Three sources with direct knowledge of the matter said Li, on a visit to the Industrial and Commercial Bank of China Ltd (ICBC) and China Development Bank (CDB), major state-owned banks, called for banks to lend more to small and medium-sized enterprises (SMEs).

A spokesman at ICBC confirmed that Li had visited and made the comments. Calls to CDB for a comment went unanswered. China's State Council Information Office declined to comment. The Chinese government's official website (www.gov.cn) subsequently published a brief online description of the visit, in which Li is quoted encouraging banks to lend to SMEs because their financing difficulties directly affect employment.The country's banks made 1.18 trillion yuan ($190 billion) of new loans in March, beating expectations as authorities ramped up efforts to support economic growth, but indicators suggest the credit has not yet flowed into key sectors.Chinese banks are increasingly profit-oriented and, critics say, seem less interested in supporting policy goals with high risk, low returns, or both."(Banks) will do some deal as a gesture, but no, money won't go in that direction," said a banker at one of the top five listed state-owned lenders in reaction to Li's comments, explaining that risks had to be acceptable for banks to lend. Beijing wants its banks to lend more to smaller private companies that create the majority of the country's jobs and produce the bulk of its growth, but bankers complain such firms are at higher risk of default than state-owned giants and more difficult to assess on a risk basis, given endemic book-cooking. Banks have also resisted orders to channel more credit to the cash-starved farm sector, an area that employs almost a third of China's 1.4 billion people, because farmers have little collateral. And they have proven reluctant to resume lending for real estate, a major economic driver of demand that has been on the slide for months. Regulators have eased policy restrictions but property investment still hit a trough in the first quarter.Instead, banks have leapt to extend margin finance to fuel a stock market rally that analysts fear has become completely disconnected from fundamentals. Beijing has taken a series of easing measures, such as cutting benchmark lending and saving rates in February to spur lending and cushion the economy. (Reporting by Beijing newsroom; Additional reporting by Engen Tham in Shanghai; Writing by John Ruwitch and Pete Sweeney in Shanghai; Editing by Kazunori Takada and Alan Raybould)China's Li urges reluctant banks to support real economy

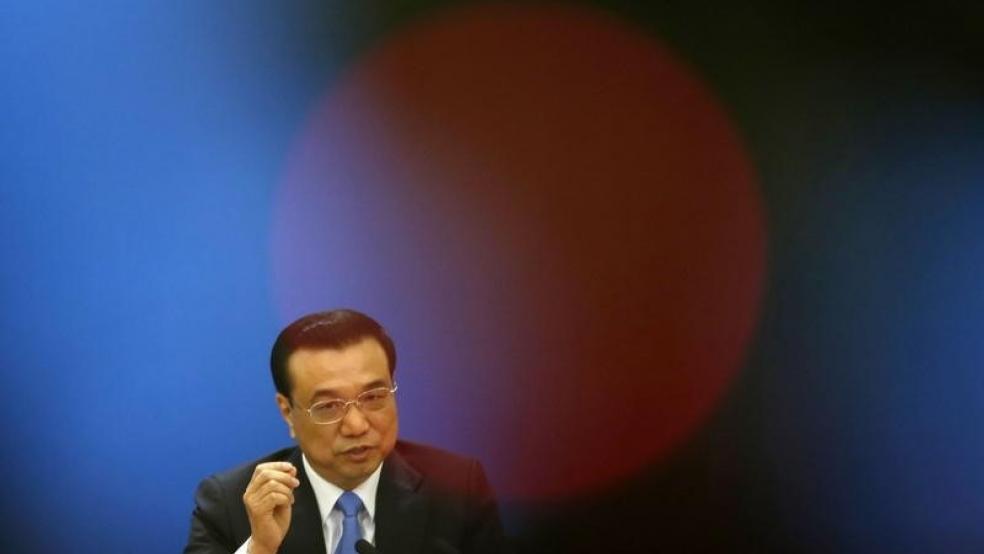

© Kim Kyung Hoon / Reuters