The absolute costs to New York City of the 9/11 attacks were and are incalculable. As others have pointed out all this week and well before that, how do you put a price tag on thousands of lives lost and the damage done to grieving families and survivors?

Even trying to assess the direct economic impact to the city is difficult because the attacks took place during a local and national recession.

“In terms of true costs, it becomes much harder to attribute cause and effect as you get farther and farther away from the actual event,” Jason Bram, an economist with the Federal Reserve Bank of New York, told The Fiscal Times.

Still, there are standout facts and figures from the period after 9/11 that can be examined in the context of the monstrous tragedy ten years ago that destroyed the two iconic World Trade Center towers and damaged numerous other buildings and structures, taking with them businesses, livelihoods, goals, hopes and dreams.

- An advisory put out earlier this week by the New York City Comptroller, John C. Liu, says that international tourism to the city fell in the two years after 9/11, by several million visitors. But it then rebounded, and since 2004, it’s shown growth every subsequent year, except for 2009. Today New York City welcomes close to 10 million international visitors and nearly 50 million total visitors each year to its myriad streets,landmarks and attractions.

- Hotel occupancy rates in the Big Apple took five years to return to pre-9/11 levels, the report also says. In 2001 the average hotel occupancy rate was less than 75 percent; by 2006 the rate was back up to 85 percent.

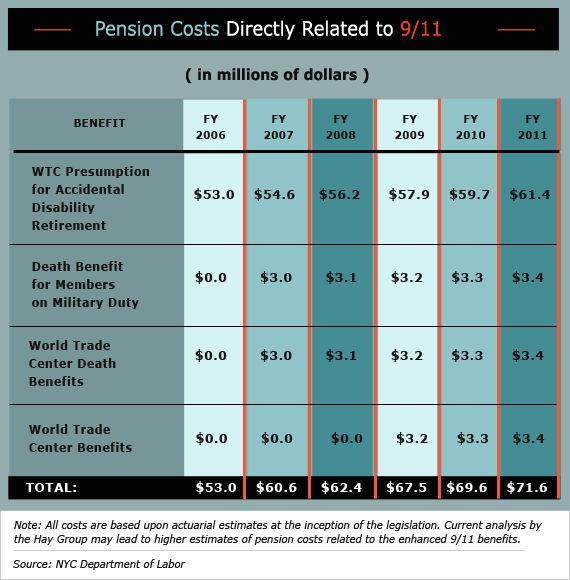

• Pension costs directly related to 9/11were, are, and will be significant for some time to come.The estimated cumulative cost for 9/11-related pension benefits is approximately $384.7 million, according to Comptroller Liu.

- To help the city meet its financial obligations, the Transitional Finance Authority issued $2.027 billion in 9/11 recovery bonds. The advisory says that since 2003, New York City has paid $279.6 million in interest on the bonds and has paid down $641.5 million of the principal. Before the bonds are retired in FY 2023, the city will have paid a total of approximately $661 million in interest on them.

A group of economists from the New York Federal Reserve, including Jason Bram, studied the economic costs to New York City directly after the 9/11 attacks. Their report,published in November 2002, calculated the “cost” of the nearly 3,000 lives lost in the World Trade Center attack by using “the discounted value of the deceased workers’ expected future earnings.” Their estimates suggested that lifetime earnings losses for these workers were, in the aggregate, about $7.8 billion — an average of $2.8 million per worker.