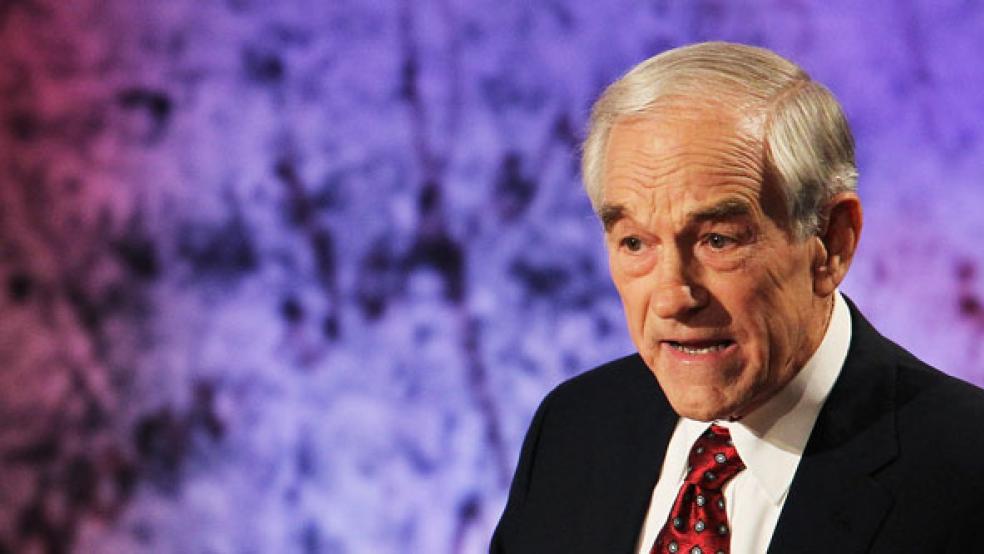

Heading into the eighth GOP presidential debate tonight in Las Vegas, libertarian Rep. Ron Paul of Texas is trying to shake things up with a budget plan that would eliminate five cabinet-level departments as soon as he takes office.

While Paul’s plan isn’t likely to garner the wide-spread attention that GOP hopeful Herman Cain did with his 9-9-9 tax reform plan, Paul is hoping for some kind of game changer that will elevate him from the third tier of Republican presidential candidates.

Like other Republican challengers, Paul says he would repeal President Obama’s health-care-reform and the Dodd-Frank financial overhaul legislation enacted last year. Paul would also allow young workers to opt out of Social Security.

Paul’s “Plan to Restore America” would slash $1 trillion from the federal budget and wipe out the Departments of Energy, Interior, Commerce, Education, and Housing & Urban Development. It is fairly common for conservative Republicans to trash the Education Department, because of alleged “meddling” in a local issue. But calling for elimination of five major departments is some kind of record for a serious presidential candidate.

Paul, who has vowed to put an end to U.S. involvement in the wars in Afghanistan and Iraq, would cut the Defense Department and foreign aid programs by 15 percent. The Food and Drug Administration would take a 40 percent hit, while the Environmental Protection Agency would its budget slashed by 30 percent.

"A lot of people will say, $1 trillion in a year, that's too radical," Paul said at the Venetian hotel in Las Vegas. "Well, the radicals have been in charge way too long."

Just to make sure there was no doubt he has his sights on the frontrunner, former Massachusetts Gov. Mitt Romney, Paul chose Las Vegas to announce his comprehensive policy plan. Just one month earlier, Romney rolled out a 59-point economic plan to create 11.5 million jobs in Vegas.

However, Paul’s skimpier 11-page plan is drastically different from Romney’s proposal. It’s heavy on tax measures, including deep cuts to the corporate tax rate and elimination of taxes on dividends and capital gains. (Romney also vowed to keep marginal income taxes and tax rates on savings and investments low.)

Apart from his wrecking-crew approach to federal departments, many of Paul’s other libertarian ideas are well-known, such as his proposal to conduct full audit of the Federal Reserve and strengthen the dollar.

While Paul’s priority is to dramatically reduce the size of the federal government and balance the budget, he doesn’t – like Romney – offer much to spur job creation. Some supporters of Paul’s plan say that’s fine with them.

“Paul’s position is more humble and more honest and recognizes the inherent limits to what people in Washington can do in terms of job growth,” said Tad DeHaven, budget analyst with the Cato Institute, a libertarian think-tank. “He understands there is a cost to what the government does.”

Under the Paul plan, the federal workforce would be reduced by 10 percent and the president’s pay would be cut from $400,000 to $39,336 a year—a level “approximately equal to the median personal income of the American worker,” He notes.

Paul, who is making his third bid for President, has consistently trailed in the presidential polls since he entered the race in May. He only has 9 percent backing while Romney and Cain are virtually tied for the lead in the GOP nomination with 25 percent, according to the latest CNN/ORC International poll. Paul has struggled to appeal to a broad audience and instead has a small, highly dedicated group of supporters. According to the latest Pew poll, Paul also gets the least news coverage of any GOP hopeful, with just two percent of campaign stories. Texas Gov. Rick Perry receives the most campaign news coverage with 17 percent.

Paul, a 76-year-old eight-term House member, would reduce the corporate tax rate to 15 percent, down from a maximum of 35 percent. He would extend the Bush-era tax cuts and abolish the estate tax. The current federal 35 percent estate tax kicks in on estates larger than $5 million (or $10 million for couples). In 2013, the federal estate tax exemption is scheduled to drop to $1 million, and the tax rate will jump to 55 percent, unless Congress intervenes.

Similar to Romney and Cain, Paul would eliminate the tax on corporate profits earned overseas. A recent report found that a repatriation holiday that lowered the corporate tax rate for one year to 5.25 percent would create as many as 2.5 million new jobs and boost the U.S. gross domestic product by as much as $336 billion.

“It’s a failed idea that many have proposed,” says Chuck Marr, director of Federal Tax Policy at the Center on Budget and Policy Priorities. Marr called the tax holiday “grossly unfair” because it encourages U.S. businesses to locate overseas.