In introducing the next generation of Kindle Fire tablets, Jeff Bezos, the CEO of Amazon.com (AMZN), has bragged in media interviews that the company’s goal was nothing less than to produce “the best tablet at any price.” Translation? Amazon believes it has produced a better product than the much-vaunted Apple (AAPL) iPad – and done it at a lower price. Or at least that’s the company line.

For its part, Apple is rumored to be ready to take on the original Kindle Fire – a smaller device – with an iPad mini that is said to be both smaller and less pricey.

The one thing that seems clear is that both Apple and Amazon are staking their financial wellbeing on their ability to wow and woo consumers with their competing gadgets during the final months of 2012.

The second quarter was a disappointing one for Apple, but with its next-generation iPhone expected to be unveiled tomorrow in San Francisco, a successful new iPad launch in the fourth quarter of the year could end up turning the second half of the year into a rewarding one for investors. That is, if Amazon’s launch of the new Kindle Fire products doesn’t end up raining on Apple’s parade by stealing away tablet consumers looking for something different or better – or by forcing Apple to lower prices and erode its hefty margins.

RELATED: Nokia and Motorola Take Aim at Apple's iPhone

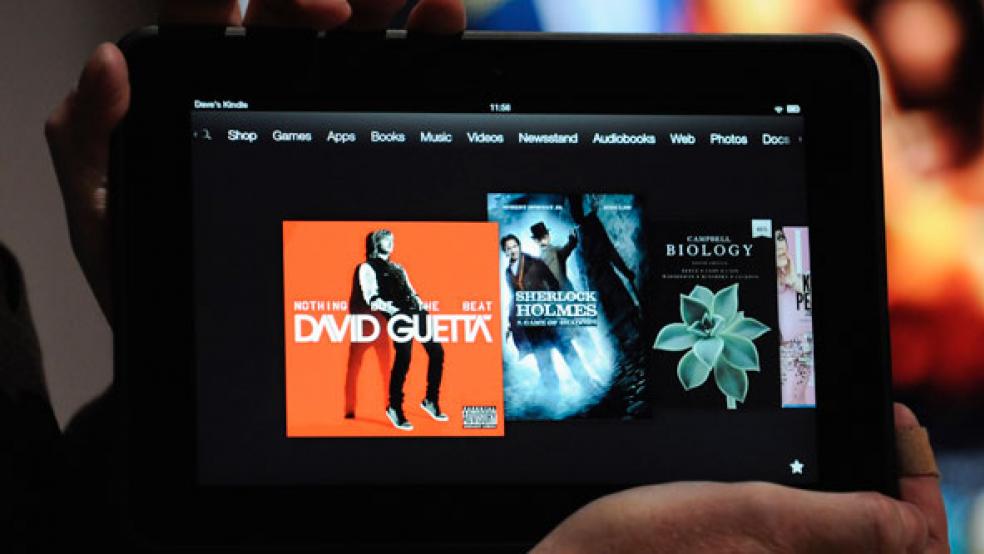

It’s been six months since the “new iPad,” the third generation of the tablet, made its debut, and already gadget addicts are in quest of the next leap forward. That’s an opportunity that Amazon has seized upon by rolling out not just one but an array of new Kindles, both of the “Fire” and more traditional variety. But the risk and challenge for Amazon also seem to be greater at this point in time.

That’s due, in part, to the fact that when it comes to tablets, Amazon is still the runner-up. Yes, the low price of the Kindle Fire made it a great product for those who didn’t need, didn’t want or couldn’t afford the fancier and more versatile iPad. But those aren’t the kind of buyers who are going to keep going back to the well every six months or so; they are likely to be the folks content to replace their gizmos every two years, or whenever they break down. They need to be convinced that there’s something “more” to the new product and that that has real, measurable value, not just that it’s a cool new feature. Amazon also has to convince consumers not to view the iPad as the standard and every other tablet on the market as an inferior runner-up product.

For its part, Apple has to be able to coax core devotees to upgrade their iPhones and contemplate bypassing Amazon’s budget priced offerings in favor of a mini, or full-sized, iPad. The former likely will be a much simpler task than the latter, as rumors of a nifty new design combined with much wider 4G LTE coverage already is causing many iPhone owners to eagerly contemplate swapping their about-to-be-old-and-stodgy devices for the new new thing.

Fighting Amazon’s marketing strategy – offering discount-priced devices in the expectation of getting consumers to snap up more music, books and video content from Amazon – is likely to be a tougher matter. An iPad mini may well be a real test of Apple’s brand in the eyes of consumers.

Regardless of the specific merits of each of the new gadgets, corporate earnings at both companies for 2012 will be tied to the fate of the products they are rolling out in time for the holiday giving season. So keep your eyes open for any early reports – even anecdotal ones – on the extent to which the next-generation Kindles, iPads and iPhones are being viewed as essential by consumers. For that matter, it’s worth keeping an eye on consumer confidence and consumer spending data more broadly; if the economy slows down much more, top-of-the-line products at both may suffer, as consumers scale back their spending.

RELATED: Apple Hits New High: Most Valuable Company Ever

One interesting twist to the whole question is whether consumer spending on the much-anticipated iPhone 5 will be enough to not only translate into a big earnings gain for Apple itself but a benefit for the whole economy. Michael Feroli, an analyst at JPMorgan Chase (JPM), suggested in a report to clients yesterday that the release of the new smartphone could add as much as half a point to annualized GDP growth in the fourth quarter of 2012. His calculation is based on an assumed price for the new phone of $600, and trade margins of about $400. The resulting impact on GDP – a gain of $3.2 billion in the fourth quarter – “would limit the downside risk to our Q4 GDP growth projection” of 2 percent, Feroli wrote. If that turns out to be the case, maybe an alternative to more stimulus measures by the Fed is simply to encourage Apple to roll out more high-demand products more often?