Although the Paycheck Protection Program was designed to help small businesses keep their employees on the payroll, millions of dollars in assistance has been allocated to publicly traded companies, according to new research from Morgan Stanley.

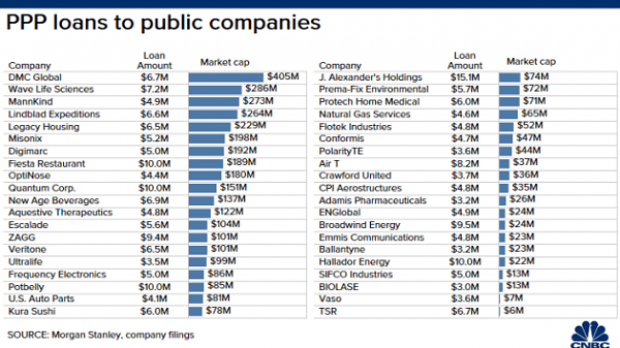

At least 75 such firms have claimed $243 million from the program, including 15 with market caps of over $100 million, according to the analysis (see the chart below, via CNBC). Fiesta Restaurant Group, for example – which operates the Pollo Tropical and Taco Cabana restaurant brands, has a market cap of over $180 million and employs more than 10,000 people – received a loan of $10 million, the maximum allowed.

The loans are available to some larger companies due to a loophole in the law that allows some businesses to treat separates locations of the same chain as individual entities. Firms that use the money to cover payroll costs are eligible for loan forgiveness.

A separate analysis by the Associated Press uncovered 75 publicly traded companies that received more than $300 million in low-interest loans through the small business rescue program. The AP found eight firms that received the maximum loan amount of $10 million and said that was likely just the “tip of the iceberg.” Some companies that received loans had recently reported millions of dollars in cash on hand, the AP said, and others likely have access to other sources of assistance.

Some larger firms that received the assistance defended their participation in the program, saying they were just following the rules, with the goal of helping their employees. But critics worry that smaller firms have been shortchanged, missing out on aid that was targeted at true mom-and-pop businesses that lack access to conventional bank loans and private investors. Thousands of small business owners were reportedly shut out of the program when funds ran dry last week, including many independent restaurant owners, some of whom feel they lost out to better financed chains.

Zachary Davis, a California businessman who owns two ice cream shops, told the AP that “if you’re a little guy, chances are you’re going to the back of the line.”

Howard Schultz, the billionaire founder of the Starbucks coffee empire, seemed to agree. “I think you’ve seen some pretty shameful acts by some large companies to take advantage of the system,” Schultz said.