The cash-strapped company has for months struggled to make timely payments on its heavily discounted bonds, in part because U.S. sanctions have made banks wary of being involved in any Venezuela-related operations. President Nicolas Maduro in November announced a restructuring of all foreign debt amid an economic crisis. Venezuela and PDVSA bonds continue to be serviced, albeit with delays.

"PDVSA calls on bondholders and investors to trust the logistical, productive and financial capacity of the industry, which has fulfilled all of its commitments," PDVSA said via Twitter. "We ratify the solvency of our oil industry, which is fighting against illegal imperial sanctions." PDVSA on Friday must complete a $135 million coupon payment on its 2026 bond. On Monday, it faces $404 million in interest on bonds maturing in 2021, 2024 and 2035. The four coupon payments were due in November, but PDVSA invoked a 30-day grace period.The company's bonds have in the past slipped into default due to payment delays. Investors so far have avoided taking action against the company because most believe that Maduro's government will eventually make the payments. (Reporting by Deisy Buitrago; Editing by Mark Potter)Venezuela's PDVSA begins making delayed bond interest payments

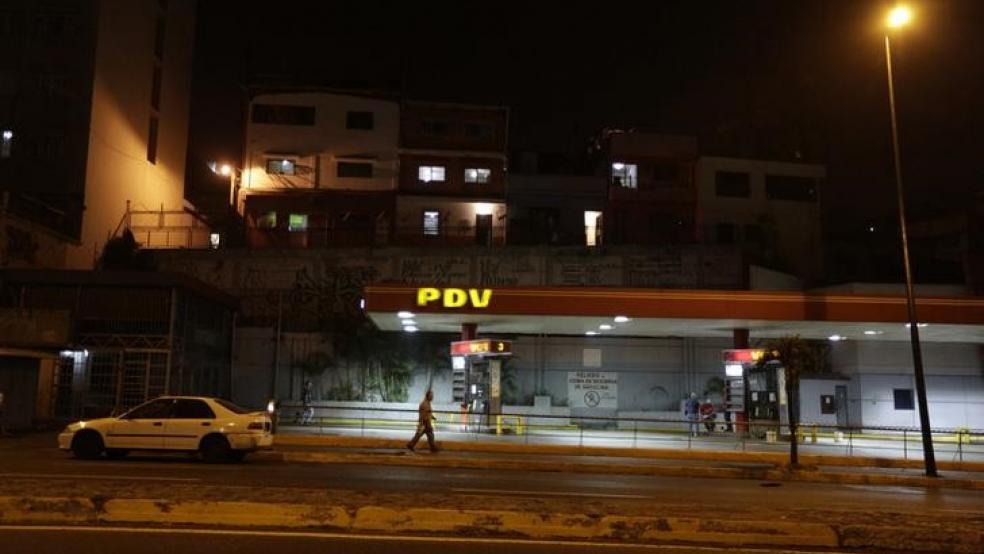

Marco Bello