A bevy of recent data suggests American shoppers — long the buy-it-now drivers of global economic growth — have lost the spring in their step. It wasn't supposed to be this way: Winter's chill has faded, gas prices are well below last summer's highs, the job market is strong, housing is steady and the stock market is at record highs.

Something is wrong. As I'll explain below, it could be Obamacare.

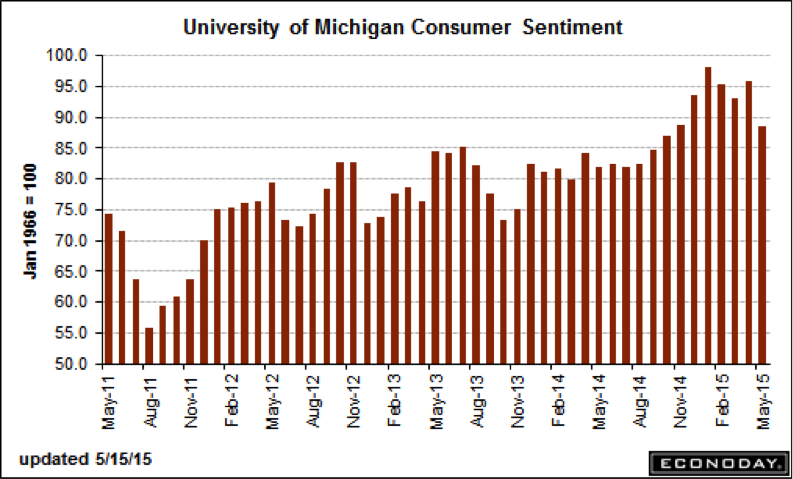

On Friday, the University of Michigan's consumer sentiment index fell from 95.9 in April to 88.6 in May. This was well below expectations and flies in the face of the current conventional wisdom — highlighted by the Federal Reserve in its latest policy statement — that consumers are feeling good. Measures of current conditions and future expectations both fell to the lowest levels since October and November respectively.

Related: We Just Went Through the Worst Month Since the Great Recession

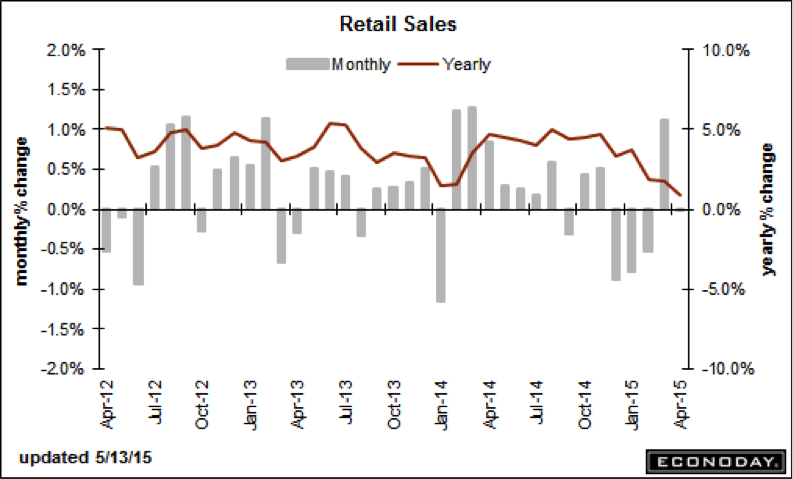

On Wednesday, the April retail sales report badly missed expectations as well. Sales less automobiles rose just 0.1 percent over March vs. the 0.5 percent growth that was expected and the 0.7 percent rise for the prior month. Auto sales were soft too, but the real surprise was the steep 2.2 percent drop in department store sales and the 0.4 percent drop in electronics and appliances, the seventh straight decline.

The weakness was a surprise in particular because hopes were high that the tightening job market (with the unemployment rate down to 5.4 percent) and the decline in energy costs (wholesale gas prices may be up 70 percent from January's lows but they’re still down 34 percent from last summer's highs) would bolster consumer spending and help the economy recover from a tepid performance in the first quarter. It just didn't happen.

What went wrong?

Paul Ashworth at Capital Economics worries that the data run counter to the assumption shared by many that weakness in the first quarter was largely related to the weather. Deeper issues besides snow are at work. Data from the New York Fed show that credit card debt declined nearly three percent in the first quarter of 2015 vs. the last quarter of 2014, a sign some gas savings were used to deleverage. The savings rate is up as well, not just here at home but in other developed economies as well.

Related: 7 Quirky Economic Indicators – from Dogs to Guns

Ed Yardeni of Yardeni Research estimates that total gas savings over the past 12 months (measured as the decline in retail sales at gasoline service stations) totaled $122 billion — money that should've acted as a powerful stimulus encouraging spending in other categories. His working thesis is that changes to the health care system under Obamacare could be partially responsible.

One aspect of this, given that we've just moved through tax season, are the tax code machinations connected to the health care law — which came into effect for the first time this year.

The other is that folks are increasingly shouldering the cost burden of their care through higher premiums, increased co-pays and higher deductibles. Yardeni admits, with all of this so new and happening in real-time, "I don't have the data to corroborate this conjecture."

Yet there is enough to wonder: The percentage of personal consumption expenditures (in current dollars) spent on health care goods and services has jumped from 20.0 percent last March to 20.8 percent this March, while the percentage spent on gasoline fell from 3.2 percent last June to 2.2 percent this March.

Related: New Lifetime Estimate of Obesity Costs: $92,235 Per Person

David Rosenberg at Gluskin Sheff echoes Yardeni, noting that the gasoline windfall wasn't spent "on gadgets and small luxury goods" as was normally the case, but on cyclical services (like bars and restaurants) and health care. He highlights the fact that spending on health care is running at a 6.6 percent annual growth rate as of March.

Thomas Costerg at Standard Chartered is also worried about the drag on spending from changes under Obamacare, charging outright that, "health-care reform is stalling private consumption." He's waiting for forthcoming statistics from the Internal Revenue Service to provide specifics, but notes "anecdotal evidence from tax preparers already suggests millions may have had to pay penalties and/or seen their tax refunds reduced." It's also worth remembering that health-care subsidies are under threat from a Supreme Court ruling in June.

Rosenberg suggests the supply-side energy price decline of the mid-1980s could be illustrative. Then, like now, a 50 percent-plus decline in energy prices was initially greeted with skepticism as consumers wondered if the windfall was for real. The savings rate increased and real consumption growth slowed. This happened from September 1985 to March 1986. But by September 1986, crude oil had stabilized at its lower level. The savings rate started to decline and spending revved up.

Related: Why So Many Americans Are Trapped in ‘Deep Poverty’

This behavior is backed by scholarly research, based on Milton Freidman's "permanent income hypothesis," that consumers only adjust spending when changes to income or costs is viewed as permanent. Other examples of this dynamic include President George W. Bush's tax cuts of the early 2000s as well as President Obama's 2008 stimulus package.

The good news is that as long as gas prices stay down and job gains continue, pocketbooks could soon open back up, potentially fueling a second half bounce back in economic growth, as the tax shock of Obamacare fades. In an ideal scenario, the ongoing decline in the unemployment rate would spur long-delayed wage gains, growing take home pay at a faster rate than household health care costs are rising.

Top Reads from The Fiscal Times: