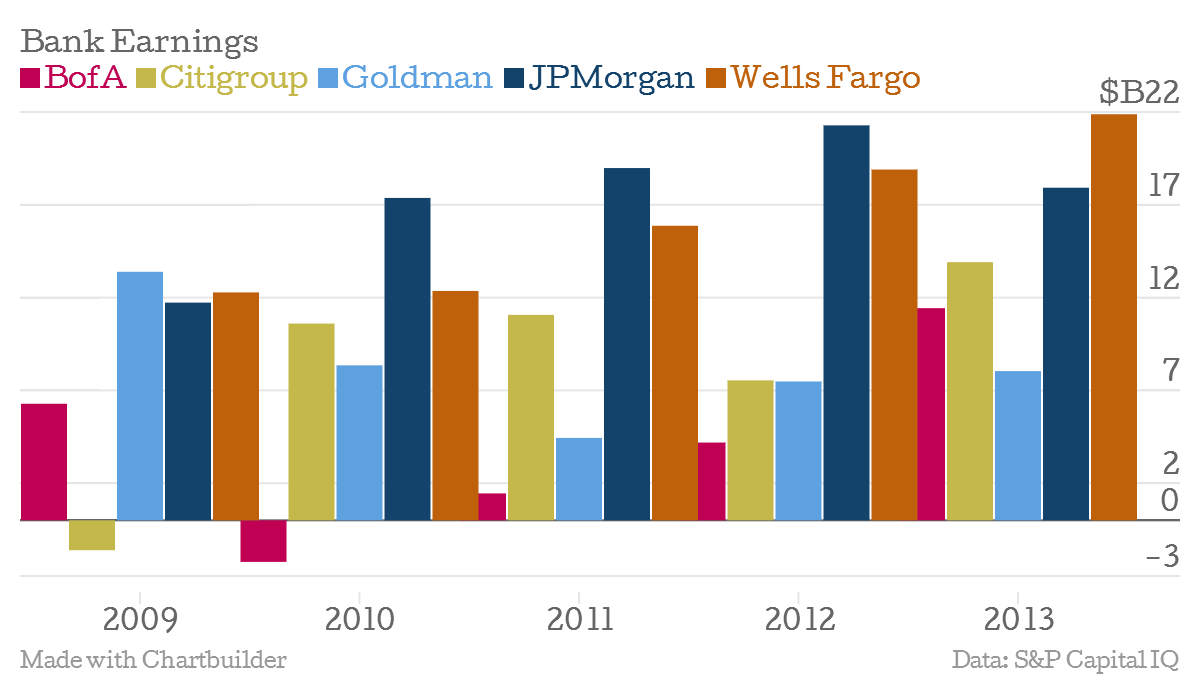

The biggest U.S. banks underwent a big shift in 2013. For the first time since 2009, JPMorgan Chase was not the most profitable of the nation's financial giants, as massive legal and regulatory settlements cut into its earnings. Instead, that title went to Wells Fargo, the country’s largest mortgage lender, based on data released by the banks this week.

JPMorgan Chase reported full-year profit of $17.9 billion, down 16 percent from a record $21.3 billion in 2012. Despite a slowdown in mortgage refinancing caused by rising interest rates late in the year, Wells Fargo earned $21.9 billion in 2013, up from $18.9 billion in 2012.

Wells Fargo’s stock has outperformed that of JPMorgan over the past year, and it now has a market value of $244 billion, roughly $20 billion larger than JPMorgan’s.

Related: Why 'Too Big to Fail' Is a Bigger Problem Than Ever

On the other hand, JPMorgan is still the largest U.S. bank by assets, and it generated $23.15 billion in revenues last year, compared with $20.67 billion for Wells Fargo. It also would have retained its profit title if not for more than $11 billion in legal expenses.

JPMorgan came through the financial crisis in the best shape of any large U.S. bank. Its profits surged past those of Goldman Sachs and Wells Fargo in 2010 and then climbed higher still over the following two years. But its sterling reputation has lost much of its luster more recently as lawsuits and government investigations mounted. The bank agreed to roughly $22 billion in fines and penalties over the past year, and about $29 billion over the past two years.

Earlier this month it agreed to pay $2.6 billion to the U.S. government to settle criminal and civil allegations that it failed to raise red flags about Bernie Madoff’s Ponzi scheme. That settlement reduced fourth quarter profits by about $850 million. It followed a record $13 billion agreement reached in November to settle investigations into its mortgage-bond sales.

"It was in the best interests of our company and shareholders for us to accept responsibility, resolve these issues and move forward," JPMorgan CEO Jamie Dimon said in a statement accompanying the earnings release.

Dimon shrugged off losing the annual profits crown. “The company is doing really well,” he told reporters on Tuesday. “And that’s what’s important, being the best, not the biggest. The biggest, that doesn’t worry me that much.”

Still, JPMorgan could regain that title fairly quickly if its legal costs ebb and falling demand for mortgages hurts Wells Fargo’s bottom line.

Top Reads from The Fiscal Times: