It’s been nearly four years since the Troubled Asset Relief Program (TARP) was signed into law by President George W. Bush, and the U.S. banking sector has clearly rebounded. The Federal Deposit Insurance Corporation said earlier this year that banks posted $35.3 billion in profits in the first quarter of 2012, the best three-month period since the second quarter of 2007, before the financial crisis hit. The amount of troubled assets, including bad loans and foreclosed property, has continued to decline, according to an Investigative Reporting Workshop analysis of first-quarter FDIC data.

Despite those overall improvements, smaller banks are still showing signs of trouble. While banks with $10 billion or more in assets have repaid almost all their TARP loans and exited the Capital Purchase Program – under which the Treasury sought to buy preferred stock in “healthy, viable institutions” in order to increase financial stability and spur lending – hundreds of smaller banks have not. In all, 707 financial institutions received $204.9 billion as part of the Capital Purchase Program, and as of March 31, 351 regional and community banks were still in the program. Another 83 financial institutions were in the TARP Community Development Capital Initiative, bringing the total number of institutions still in TARP to 434.

Many of those smaller banks are struggling to exit the program. To leave TARP, the banks would need to come up with enough capital to buy back the shares the government owns and pay out the quarterly dividends they may have missed. Under the terms of the program, the banks also face a hike in the dividend payments they owe the government, from 5 percent to 9 percent as of late next year.

Just how much money do community banks nationwide need? In an April 25 report to Congress, the special inspector general for TARP cited two very different estimates: $23 billion and $90 billion.

Nearly two months after that report, not much has changed, as a breakdown of a June 11 Treasury report by research firm SNL Financial shows.

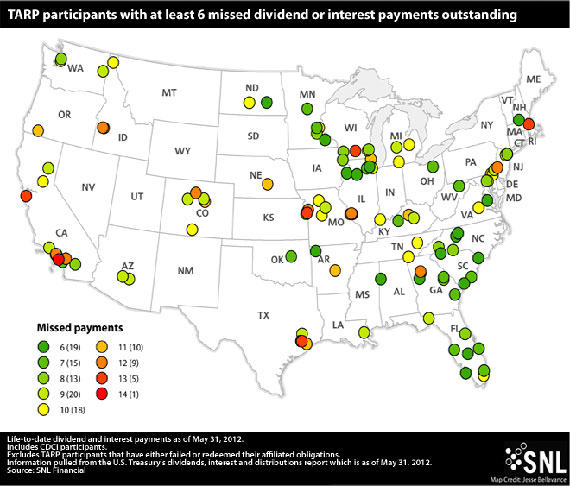

Many banks are still having trouble meeting their TARP obligations, with 139 missing their May 15 dividend payments, down slightly from the prior quarter. The number of banks that have missed at least six payments climbed to 102, from 89 the previous quarter – or 73 percent of the 139 that missed their latest payment. The Treasury can place up to two directors on the boards of banks that have missed six payments, and nine companies have had board members picked by the government. But 48 companies have agreed to have a Treasury observer attend their board meetings, up from 40 in February.

The amount of taxpayer dollars invested in these banks is relatively small – the 139 banks that missed their recent dividend payments received $3.2 billion under the Capital Purchase Program, or just 1.6 percent of the total invested. But the numbers serve as a reminder that, while big banks are mostly back on track, many smaller ones haven’t been as successful – leading some industry analysts to expect a wave of consolidation.

And it’s a reminder that, as the special inspector general for TARP noted in April, “Despite the dramatic efforts to expedite the exit of the largest banks from TARP, there appears to be no corresponding plan for community banks’ exit from TARP.”