The slow-rolling recovery of the U.S. economy in the years following the recession of 2007-2009 is part of a worsening historical trend, according to the Federal Reserve Bank of Atlanta’s 2013 annual report. In an interactive report on the labor market, released Monday, researchers noted that recovery from each of the last three recessions, measured by the amount of time it takes to restore all the jobs lost during the recession, has taken increasingly more time.

From 1950 to 1989, the U.S. suffered seven different economic recessions, and the average amount of time required to replace the lost jobs was 10 months. But the recession of 1990-1991 took 23 months, the 2001 recession took 38 months, and the Great Recession of 2007-2009 has been ongoing for 57 months, and still isn’t complete.

Related: Just 10 Days to Pass an Unemployment Extension Bill

“The nation's labor market has recovered far more slowly after the Great Recession than it did following every other economic downturn since World War II,” the report found.

“The compensation to workers—including benefits and adjusted for inflation—has barely risen above its prerecession level,” it says. “At year's end, almost 38 percent of unemployed people had been jobless for at least 27 weeks, by far the highest percentage of long-term unemployment since World War II. Moreover, 12.6 million people left the labor force in the six years through December 2013.”

One of the differences between this recovery and those in the past was the austerity measures the government adopted to reduce spending. The study notes that public sector employment has historically weathered economic downturns well. But this time around, with officials at all levels of government citing the need to slash spending, government employment dropped precipitously, creating more unemployed workers with little spending power. The cuts were felt most dramatically at the local level, but all layers of government experienced reductions. As with many industries, government employment remains below pre-recession levels.

While the unemployment rate had been gradually falling over the past few years, there remain more than 10 million unemployed Americans as well as nearly 8 million more who are working part time because they cannot find full time work. And there is evidence, according to Fed researchers, that the kind of jobs that are coming back into the economy aren’t necessarily as desirable as the jobs that were lost.

Related: New Deadline Looms on Unemployment Benefits Extension

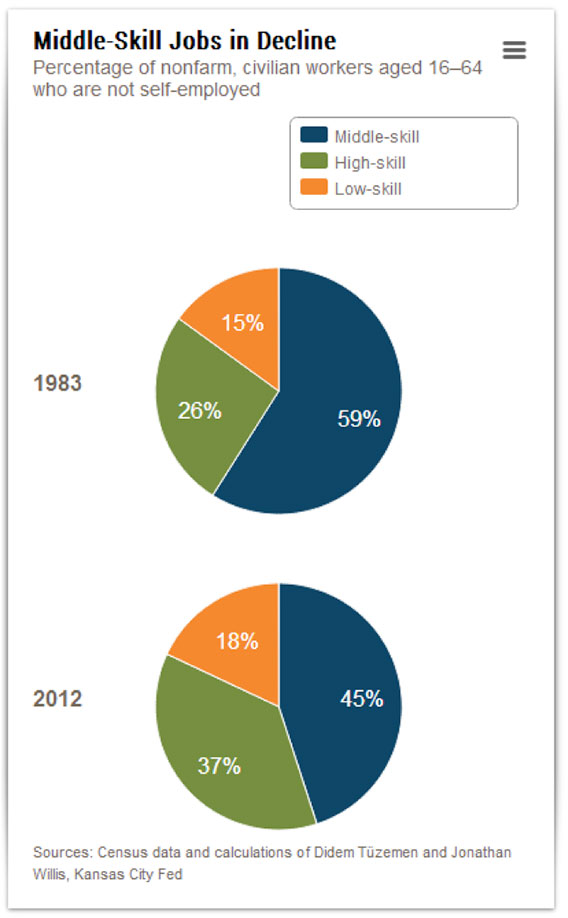

Researchers also cite several things that may be “holding back” a return to full employment. They describe a “polarization” in the jobs market, as the number of jobs requiring a moderate level of skill decrease or get off-shored, while the number of both low-skill and high-skill jobs increase. (See graph.)

Some economists believe that there is a “skills mismatch” – meaning that companies looking to hire can’t find competent workers in their field. For instance, manufacturing and construction firms cut jobs during the recession, and many of the companies hiring as the country recovers are in different sectors, meaning that the unemployed may not have the necessary skills for the job. Researchers dismissed the skills mismatch theory as a major cause of unemployment, saying that the role it plays is likely a relatively small one. However, they added, it might contribute to the relatively high number of long-term unemployed in the country.

More worrying, they said, was the slow pace at which U.S. businesses have been growing.

“Early in the recovery, firms continued to have the lowest rate of job creation on record, and fewer new firms were created in 2009 and 2010 than in any other time in the previous 30 years,” they found. “Although the unemployment rate fell faster than expected in the latter part of 2013—roughly four-and-a-half years into the recovery—hiring rates at firms were still relatively subdued.”

Related: Four Ideas to Help Revive the Middle Class

The complexity of the U.S. economy, Fed researchers said, creates a tricky public policy problem for lawmakers and others looking to spur hiring and expansion.

“The diversity of the types of businesses that create jobs, large firms, small firms, young firms, old firms, creates a significant economic policy challenge,” said John Robertson, vice president and senior economist at the Atlanta Fed. “No single policy is necessarily going to be effective in solving the jobs problem in the United States.”

Top Reads from The Fiscal Times

- High Tax States Are Losing Billions

- Four Ideas to Help Revive the Middle Class

- Liberal Dems’ New Goal: Boost Social Security Benefits