The day after President's Day this year, employees of the President Abraham Lincoln Hotel and Conference Center in Springfield, Ill., got bad news: The hotel would no longer help pay for health insurance coverage for workers' spouses and children. It had been covering 60 percent of the cost.

Brian Lewis, a front desk clerk, saw his monthly health insurance premium jump to $460 from $230 to cover himself and his wife, Sarah. He estimates about a third of his paycheck now goes to health coverage. “We try to live a little more modestly,” said Lewis, 28. “We used to go out of town for a few weekends, but not anymore.”

Brian Lewis, a front desk clerk, saw his monthly health insurance premium jump to $460 from $230 to cover himself and his wife, Sarah. He estimates about a third of his paycheck now goes to health coverage. “We try to live a little more modestly,” said Lewis, 28. “We used to go out of town for a few weekends, but not anymore.”

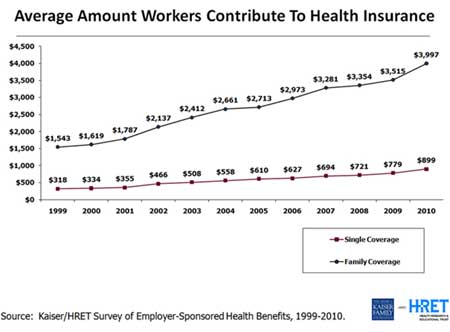

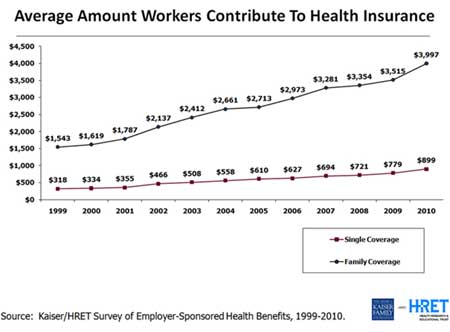

In facing rising costs for coverage, Lewis isn't unusual. Workers nationwide, on average, are paying nearly $4,000 a year toward the cost of family coverage. That's a hefty 14 percent, or $482, more for family health insurance in 2010 than in 2009, according to a survey released today by the Kaiser Family Foundation and the Health Research & Educational Trust, two nonprofit organizations that focus on health policy issues. (Kaiser Health News is a part of the foundation.)

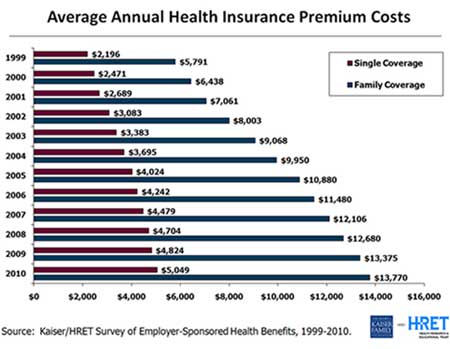

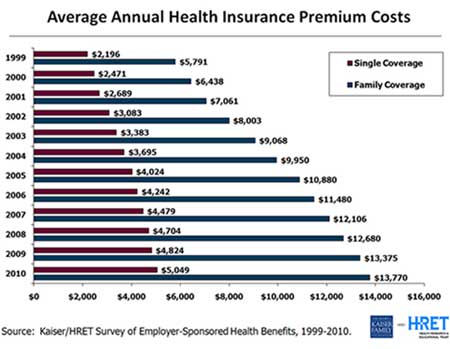

Total premiums for family coverage, taking into account both employee and employer contributions, are $13,770, up 3 percent from last year, the survey found.

The share of the premium paid by workers jumped 3 percentage points to 30 percent. In the dozen years the survey has been conducted, the employee share of family coverage has never topped 28 percent and has never risen more than 2 percentage points in a single year.

In past years, employers typically have shared the increase in health costs with workers. This year, employers' contribution to the premium remained flat on average, the survey said.

Drew Altman, president and CEO of the Kaiser Family Foundation, said in an interview that “shifting the costs to workers during a terrible economy is bad news for working people.” He added, “It speaks to the depths of the recession and the pressure employers are under, and it means added economic insecurity for working people.”

30 percent of employers reported reducing the health benefits they offered or increasing the employees' share of the cost.

Paul Fronstin, senior research associate with the Employee Benefit Research Institute, a nonprofit, nonpartisan organization, said employers increase workers' share of premiums only if they are desperate — because it can drive the healthiest employees to drop coverage, resulting in higher premiums for everyone else. “Raising the employees' share of the premium really makes no sense,” he said.

No End in Sight

Yet, it's likely to keep happening. A survey released in August by the National Business Group on Health, an employer coalition, found 63 percent of large employers planned to increase the proportion that employees contribute to their premiums next year. The survey was based on responses from 72 of the nation's largest employers representing more than 3.7 million employees.

“This is a growing reflection that costs are unaffordable and the general state of the economy,” said Helen Darling, president of the group. She said most employers increasing the employee share of health premium were charging workers only a small part of the costs. She said the trend could lead employees not to cover their dependents.

At the Lincoln Hotel, nearly all the employees who had been covering spouses and children stopped covering their dependents when the hotel decided to no longer help pay the cost. The hotel still covers about 60 percent of health insurance premium for its 140 employees.

Jeanne Miller, human resources coordinator at the 316-room hotel, said the hotel made the switch as a result of less business from conferences. “People panicked … it was rough,” she said of employees' reaction.

She said the business increased the employee share even though the total premium only went up slightly. “It was all about cutting costs,” Miller said. The hotel, which bills itself as the closest hotel to the Abraham Lincoln Presidential Library and Museum, this summer did not follow its usual practice of offering pay raises to workers.

Lewis said the he had little choice but to pay the higher rate because his wife has asthma and a thyroid condition and takes medication for both. They hope to save money next year when his wife will switch to a plan provided by her own employer, a local insurance agency.

A Doubling of Costs

Nationally, employees now pay an average of $3,997 as their share of the annual family health insurance premium — about $1,000 more than in 2006 and twice the 2001 amount, the Kaiser survey found. For single coverage, employees this year pay an average of $899 — nearly triple the price of a decade ago.

The increase in health costs in recent years has far outstripped inflation and helped propel efforts to overhaul the country's health system. Since 2005, premiums overall have gone up 27 percent, more than twice the rate of inflation. In that period, workers' contributions to premiums rose 47 percent. Wages since 2005 have increased 18 percent.

The Kaiser survey, completed by 2,046 employers, was conducted between January and May of 2010.

The new health law, which will expand health coverage to 32 million Americans starting in 2014, will bring no immediate cost relief for most workers getting coverage in the workplace.

Under the health overhaul law, employees who have to spend more than about 9.5 percent of their income buying health coverage through an employer will be able to buy lower cost coverage in new insurance exchanges, or marketplaces. But that benefit won’t start until 2014.

Most of the major provisions in the law that aim at reducing health costs — such as pilot projects that bundle Medicare costs to hospitals and doctors — will take years to play out and results are anything but certain.

“The new law helps a lot of people in a lot of ways … but in general it left employer-based coverage alone,” Altman said. “That is what the politics of health care dictated and what the American people asked for.”

But as the Kaiser survey shows, employer-based coverage is anything but stagnant as workers face more financial barriers to access care. About 27 percent of employees now face annual deductibles of at least $1,000, up from 22 percent in 2009 and 12 percent in 2007, the survey showed.

J.W. Cheatham LLC, a construction company in West Palm Beach, Fla., used to pay the full cost of employees health insurance premium. But when the economy worsened two years ago, it started charging employees about $26 a week. Although the employees' share of the premium may seem modest, it was still too high for 10 of the company's 96 employees who chose to drop the coverage.

Those employees are all uninsured, said Michael Damron, co-owner and personnel director at Cheatham.

The company initially faced a 9 percent increase in health premium costs this year, but it negotiated that down to 4 percent after agreeing to bundle the purchase of health and life insurance through Blue Cross and Blue Shield of Florida. In addition, the company eliminated paid vacation and holidays for employees this year. Those cost cutting measures helped Cheatham hold the line on premium costs for workers. Employees are paying $26.80 a week.

Damron is already worrying about how much higher insurance costs will go to next year. “It never goes down.”

Brian Lewis, a front desk clerk, saw his monthly health insurance premium jump to $460 from $230 to cover himself and his wife, Sarah. He estimates about a third of his paycheck now goes to health coverage. “We try to live a little more modestly,” said Lewis, 28. “We used to go out of town for a few weekends, but not anymore.”

Brian Lewis, a front desk clerk, saw his monthly health insurance premium jump to $460 from $230 to cover himself and his wife, Sarah. He estimates about a third of his paycheck now goes to health coverage. “We try to live a little more modestly,” said Lewis, 28. “We used to go out of town for a few weekends, but not anymore.”In facing rising costs for coverage, Lewis isn't unusual. Workers nationwide, on average, are paying nearly $4,000 a year toward the cost of family coverage. That's a hefty 14 percent, or $482, more for family health insurance in 2010 than in 2009, according to a survey released today by the Kaiser Family Foundation and the Health Research & Educational Trust, two nonprofit organizations that focus on health policy issues. (Kaiser Health News is a part of the foundation.)

Total premiums for family coverage, taking into account both employee and employer contributions, are $13,770, up 3 percent from last year, the survey found.

The share of the premium paid by workers jumped 3 percentage points to 30 percent. In the dozen years the survey has been conducted, the employee share of family coverage has never topped 28 percent and has never risen more than 2 percentage points in a single year.

In past years, employers typically have shared the increase in health costs with workers. This year, employers' contribution to the premium remained flat on average, the survey said.

Drew Altman, president and CEO of the Kaiser Family Foundation, said in an interview that “shifting the costs to workers during a terrible economy is bad news for working people.” He added, “It speaks to the depths of the recession and the pressure employers are under, and it means added economic insecurity for working people.”

30 percent of employers reported reducing the health benefits they offered or increasing the employees' share of the cost.

Paul Fronstin, senior research associate with the Employee Benefit Research Institute, a nonprofit, nonpartisan organization, said employers increase workers' share of premiums only if they are desperate — because it can drive the healthiest employees to drop coverage, resulting in higher premiums for everyone else. “Raising the employees' share of the premium really makes no sense,” he said.

No End in Sight

Yet, it's likely to keep happening. A survey released in August by the National Business Group on Health, an employer coalition, found 63 percent of large employers planned to increase the proportion that employees contribute to their premiums next year. The survey was based on responses from 72 of the nation's largest employers representing more than 3.7 million employees.

“This is a growing reflection that costs are unaffordable and the general state of the economy,” said Helen Darling, president of the group. She said most employers increasing the employee share of health premium were charging workers only a small part of the costs. She said the trend could lead employees not to cover their dependents.

At the Lincoln Hotel, nearly all the employees who had been covering spouses and children stopped covering their dependents when the hotel decided to no longer help pay the cost. The hotel still covers about 60 percent of health insurance premium for its 140 employees.

Jeanne Miller, human resources coordinator at the 316-room hotel, said the hotel made the switch as a result of less business from conferences. “People panicked … it was rough,” she said of employees' reaction.

She said the business increased the employee share even though the total premium only went up slightly. “It was all about cutting costs,” Miller said. The hotel, which bills itself as the closest hotel to the Abraham Lincoln Presidential Library and Museum, this summer did not follow its usual practice of offering pay raises to workers.

Lewis said the he had little choice but to pay the higher rate because his wife has asthma and a thyroid condition and takes medication for both. They hope to save money next year when his wife will switch to a plan provided by her own employer, a local insurance agency.

A Doubling of Costs

Nationally, employees now pay an average of $3,997 as their share of the annual family health insurance premium — about $1,000 more than in 2006 and twice the 2001 amount, the Kaiser survey found. For single coverage, employees this year pay an average of $899 — nearly triple the price of a decade ago.

The increase in health costs in recent years has far outstripped inflation and helped propel efforts to overhaul the country's health system. Since 2005, premiums overall have gone up 27 percent, more than twice the rate of inflation. In that period, workers' contributions to premiums rose 47 percent. Wages since 2005 have increased 18 percent.

The Kaiser survey, completed by 2,046 employers, was conducted between January and May of 2010.

The new health law, which will expand health coverage to 32 million Americans starting in 2014, will bring no immediate cost relief for most workers getting coverage in the workplace.

Under the health overhaul law, employees who have to spend more than about 9.5 percent of their income buying health coverage through an employer will be able to buy lower cost coverage in new insurance exchanges, or marketplaces. But that benefit won’t start until 2014.

Most of the major provisions in the law that aim at reducing health costs — such as pilot projects that bundle Medicare costs to hospitals and doctors — will take years to play out and results are anything but certain.

“The new law helps a lot of people in a lot of ways … but in general it left employer-based coverage alone,” Altman said. “That is what the politics of health care dictated and what the American people asked for.”

But as the Kaiser survey shows, employer-based coverage is anything but stagnant as workers face more financial barriers to access care. About 27 percent of employees now face annual deductibles of at least $1,000, up from 22 percent in 2009 and 12 percent in 2007, the survey showed.

J.W. Cheatham LLC, a construction company in West Palm Beach, Fla., used to pay the full cost of employees health insurance premium. But when the economy worsened two years ago, it started charging employees about $26 a week. Although the employees' share of the premium may seem modest, it was still too high for 10 of the company's 96 employees who chose to drop the coverage.

Those employees are all uninsured, said Michael Damron, co-owner and personnel director at Cheatham.

The company initially faced a 9 percent increase in health premium costs this year, but it negotiated that down to 4 percent after agreeing to bundle the purchase of health and life insurance through Blue Cross and Blue Shield of Florida. In addition, the company eliminated paid vacation and holidays for employees this year. Those cost cutting measures helped Cheatham hold the line on premium costs for workers. Employees are paying $26.80 a week.

Damron is already worrying about how much higher insurance costs will go to next year. “It never goes down.”