. monetary policymaker.

Harker, 56, begins the job July 1 and succeeds Charles Plosser, an outspoken and hawkish Fed official who retired on Sunday after more than eight years at the helm. Relatively unknown on the national economic scene, Harker sat on the Philadelphia Fed board's committee that conducted the search for a new president. A spokeswoman for the regional Fed bank said he recused himself from the process once he became a candidate, but did not give further details.Harker, who has a Ph.D in civil and urban engineering, will join the U.S. central bank just as it looks to raise interest rates after more than six years of unprecedented accommodation. Markets globally are focused on the timing and the ultimate path of rate hikes as mid-year approaches.An initial review of Harker's published research gives little indication of his policy leanings. In early 2013, he said in a speech that the slow economic recovery was due in part to bruised consumer confidence and "stalemates and brinkmanship" among fiscal policymakers, and that the recovery would bring needed adjustments to the labor market."It is valuable to ... the Fed to have a diversity of views," Plosser, now retired, told reporters on the sidelines of a gathering in Washington on Monday. Harker is "smart and capable" and, as an engineer and manager, he has "a great set of skills."The announcement surprised many Wall Street economists, who had not heard of Harker. One wrote in an e-mail: "Patrick Who?" Others noted that his appointment continued a trend of naming Fed insiders to such posts: nine of the other 11 regional Fed presidents came from within the central bank's ranks. SKILL SETHarker's more than 150 publications appear to have little to do with monetary policy, but suggest a fluency in some of the hottest topics for the banks he will help supervise as head of the Philadelphia Fed, including extensive analyses of banking performance, the role of technology and cyber security.His publications also reveal an expertise in topics that appear to have little relevance to his new job, including optimal scheduling for rail and air traffic.Harker was named a White House Fellow in 1991 by former President George H.W. Bush and later was special assistant to the director of the Federal Bureau of Investigation. He is a former trustee of the Goldman Sachs Trust, and dean of the Wharton School of the University of Pennsylvania, where he earned his Ph.D and a masters degree in economics.He has been president since 2007 at the University of Delaware, where he taught some business and engineering courses, and advocated for school expansion. A published column that urged cost cuts and a new approach to a university mission drew criticism from a teachers union, according to recent press reports. Harker will resign his position at the university and take Plosser's seat at Fed meetings starting with one on July 28-29, though he will not have a vote on policy until 2017 under a rotating system. Blake Prichard, the Philadelphia Fed's first vice president, is now the acting president. The Washington-based Fed Board of Governors, including Chair Janet Yellen, interviewed Harker and approved his appointment."I would note that selecting a member of their own board of directors continues the pattern of Fed regional banks selecting Fed insiders," said Aaron Klein, a director at the Bipartisan Policy Center think tank.The Dallas Fed is also seeking a new president.A lifelong resident of Pennsylvania and neighboring Delaware, Harker will likely take a big pay cut. He earned more than $700,000 in the 2011-2012 academic year, while Plosser received $350,400 in 2013, according to the most recent data available.Harker did not immediately return a call requesting comment. A Philadelphia Fed statement quoted him as saying he was excited to continue its "vital service" to the country. (Additional reporting by Ann Saphir in San Francisco, and Michael Flaherty and Howard Schneider in Washington; Editing by Bernadette Baum, Dan Grebler and Chizu Nomiyama)Philadelphia Fed names Patrick Harker as Plosser's successor

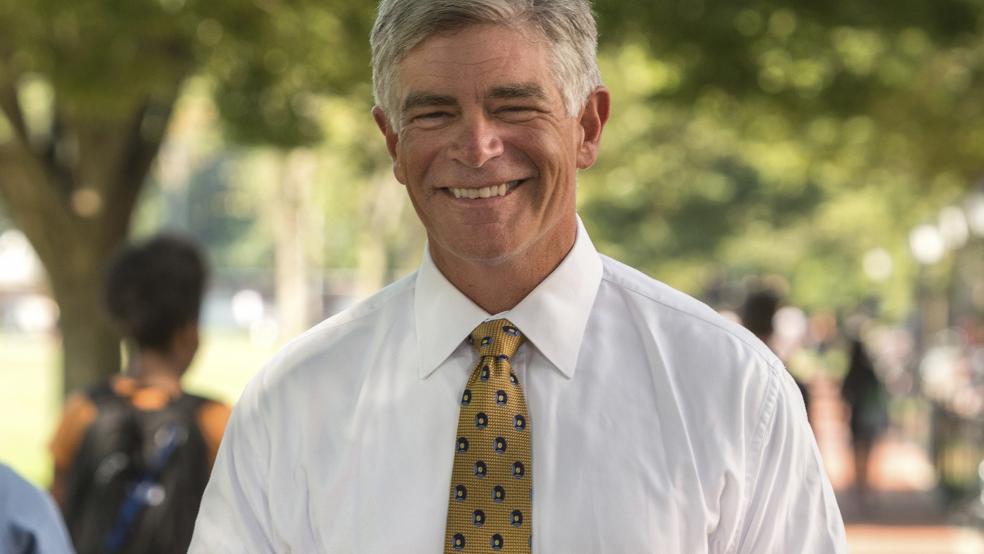

HANDOUT