Just 100 top CEOs have as much saved for retirement as 50 million Americans, thanks in large part to special savings plans that their employees don’t receive, according to a new study.

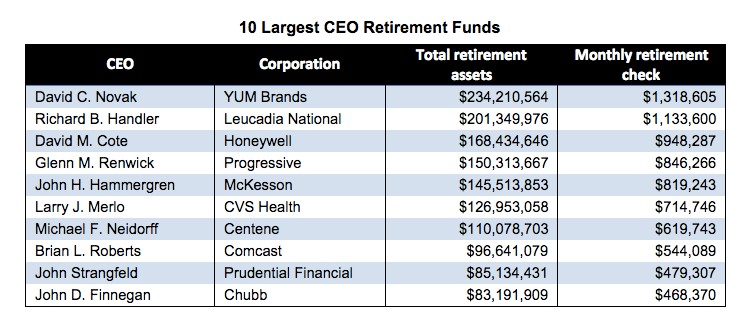

The Center for Effective Government found that the 100 biggest nest eggs of corporate chiefs added up to $4.9 billion, or 41 percent of what American families have saved for retirement. David Novak, the former CEO of Yum Brands, the company that owns Taco Bell, Pizza Hut and KFC, had the largest nest egg, worth $234.2 million, or enough money to provide an annuity check of about $1.3 million a month starting at age 65.

Related: 10 CEOs Who Make Way, Way, WAY More Than Their Workers

By contrast, almost three in 10 Americans approaching their golden years have no retirement savings at all, the study said, and more than half between 50 and 64 will have to depend on Social Security alone, which averages $1,233 per month.

Aside from fatter paychecks, CEOs get two other perks to help them grow their retirement funds faster than their employees can. Companies and business groups argue that CEO retirement packages are tied to executive performance and necessary to be able to attract top executives.

Special Pensions

More than half of Fortune 500 CEOs receive supplemental executive retirement plans (SERPs), a type of tax-deferred defined-benefit plan for the C-suite. These plans have come under heat from shareholders as expensive and unnecessary.

Related: Baby Boomers Face a Shocking Retirement Savings Shortfall

CEOs enjoy these plans even as companies eliminate regular defined-benefit plans for employees. Only 10 percent of companies provide defined-benefit pension plans, covering just 18 percent of private sector workers, according to the Bureau of Labor Statistics. In the early 1990s, more than a third of private sector workers had pension plans.

Executive Tax-Deferred Compensation Plans

Almost three-fourths of Fortune 500 companies offer their senior executives tax-deferred compensation plans. Unlike 401(k) plans offered to regular workers, these special plans have no limits on annual contributions. That allows CEOs to invest a lot more in their retirement than everyday Americans. For example, last year, 198 CEOs running Fortune 500 companies were able to invest $197 million more in these plans because they were not hamstrung by limitations on defined compensation plans, the study found.

American workers over 50 can contribute only $24,000 a year to 401(k) plans, while younger employees have an $18,000 limit.