• Total state and local receipts, excluding federal grants, are up $120 billion.. • 42 states show increased tax revenues compared to a year ago. • There were 72 municipal bond defaults in 2010, down 65 percent from 2009. |

The poor condition of state and local budgets is on everyone’s radar, but just how much should we worry? Wall Street analyst Meredith Whitney recently declared on CBS’s 60 Minutes that, next to housing, the situation was the single biggest threat to the U.S. economy. That may have been true a year ago, when the recession had ravaged tax receipts and a lasting economic recovery was still in doubt. However, recent trends in both revenues and the economy look much more encouraging, and the risk of major short-term economic damage appears to be waning, not waxing.

Budget problems are not going to disappear anytime soon as states face the burden of huge unfunded pension obligations and rising Medicaid costs, among other expenses. California, for one, has a $28 billion deficit this year. The state received $630 million of stimulus funds for job creation, but according to the L.A. Times, only 25% of those funds have been spent due to bureaucratic red tape.

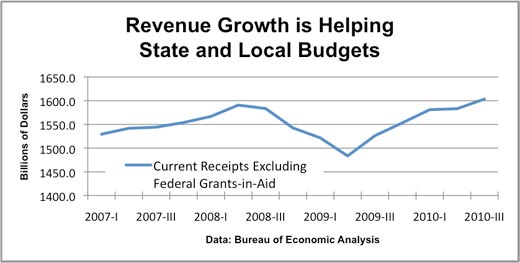

But governments are making significant progress, as many start to feel the updraft from the economic recovery. Tax receipts of state and local governments rose 5.1 percent in the third quarter from the same quarter a year ago, based on the latest accounting from the Bureau of Economic Analysis. Personal income taxes have yet to show much progress amid slow job growth, but sales tax receipts picked up notably last quarter, reflecting improving retail sales. The lion’s share of the growth in revenues has come from corporate taxes, which have surged 87 percent over the past year, as a result of this year’s surprisingly strong gain in corporate profits.

One often-cited problem for many states in the coming year is the expected loss of some $40 billion in federal money provided by the 2009 Recovery Act. However, many governments stand ready to make up the difference. State and local revenues from individual and corporate income taxes and sales taxes in the third quarter were up by $54 billion from a year ago, a growth rate that is likely to pick up in 2011, as economic growth and labor markets strengthen. In fact, since hitting bottom in the second quarter of 2009, total receipts from all sources, excluding federal grants-in-aid, have increased by $120 billion and have recovered all of their recession losses.

Analysts at the Rockefeller Institute noted a “significant improvement” in the state revenue picture and that the trend in tax collections for 2011 is “positive.” Based on their preliminary tracking for the third quarter, 42 states show an increase in revenues compared to a year earlier. However, individual stress levels vary greatly. Overall, the Rockefeller analysts say budget pressures remain, and additional revenue growth will be needed at a time when spending commitments continue to grow.

More revenue may well be the key surprise in the coming year. Revenue projections for the 2011 fiscal year, which began for most states on July 1, were based partly on economic forecasts at that time. Six months ago, the economy was slowing down as the European debt crisis sparked fears of a double-dip recession, and economists widely projected growth only in the 2-2.5 percent range for 2011. Now, given the rebound in consumer spending in the second half of 2010 and significant new stimulus in the recent tax deal, which offers a big boost to household incomes, a broad brush of economists have raised their 2011 growth projections into the 3.5-4 percent range. If realized, that pace and its implied boost to payrolls would greatly lift receipts from income, profits, and sales taxes, which make up 46 percent of state revenues, compared to 34 percent from federal grants.

State budgets may actually fair better than local finances next year. That reflects the different sources of revenues between states and cities. Property taxes account for 35 percent of local government receipts, while grants-in-aid from their respective state governments make up another 40 percent. The problem: Property taxes fluctuate with assessments, which are bound to go nowhere in the coming year, and many states under continued stress will find it difficult to funnel money to municipalities. Clearly, the better state coffers do in 2011, the better the condition of local budgets.

All this raises fears of a rash of defaults in the $2.8-trillion municipal bond market, as the 60-minutes report suggested. States and cities under the heaviest fiscal stress are already paying a significant premium on new borrowing, and the loss of Build America Bonds at the end of 2010, part of the 2009 Recovery Act, could lift borrowing costs further.

However, muni-bond defaults have actually fallen in 2010, to 72 totaling $2.5 billion, down from 204 in 2009, according to data reported by Bloomberg. Chris Hoene, director of research and innovation at the National League of Cities, notes that interest expense is only about 5 percent of state and local expenditures, and nearly all debt is long-term with predictable payments. Plus, almost all states and cities have balanced-budget requirements with provisions to address debt issues before default can occur.

Unfortunately, the draconian cuts already seen in state and local services and jobs have been the chief reason defaults have been held in check. For 2011, however, fewer cutbacks and a smaller hit to the overall economy seem likely. Economists at Barclays Capital project further declines in state and local payrolls of about 150,000 by the end of 2011. Every job is important, but in the big picture, that’s a drop in the bucket. Moody’s Analytics estimates that, if the economy grows nearly 4 percent next year, it will create about 2.6 million jobs, each one adding new revenues to state and local coffers. The same Barclays analysis projects that state and local governments will subtract only about 0.1 percentage point from growth in GDP in 2011.

State and local budgets are by no means out of the woods. Pressure will most likely continue into 2012, and longer-term problems loom with rising pension costs and Medicaid commitments. For now, at least, governments are making progress, and a stronger economy will add to the positive trend.