•32 percent of payroll gains are temp positions. • 85 percent of gains are in industries making up a quarter of private-sector payrolls. • 100 percent of gains are in industries with below average pay scales. |

The 2007-09 recession wrought enormous change in the U.S. economy, especially for labor markets, where many jobs in finance, real estate, auto manufacturing, and other industries devastated by the downturn will never return. Since shedding 8.5 million workers, businesses are slowly beginning to hire again. But what kind of jobs, and will they be of sufficient quality and quantity to promote a self-sustaining economic recovery?

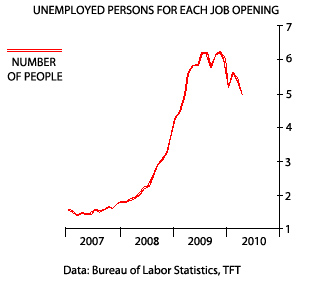

The good news for people out of work is that overall job vacancies are up 21 percent over the past six months, based on a separate Labor Dept. report . The bad news is that there are still five unemployed people for each job opening. That’s down from a peak of 6.2 at the end of last year, but at the beginning of the recession in December 2007, there were only 1.8 people competing for each vacancy. That means, for many months to come, a lot of talented people will be going head-to-head for new positions, a lot of which are still concentrated in lower-wage industries.

So far this is not the jobless recovery that many had feared, but it remains unsatisfying in many respects. In June, private-sector industries added a slim 83,000 workers to their payrolls. Although the pace of employment has turned up faster than in the 1990-91 and 2001 recessions, it remains far below the rapid growth seen after the 1973-75 and 1981-82 downturns. Through June, non-government jobs have grown by nearly 600,000 since hitting bottom in December, but industries that make up only 26 percent of total payrolls accounted for 85 percent of those gains, including administrative and support services, a handful of manufacturing industries, and health care.

Where The Jobs Growth Is Coming From | ||||

Industry | Share of Total Payrolls | Job Gains (Dec - Jun) | ||

| Goods Sector: | 16.7 | 71.0 | ||

| Mining | 0.7 | 49.0 | ||

| Construction | 5.2 | -114.0 | ||

| Manufacturing | 10.8 | 136 | ||

| Services Sector: | 83.3 | 522.0 | ||

| Wholesale | 5.2 | 10.9 | ||

| Retail | 13.4 | 75.8 | ||

| Transportation | 3.9 | 5.6 | ||

| Utilities | 0.5 | -1.1 | ||

| Information | 2.5 | -33 | ||

| Finance | 5.2 | -48.1 | ||

| Real Estate | 1.8 | -25.1 | ||

| Professional | 6.9 | -22.3 | ||

| Management | 1.7 | 6.4 | ||

| Administrative | 6.9 | 237.4 | ||

| Education | 2.9 | 35.4 | ||

| Health Care | 15.2 | 134.1 | ||

| Leisure | 12.2 | 123.0 | ||

| Other Services | 5.0 | 23.0 | ||

| Total | 100.0 | 593.0 | ||

Data: Bureau of Labor Statistics, TFT | ||||

Private-sector job growth has averaged almost 100,000 per month this year, but the pace needs to be well above that to make a significant dent in unemployment. The jobless rate dipped to 9.5 percent last month, from 9.7 percent in May and a peak of 10.1 percent last October. But the June decline reflected some 650,000 people who dropped out of the labor force rather than look for work, in which case they are not counted as unemployed. Teenagers, for whom the jobless rate was a historically high 25.7 percent in June, accounted for much of that decline. Many of the 225,000 temporary Census workers, whose jobs ended in June, most likely dropped out, as well, along with people whose jobless benefits have expired. The overall unemployment rate could easily tick up again in July.

A big chunk of non-government job gains since December have been in relatively low-paying industries or temporary jobs. Temporary-help services, only 2 percent of private-sector payrolls, have accounted for one of every three new jobs since December. Historically, that’s not such a bad trend, since temp jobs traditionally lead overall job growth. Since December, temp hiring has slowed, while overall gains have sped up, as job growth has broadened. Still, hourly pay among temp workers averages less than that for all private industries.

Low Wages

The job rebound so far has been almost exclusively in low-wage industries, with no net growth in high-wage sectors. Economists at UBS, who categorized 80 industries as either above or below the U.S. average in hourly pay, say that from December to May, low-wage payrolls grew by 463,000, while in high-wage industries they declined by 5,000. That split appears to reflect a normal post-recession upswing in low-wage industries, including big gains in administrative and support services, food services, clothing stores, and metal products manufacturing. It also points to the job market’s longer-term structural changes, given the large ongoing decline in certain high-wage industries, such as specialty-trades construction, insurance, and telecom.

Despite the concentration of gains in lower-paying industries, more people are nevertheless on the job, and are working longer hours. That means the pay workers take home at the end of the month, so crucial to consumer spending, is on the rise. In the first five months of the year, income from wages and salaries adjusted for inflation grew 4.1 percent, the fastest five-month clip in three years.

One positive trend compared to past recoveries is the early jump on hiring by large companies. After the 2001 recession, big corporations continued to shed workers for more than a year after the recovery began, even as small businesses began to hire, based on a UBS analysis of data compiled by Automatic Data Processing. Back then, lingering effects from the tech bust and corporate scandals made financing difficult for large firms, even as the economy began to pick up. Now, surging corporate profits and improving financial conditions have put large companies in a better position to expand. Consequently, job growth at large and medium-sized firms are outpacing gains at small businesses.

Starting Small

Hiring at small businesses, which are more dependent on bank loans, appears to have been constrained by tight credit conditions, more so than at large companies that can obtain financing from credit markets. Now, small businesses, which have one to 500 employees and account for roughly half of all payrolls, appear ready to accelerate their hiring as demand picks up. Federal Reserve surveys show that banks have become much friendlier to small-business borrowers this year, largely because of improving revenues and profits. Proprietors’ income, a proxy for small-business health, is up 5.9 percent from a year ago, the fastest growth in four years.