Raise it? Don’t raise it? The state of the minimum wage has long been a hot-button political issue, but in a struggling economy, an election year, and with many states proposing changes, it’s only getting hotter.

Raise it? Don’t raise it? The state of the minimum wage has long been a hot-button political issue, but in a struggling economy, an election year, and with many states proposing changes, it’s only getting hotter.

PHOTO GALLERY: Minimum Wage and What It Buys You: 1950s to Now

This month, the New Jersey General Assembly’s Labor Committee approved legislation that would set a minimum wage of $5 an hour by June 2013 for tipped employees (the current rate is the federal minimum of $2.13). Also making headlines is the city of San Francisco, which raised its minimum wage to $10.24 in February―that’s nearly $3 above the federal minimum of $7.25, which hasn’t risen since 2009. Many states, including New York and Massachusetts, are also considering increases, to much praise and outcry.

Approximately 4.4 million Americans, or 6 percent of all hourly workers, earned wages at or below the federal minimum in 2010, and workers under age 25 made up about half of them. Many fiscal conservatives and economists argue that an increase could further raise unemployment, while others, especially at the state and local level, claim minimum wage is in serious need of a hike. Even the Republican candidates are divided. Mitt Romney said at a trip to New Hampshire that the minimum wage should naturally raise according to inflation clocked by the Consumer Price Index―and was soon lambasted by radio host Rush Limbaugh. Rick Santorum has also taken flak for supporting a minimum wage increase in a 2006 campaign commercial (Newt Gingrich and Ron Paul are both adamantly opposed.)

RELATED: 9 Hot Blue Collar Jobs

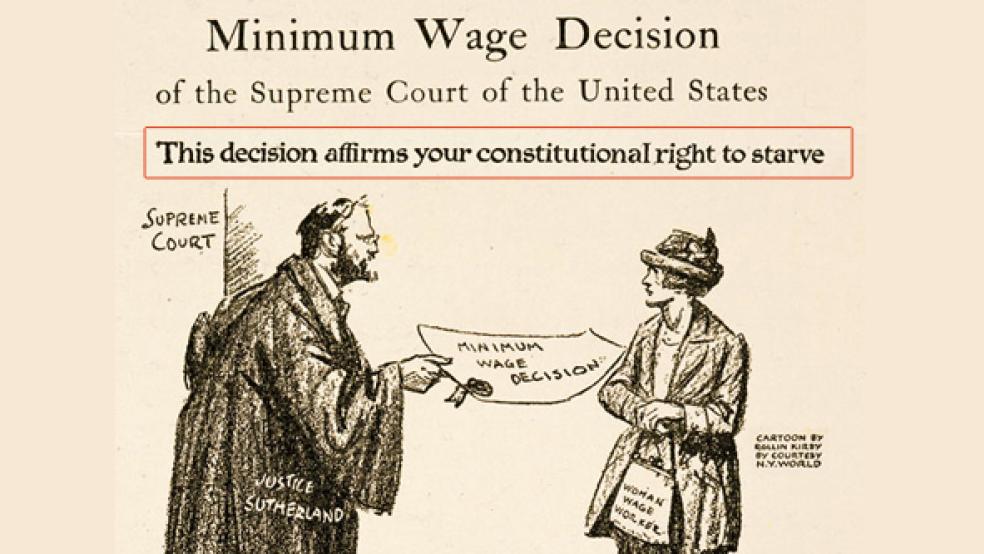

Since being established at 25 cents in 1938 under the Fair Labor Standards Act, the federal minimum wage has been raised only 22 times. Though it was originally proposed to periodically raise wages along with the increased cost of living, the law that was passed left any increases to Congress and the president. “Congress decided to not tie the minimum to the rate of inflation because they wanted to get credit each year for raising the minimum,” says Stephen J. Rose, senior economist at the Center on Education and the Workforce at Georgetown University.

The result is an effective decrease in the minimum wage. According to the website EconProph, when inflation is factored in, the federal minimum wage is actually 25 percent lower today than it was in 1968. When it comes to housing costs, for example, the U.S. Department of Housing and Urban Development (HUD) suggests applying no more than 25 percent of your gross income towards rent. But almost no one earning minimum wage would be able to pay the national median rent using that formula.

The jury is still out on whether an increase would also increase unemployment. “Economic theory would seem to indicate that raising the minimum wage would have negative employment,” Rose says. “But when you look at the long term effects, a higher minimum wage increases workers’ earnings over multiple years as they move in and out of the labor force, so the increased pay while working offsets whatever small negative effects there are on employment.”

All the talk got us thinking―what is the real power of the minimum wage? The Fiscal Times looked at the minimum wage at the start of each decade from 1950 to 2010, and compared it to average unadjusted prices for two necessities and one indulgence―rent, a gallon of gas, and a ticket to the movie theater―to see how many hours you’d have to work at minimum wage to afford them.