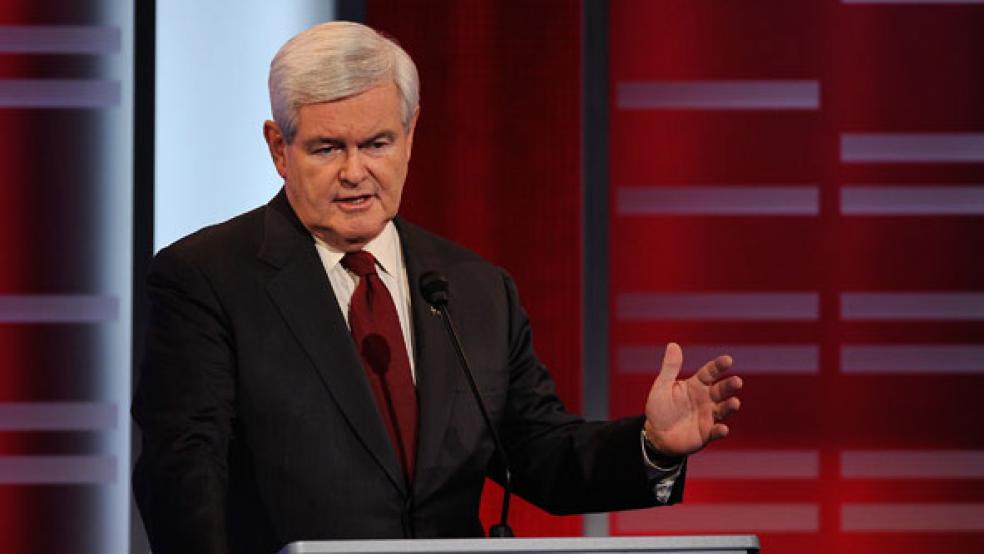

Former House Speaker Newt Gingrich vowed in his South Carolina victory speech that he would balance the budget and even build up a surplus if he is elected president. But how he would manage that while delivering on a costly revamping of the tax code and maintaining robust defense spending is far from clear.

“I am committed to getting back to a balanced budget,” Gingrich told a cheering crowd in Columbia, S.C. Saturday night after defeating former Massachusetts governor Mitt Romney in the primary contest. “And since I am the only Speaker of the House in your lifetime to have helped create four consecutive balanced budgets, I think I can tell you as president I will work very hard to get back to a balanced budget as rapidly as possible. And then to run a surplus to pay down the debt so no Chinese leverage exists on the United States by having our debt.”

Gingrich has claimed partial credit for four consecutive years of budget surpluses during the Clinton administration beginning in the late 1990s that paid off almost $500 billion in federal debt. But Gingrich’s presidential campaign pledge to replace the federal tax code with an optional 15 percent flat tax, while eliminating the estate and capital gains taxes and reducing the corporate rate from 35 percent to 12.5 percent, would likely blow a hole in the budget and send the deficit soaring, according to some experts.

Seth Hanlon, director of fiscal reform at the left-leaning Center for American Progress Action Fund, contends the Gingrich plan “is by far the most fiscally reckless plan to be released by a major 2012 contender,” adding that the projected revenues under the former speaker’s approach “are not even in the ball park of the type of revenue that would support a modern country.”

“It’s simply not possible at all to get down to those levels of revenues and still have a military, some semblance of a government and anywhere near the commitment to seniors we now have with Social Security and Medicare,” he told The Fiscal Times today.

Gingrich’s plan would provide a windfall for corporations and upper income Americans while reducing federal tax revenues dramatically, according to an analysis by the nonpartisan Tax Policy Center. Gingrich’s plan would reduce federal revenues by $1.28 trillion below the Congressional Budget Office’s baseline in 2015, roughly a 35 percent reduction. That would mean essentially reducing the level of federal revenues to 13.2 percent of the Gross Domestic Product in 2015, contrasted with the 19 percent of GDP the government is currently projecting for that year.

The revenue loss would be considerably less than that -- only $850 billion in 2015 – if Congress and the president agree to eliminate the high end of the Bush era tax cuts. But in either case, there would be a substantial drop in the federal tax liability that would push up the deficit or force draconian cuts in domestic and entitlement spending.

Gingrich has yet to propose specific levels for federal spending, so there’s no way of knowing how he intends to control the deficit, although he has long supported a balanced budget amendment to the Constitution. However, after blasting the House-passed GOP budget drafted by Rep. Paul Ryan of Wisconsin as “right-wing social engineering” earlier this year, Gingrich said he would support it.

That plan would have reduced long-term spending by reshaping Medicare, converting Medicaid to block grants to the states and reforming the tax code. House Republicans who met over the weekend in Baltimore signaled they were ready to pass another big spending cut designed by Ryan, the chairman of the House Budget Committee.

But Gingrich has repeatedly indicated he would oppose deep defense cuts that Obama and congressional GOP leaders already have agreed to. Gingrich contends that those cuts in military spending would lead to the most dangerous security situation in the nation since Pearl Harbor.

The administration is in the final stages of deciding specific cuts in the 2013 budget, which Obama will submit to Congress next month. The budget is meant to accommodate about $489 billion in defense savings over the coming 10 years as called for in a budget deal with Congress last summer. Another $500 billion in cuts may be required starting in January 2013 as part of the budget deal.

So how would Gingrich reconcile his plans to slash federal revenues, maintain or increase current levels of defense spending, and return the budget to the glory days of surpluses is hard to imagine?

According to his campaign website, Gingrich would balance the budget “by growing the economy, controlling spending, implementing money saving reforms, and replacing destructive policies and regulatory agencies with new approaches.”

Robert Bixby, executive director of the Concord Coalition, an anti-deficit advocacy group, said that Gingrich and the other Republican contenders have done little to connect the dots between the tax cuts and reforms they are proposing and their likely impact on the budget and deficit.

“Spending and revenues both affect the deficit,” he said. “Politically the Republicans choose to attack it only on the spending side and never dare to breathe a word about the need for new revenues, but I don’t think that’s very realistic . . . . I would feel much better about these proposals if they were connected to budget goals that seem realistic. We can’t look at tax policy in a vacuum.”

Romney – who also has promised a balanced budget – has outlined an economic plan that would lower federal tax liability by $600 billion in 2015 compared with current law, according to the Tax Policy Center analysis. That would be roughly a 16 percent cut in total projected revenue.

Romney’s approach to tax reform is more traditional Republican orthodoxy that includes extending the Bush era tax cuts, continuing the alternative minimum tax break, reducing the corporate income tax rate from 35 percent to 25 percent, making permanent the research and experimentation tax credit, and eliminating investment taxes for middle-class taxpayers.

Romney’s proposals to cap total spending, boost defense spending, cut taxes, and balance the budget would require extraordinarily large cuts in nondefense programs, according to a new study by the Center on Budget and Policy Priorities. If policymakers cut all nondefense programs by the same percentage, the cuts would measure 21 percent in 2016 and 36 percent in 2021, according to the analysis, the study says. If policymakers exempted Social Security from the cuts and then cut all other nondefense programs by the same percentage, the cuts would rise to 30 percent in 2016 and 54 percent in 2021.

These cuts are far deeper than those required under the austere Ryan House budget plan. They would shrink nondefense discretionary spending — which, over the past 30 years, has averaged 3.7 percent of GDP and never fallen below 3.2 percent — to just 1.7 percent of GDP by 2021.