Facebook’s announcement late Wednesday of a $19 billion deal to buy WhatsApp instantly raised a couple of key questions.

The first, for many: What’s WhatsApp? (So don’t feel like a complete dork if you asked that, too.)

For those not in the know, WhatsApp is a smartphone app that lets users send messages over the Internet, avoiding text messaging charges from wireless carriers. And it has very quickly become a very big deal in mobile messaging, a key part of the push by Facebook and others toward broader, global mobile supremacy.

Related: How My Mom Killed Facebook

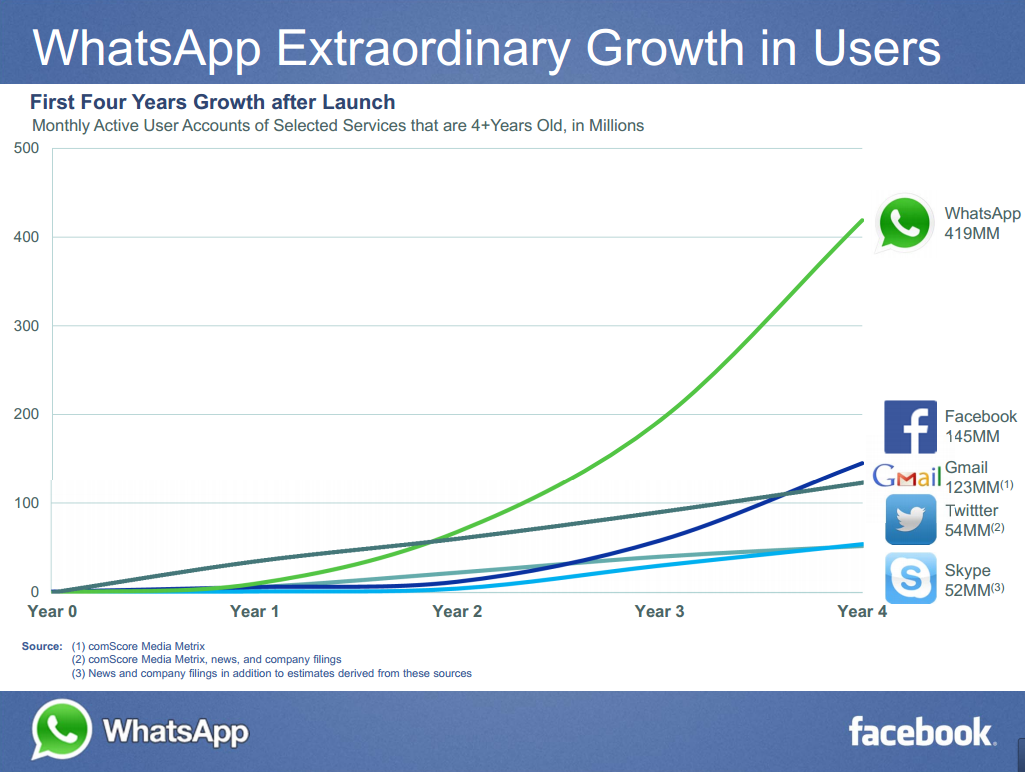

The Mountain View, CA, startup says 450 million people use its service each month, with about 70 percent using it daily. It also says it is adding 1 million registered users a day, allowing Facebook to tout its potential to reach 1 billion or more people in the next few years.

Despite that trajectory, WhatsApp may be far less familiar to smartphone users in the United States — even those who have loaded their iPhones or Android models with apps like Facebook, Instagram, Snapchat, Angry Birds or Candy Crush Saga.

“It doesn’t get as much attention in the U.S. as it deserves because its community started off growing in Europe, India and Latin America, but WhatsApp is a very important and valuable worldwide communication network,” Facebook’s Mark Zuckerberg told analysts on a conference call Wednesday. “In fact, WhatsApp is the only widely used app we’ve ever seen that has more engagement and a higher percent of people using it daily than Facebook itself.”

Related: Facebook ‘Likes’ Tax Schemes to Avoid Paying Uncle Sam

Both the relatively low profile and the engagement are the result of the approach taken by WhatsApp co-founders Jan Koum and Brian Acton since they started the company in 2009. The two former Yahoo employees and their team focused entirely on the product and the users. They spent no money on marketing or user acquisition, venture capitalist Jim Goetz of Sequoia Capital noted in a post on Tumblr after the deal was announced. Sequoia, the only venture firm to back WhatsApp, invested a reported $60 million in the company.

“While others sought attention, Jan and Brian shunned the spotlight, refusing even to hang a sign outside the WhatsApp offices in Mountain View,” Goetz wrote. “As competitors promoted games and rushed to build platforms, Jan and Brian remained devoted to a clean, lightning fast communications service that works flawlessly.”

WhatsApp may be a huge hit, but that still leaves the second key question: Is it really worth the enormous sum Facebook is paying to make its largest acquisition by far? The $19 billion purchase price works out to about $42 for each of WhatsApp’s monthly users — or $345 million for every one of its 55 employees.

Facebook has its own Messenger service, which is popular in the U.S. but trails competitors like WhatsApp and others internationally. The deal dramatically extends Facebook’s global reach in messaging at a point when foreign sales have grown to account more than half of Facebook’s ad business. The deal also helps further diversify Facebook’s business beyond just the core social network, helping ensure it won’t simply go the way of MySpace, Pivotal Research Group analyst Brian Wieser wrote Wednesday. Last year, Facebook had sought to buy another messaging app, Snapchat, for $3 billion but was spurned.

WhatsApp is reportedly profitable, but analysts peppered Zuckerberg and Facebook CFO David Ebersman with questions about the valuation and how Facebook plans to make money off the acquisition. The answers were reminiscent of one given often back in the days of the dotcom boom: eyeballs.

“Internet services that reach a billion people are all incredibly valuable, and we believe WhatsApp will be as well,” Zuckerberg said. “Our focus will remain on connecting more people and increasing engagement, but over the long term we look forward to seeing what the team can do to build a really great business.” WhatsApp lets users send messages for free for a year. After that, it charges 99 cents a year. “We’re not really concerned about monetization today. We’re focused on growth,” WhatsApp co-founder and CEO Jan Koum said on the conference call.

The WhatsApp founders have shunned integrating ads — where Facebook makes it money — into their messaging service. The app’s existing subscription model, Zuckerberg said, is a “promising start.” Stronger monetization will come eventually, Zuckerberg said: “We believe that, once we get to being a service that has a billion, 2 billion, maybe even 3 billion people one day, that there are many clear ways that we can monetize.”

For now, though, the price looks rich. “While we see strategic merit, the acquisition is difficult to justify on metrics we use to value Facebook,” Pivotal Research Group’s Wieser wrote in downgrading the stock from a “Buy” to a “Hold.”

Top Reads from The Fiscal Times: