A currency swap agreement will facilitate the exchange of a maximum of 2.2 trillion pesos ($3.6 billion) for three years, the two central banks said in statements on Monday.

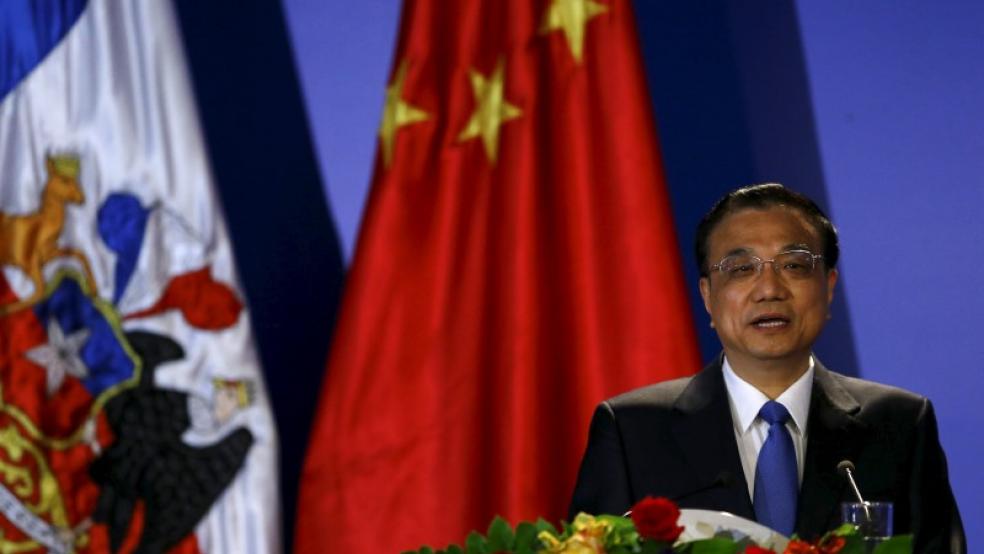

China's central bank said in a statement that it had appointed China Construction Bank as the yuan clearing bank in Chile.The yuan clearing bank in Chile would be the first of its kind in Latin America and "could serve as a base to finance projects," said Chilean foreign minister Heraldo Munoz.China also agreed to grant a 50 billion yuan ($8.1 billion) quota to renminbi (RMB) qualified foreign institutional investors in Chile, China's central bank said. The countries announced the agreement during Chinese Premier Li Keqiang's first official trip to Latin America. It is the latest in a series of deals to establish regional yuan hubs as China ramps up its efforts to internationalize the renminbi.Last week, Li visited Brazil, where he oversaw a raft of agreements ranging from aviation to agriculture, as well as a possible new rail link across the continent.Chile's top trade partner, China accounts for about 24 percent of the nation's exports, mostly copper but also wood pulp, wine, salmon and other products. However, Chinese investment to date has been considerably lower than in other Latin American countries such as Peru, and Chilean officials said they were keen to address that.In particular, they said they were encouraging investment in the energy sector. Power prices are high in Chile, which has almost no hydrocarbons of its own and relies on imports.($1 = 609.7800 pesos) (Reporting by Anthony Esposito; Additional reporting by Engen Tham in SHANGHAI; Writing by Rosalba O'Brien; Editing by Lisa Von Ahn and Jacqueline Wong)China looks to boost use of yuan in Latin America

HANDOUT