Obama took a preemptive swipe at one of his likely 2012 opponents, Mitt Romney, by releasing a plan to overhaul the U.S. corporate tax code on the same day Romney is introducing his own tax reform manifesto.

While political analysts says the White House timing is an intentional campaign move, the administration has been wrestling with the plan’s contents since Obama’s 2011 State of the Union address. It’s also a pointed response to criticism from congressional Republicans and business leaders who have long questioned his commitment to helping U.S. businesses compete in a global marketplace.

RELATED: 7 Ways Obama Wants to Tax the Rich

Administration officials say the document’s ultimate goal is less about politics and more about nudging long-term policy forward once the election is over. They say the document is meant to act as a guide for lawmakers to use when they grapple with a series of expiring budgetary and tax provisions, including the Bush-era tax cuts, at the end of 2012.

“We want to use this framework to begin the consensus and foundation-building process with tax writing committees with Democrats and Republicans,” Treasury Secretary Timothy Geithner said to reporters Wednesday. “We’re doing this because we think that these things take time, so better to start now.”

Obama’s proposal calls for slashing the top corporate tax rate to 28 percent from 35 percent by scrubbing the vast majority of the more than 130 tax preferences businesses currently enjoy. Preferences for domestic manufacturers, company research and development, and clean energy firms would be the only ones spared.

The plan could bring the government an extra $250 billion from businesses over the next 10 years. However, the plan is relatively light on numbers and specifics—something administration officials say was purposeful. “If over the course of consultation in the coming months we think that it would help advance the debate by giving people more specific proposals, we’ll do that,” Geithner said.

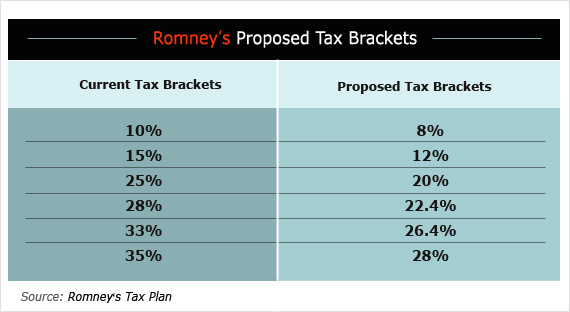

Romney’s proposal is mostly geared toward reforming the individual tax code, but like the White House, the plan carries few details. His plan, which officially will be released Wednesday evening, calls for cutting marginal tax rates for all individuals by 20 percent.

Romney omits any mention of curbing popular individual tax preferences like deductions for home mortgage interest deduction, charitable contributions, and state and local taxes.