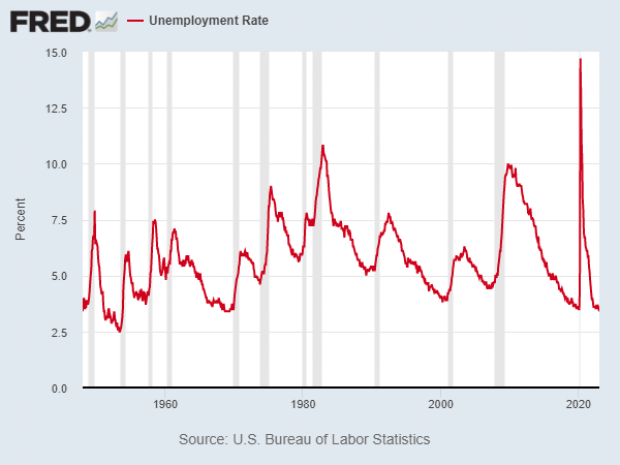

Job creation soared in January as employers added 517,000 positions and the unemployment rate dropped to a 53-year low of 3.4%, the Bureau of Labor Statistics reported Friday. The report blew the doors off expectations, signaling that the post-pandemic labor market is still going strong despite the Federal Reserve’s effort to cool the economy.

“Job growth was widespread, led by gains in leisure and hospitality, professional and business services, and health care,” BLS said.

An even bigger jobs boom: Job gains in previous months were revised upward, with the estimate for November rising from 256,000 to 290,000 and the estimate for December rising from 223,000 to 260,000. And the total number of employed workers at the end of 2022 was revised higher to 154.6 million – an increase of 813,000.

“It was a phenomenal report,” Michelle Meyer, chief U.S. economist at the Mastercard Economics Institute, told CNBC. “This brings into question how we’re able to see that level of job growth despite some of the other rumblings in the economy. The reality is it shows there’s still a lot of pent-up demand for workers where companies have really struggled to staff appropriately.”

Check the footnotes: The exceptionally strong jobs report does come with some notable caveats. Seasonal adjustments typically play a major role in the January report as the BLS updates its benchmarks and population controls, and this month’s report is no exception. Even more than usual, those adjustments may have exaggerated the extent of job growth during the month.

“The January jobs report will almost certainly be revised down in the coming months, and one should take the top-line estimate of an increase of 517,000 in total employment with more than a grain of salt,” wrote Joseph Brusuelas, chief economist at RSM.

Mark Zandi, chief economist at Moody’s Analytics, was even more skeptical. “I wouldn’t take this data at face value. In fact, there is strong evidence … that future revisions will show the economy created many fewer jobs over the past year,” he wrote. “Probably better to ignore the report altogether.”

Not all experts agreed on the severity of the distortion in the data. Bloomberg economists Anna Wong and Eliza Winger said that while much of the job gains are driven by seasonal factors and revisions, “it can’t be denied that the labor market remains tight.”

Jennifer Lee, senior economist at BMO Capital Markets, said, “We can’t completely dismiss all of these data. We can’t blame it on the seasonals. Breaking it down by industry, it’s pretty safe to say there’s wall-to-wall strength.”

A boost for Biden: Concerns over the quality of the data certainly didn’t stop the White House from celebrating the “strikingly good” jobs numbers ahead of President Joe Biden’s State of the Union address next week. “For the past two years, we’ve heard a chorus of critics write off my economic plan. They said it’s just not possible to grow the economy from the bottom up and the middle out,” Biden told reporters Friday. “What today’s data makes crystal clear what I’ve always known in my gut: These cynics and critics are wrong.”

What recession? Whatever the final readings on the job numbers, it seems clear that the job market is still showing signs of remarkable resilience, in ways that make a recession less likely, at least in the near term. “Many people have assumed the US economy will tip into a recession this year,” economist Nick Bunker of Indeed Hiring Lab said in a research note. “But with each new batch of labor market data, those prospects seem to dwindle.”

A complicating factor for the Fed: One major question is how the Fed will respond to the data. While distortions created by the seasonal adjustments may lead the central bank to discount the report to some extent, there’s no missing the fact that the labor market remains strong — probably too strong for the Fed as it tries to tame inflation. The jobs report will likely only stiffen the Fed’s resolve to cool the economy, especially wage growth, raising the odds that the bank will hike interest rates higher and hold them there longer.

“My own view,” Fed Chair Jay Powell said earlier this week, “would be that you’re not going to have a sustainable return to 2% inflation … without a better balance in the labor market.”

However, there are signs that the strong demand for labor is not translating into a surge in wages. Average hourly earnings rose 0.3% in January — higher than the Fed wants, but not dramatically so. “More focus should be placed on the [wage] earnings data,” Rob Clarry, an investment strategist at Evelyn Partners, said in a research note. “The high headline reading does not appear to be translating into further inflationary pressure — an important finding for the Fed.”

Elise Gould, an economist at the left-leaning Economic Policy Institute, encouraged the Fed to take note of the data, with the hope that officials will allow the booming job market to continue rather than strangling it with higher rates. “Message to the Fed: Wage growth continues to decelerate no matter how it's measured,” she wrote. “These trends are not driving inflation.”

EPI’s Heidi Shierholz had a similar message. “January’s annualized monthly wage growth was 3.7%, a very non-inflationary number,” she wrote. “I’ve said this before and I’ll say it again, BY THIS MEASURE THE FED’S WORK IS DONE.”

Still, the bias at the Fed will likely lean toward more tightening. “As long as unemployment continues to go down, as long as the economy continues to be strong, the Fed’s going to keep fighting inflation,” Giacomo Santangelo, an economist at the employment site Monster, told the Associated Press.