Yesterday, the European Central Bank cut its principal interest rate to counter continuing slow growth. A key factor in the decision is evidence that inflation has been falling in the euro zone from 2.2 percent late last year to a current rate of just 1.2 percent.

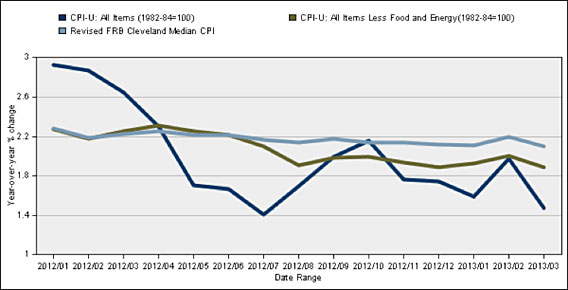

A day earlier, the Federal Reserve voted to maintain an accommodative monetary policy and noted that inflation has been running below its expectations. The consumer price index has been trending downward since last fall.

While it is true that some prices are rising, it’s important to remember that the CPI is a weighted average of everything that a household buys and people tend to notice those that are rising and may not be aware of those that are falling.

Keep in mind also that many experts believe that the CPI overstates the true rate of inflation because of a statistical flaw in its measurement. This is the rationale for changing the way Social Security benefits and tax brackets are indexed for inflation to what is called “chain weighting". While controversial, it has bipartisan support.

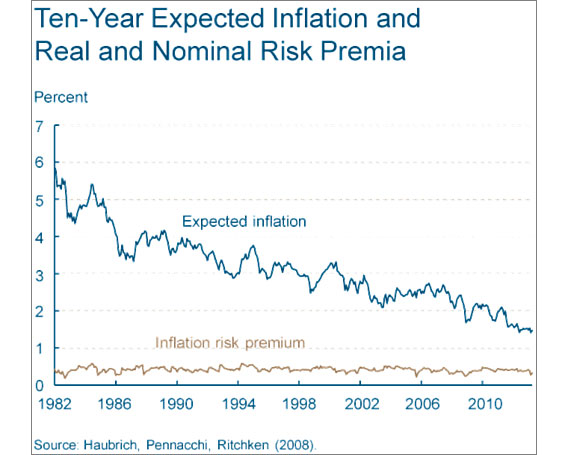

Perhaps more importantly, expectations of inflation are falling. This can be derived from Treasury bonds that are indexed to inflation. Comparing yields on such securities with those on non-indexed bonds tells us what markets are expecting in terms of inflation. While not a perfect indicator of future inflation, those buying indexed bonds are putting their own money at risk if they are wrong and inflation comes in higher than expected.

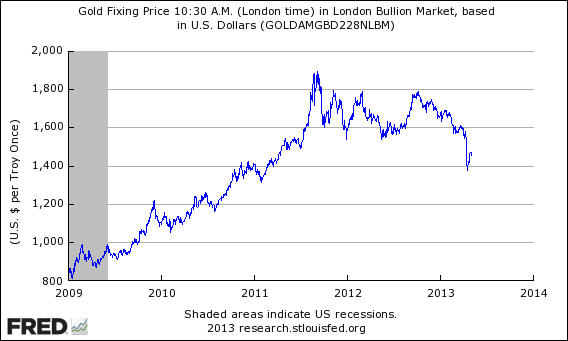

Some people believe that the price of gold is a very accurate indicator of inflationary expectations. Insofar as this is true, it is also signaling declining inflation. The price of gold is down 13 percent since the first of the year and many observers think it has much further to fall to be consistent with the moderate inflation since the big run-up between 2009 and 2012.

In the last few days, steelmakers have complained about plunging prices for steel, and one of the Federal Reserve’s leading “inflation hawks,” James Bullard of the Federal Reserve Bank of St. Louis, has warned that inflation in running so far below the Fed’s target rate that it may require further action by the central bank.

Yet conservatives continue to insist, as they have continuously since 2008, that hyperinflation is right around the corner because they Fed has increased the money supply. For example, on March 21, Rep. Louis Gohmert (R, Texas), warned that people’s bank accounts are disappearing daily because of the massive, ongoing inflation caused by the Fed.

One explanation for the disconnect between monetary stimulus and falling inflation is the deflationary effect of fiscal policy. The budget deficit has fallen by half from 10 percent of the gross domestic product in 2009 to 5 percent this year and will fall by half again in 2015, according to the latest Congressional Budget Office projections. In fact, the Treasury expects to run a $35 billion surplus in the second quarter of this year.

Many economists believe that deficits are per se inflationary. This is a key reason why they expected inflation back in 2009, which fueled a run-up in the gold price. If so, then falling deficits must be anti-inflationary. Other economists believe there is a vital connection between monetary and fiscal policy, and that increases in the money supply are passive unless federal spending causes the money to be circulated rather than sitting in bank reserves where it has no economic effect.

Falling federal spending due to various budget deals and the ongoing sequester, therefore, makes monetary policy less effective and less inflationary. In fact, the Fed said that “fiscal policy is restraining economic growth,” in its May 1 statement, by which it means that spending is falling too rapidly, not rising too much as Republicans insist.

The political constraints on higher spending are unlikely to change anytime soon, with Republicans still insisting that spending be slashed. Therefore, the Fed alone must find a way to deal with continuing downward price pressure, which could become recessionary unless checked.