The growing wealth disparity between CEOs and workers finally may be catching up to corporate America.

With the Securities and Exchange Commission pushing an ambitious new proposal that would mandate companies to disclose gaps between executive and worker pay, a new study which does just that will only add fuel to the debate.

CEO pension plans are now worth an average 239 times more than the retirement plans for the employees they supervise, according to data compiled by NerdWallet on the companies with the 10 highest gaps.

Compensation for chief executives at those companies is 550 times higher.

| Company | CEO pension value | Average 401k balance per worker | CEO pension multiple |

|---|---|---|---|

| 1. Walmart | $113,157,559 | $18,303 | 6,182 |

| 2. McKesson | $115,822,288 | $122,768 | 943 |

| 3. GE | $53,184,790 | $83,386 | 638 |

| 4. AT&T | $42,744,354 | $78,223 | 546 |

| 5. Phillip Morris | $60,450,060 | $238,577 | 253 |

| 6. Pfizer | $34,541,840 | $153,860 | 225 |

| 7. ExxonMobil | $68,072,125 | $469,885 | 145 |

| 8. Bank of America | $7,698,032 | $54,762 | 141 |

| 9. Google | $9,105,779 | $70,517 | 129 |

| 10. Oracle | $14,866,191 | $153,195 | 97 |

| Median | 239 |

That's a lot of ammunition for those pushing for tighter controls over executive compensation.

"Maybe CEOS won't be bothered, but I think workers will," said Dana Lime, product manager at NerdWallet. "This will hurt morale and to some extent productivity."

Related: 5 Years After the Crisis: Why the Income Gap Is Widening

Perhaps as importantly, the numbers will stoke the debate over the SEC plan, which in turn was guided by the Dodd Frank reform act. SEC officials have battled over the plan's merits, with proponents saying it will tell shareholders whether company heads are performing up to their level of pay, while opponents believe there is no other purpose to the law than "to shame CEOs," as Republican commissioner Michael Piwowar described it.

In a statement to Reuters, Piwowar said "the shame from this rule should not be put on CEOS - it should be put on the five of us," he said. "Shame on us for putting special interests ahead of investors."

According to NerdWallet's numbers, which were gleaned from proxy statements, government reports and data firm BrightScope, Wal-Mart leads the disparity, with CEO Mike Duke having a retirement nest egg more than 6,000 times the size of his average worker's 401(k) plan.

Duke's compensation, including salary and other forms, comes to $20.7 million a year, which is 836 times larger than the average non-manager compensation and 305 times the average manager compensation, NerdWallet said. Those numbers don't tell the whole story, said Wal-Mart spokeswoman Brooke Buchanan.

Related: Some CEOs Are Still Cashing In at Our Expense

"Mike has been with the company since 1996, for nearly 20 years. He's been voluntarily contributing to the deferred contribution (plan) since then, so you can imagine when you're working for a company for a while, the number gets higher," she said.

Wal-Mart employees, meanwhile, amassed more than $770 million in quarterly bonuses in 2012. "We offer our associates pay and benefits that are as good or even better than our retail competitors, and we are a pay-for-performance company. That includes our executives as well as our field members and corporate staff," Buchanan said. "There are a lot of opportunities for workers to drive up their own (compensation)."

Other companies on the list did not return requests for comment.

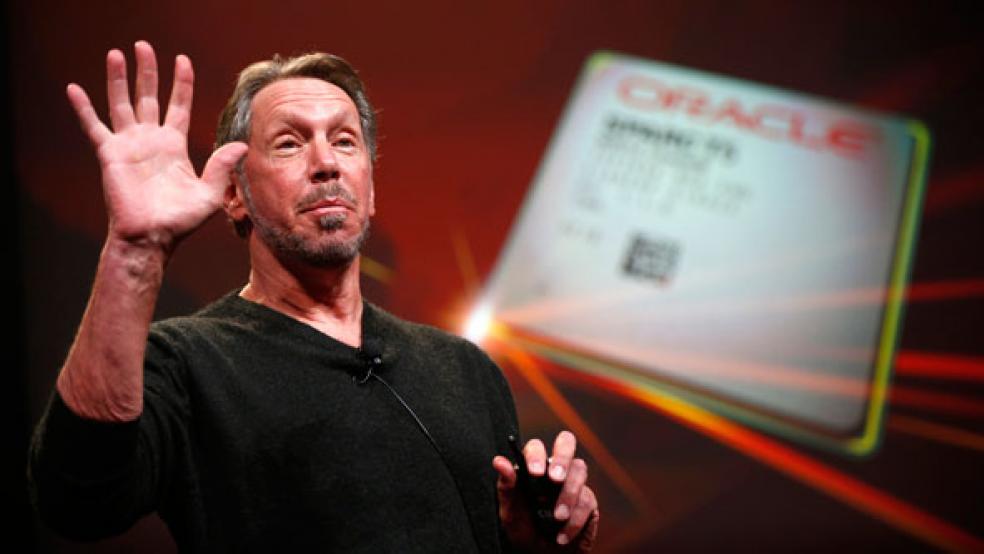

Not surprisingly, Oracle topped the list of companies with the biggest discrepancy between CEO and worker pay, as its leader, Larry Ellison, makes just below $80 million, 1,262 times the average nonmanager salary and 571 times the manager's salary. "This will be a wake-up call in terms of governance," Lime, of NerdWallet, said. "There's going to be pressure just from a political standpoint to bring those multiples down."

This article originally appeared at CNBC.

Read more at CNBC:

CEO Pay: Another Statistic Coming for Investors

Billionaires Say What? 6 Words Only They Know

10 Ways to Get Your Retirement Plan on Track