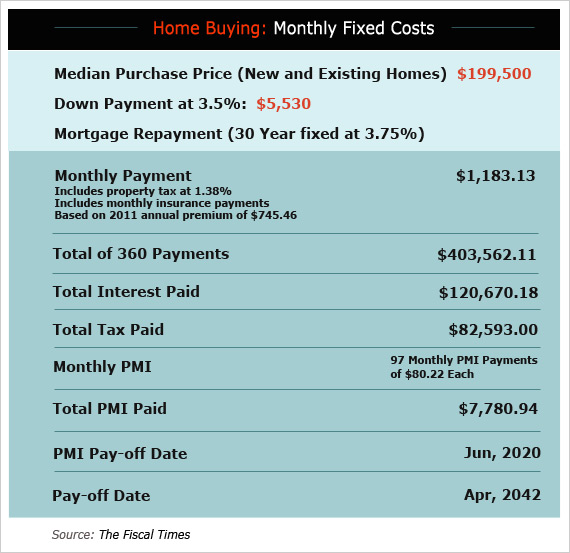

Right now, the U.S. Federal Housing Authority is offering historically low interest rates on home loans as part of an effort to kick-start the housing market. Under a plan introduced by President Barack Obama, an FHA-qualifying U.S. homebuyer can apply for a 30-year mortgage with a fixed interest rate of 3.75 percent and a 15-year fixed mortgage at 3 percent. FHA loans require as little 3.5 percent of the home’s value up front in the form of a down payment.

Compare this to a traditional mortgage offered by a private bank. Private banks require large down payments of buyers – traditionally 20 percent – to qualify for a low interest rate.

After the housing bubble burst forcing the United States into the Great Recession, traditional home loans have become harder to get. Banks have tightened lending standards, and wage stagnation and job loss have made it difficult for prospective buyers to save enough to qualify. But without qualified buyers, the housing market can’t recover and play a part in the broader economic recovery.

The Obama administration’s answer to this Catch 22 is this government-backed FHA mortgage program, a plan aimed at adding buyers to a seller-heavy market. But according to experts, giving under-qualified buyers loans at such low interest rates creates the potential for many of the same problems that led to the housing bust in 2007: people with questionable finances who can’t qualify for traditional mortgages are entering an uncertain housing market, just as unqualified borrowers did in the years before the housing crash.

"You’re creating a country of renters….Because of this lack of fiscal prudency, we’re never going to become a nation of non-debtors."

Without putting down large down payments, these borrowers are not building equity in their home. And any disruption in the economic recovery – the crisis in Europe spilling onto American shores, for instance – could lead to an economic slowdown that compromises their ability to pay for their homes.

“You’re creating a country of renters who are now renting from the bank,” said Roger Staiger, an adjunct faculty member at the Johns Hopkins Carey Business School. “Because of this lack of fiscal prudency, we’re never going to become a nation of non-debtors.”

According to Edward Pinto, a resident fellow at the conservative American Enterprise Institute, FHA loans are allowing a repeat of pre-bubble history. Buyers with questionable credit are being given access to the housing market, creating uncertainty and risk.

FHA “continues to make loans that are very high risk and they’re not pricing them right,” Pinto said. “There’s no incentive to put down a larger down payment. It makes it difficult for the private sector to complete as they price rationally, as private banks cannot compete with irrational pricing.”

“One of the horrible unintended consequences of the affordable housing push is the loosening of housing standards across the board,” Pinto continued. “Lending is not being done on a rational basis but a political basis.”

Merrill Lynch/Bank of America cite a recent report from the Treasury Department that raised some red flags, particularly regarding loans from the Federal Housing Authority (FHA). “About half of the modified FHA mortgages have defaulted within a year. In contrast, only 27% of Fannie and Freddie loans have become delinquent again. This is not surprising, since the FHA did not tighten lending standards as much as Fannie or Freddie, keeping a low downpayment requirement. For borrowers with FICO scores above 580, only 3.5% down is required, making it easy to fall into negative equity. It is, therefore, not surprising that 11% of the loans originated in 2009 and 24% of those originated in 2008 are seriously delinquent."

“When equity goes into a home, equity stays in a home,” Staiger said. “The familial financial security grows because every day you pay down principle. Exotic loans [like FHA loans] should be reserved for very special circumstances.”

Overcoming Barriers to EntryDuring an interview with the Fiscal Times, acting FHA commissioner Carol Galante defended the FHA loan-making process. She said that the tight private lending market has led to a better quality of borrowers for FHA mortgages.

"[During] the buildup to the crisis, FHA’s market share went from 15 percent to 2 to 3 percent of the market. Private subprime lenders siphoned off FHA borrowers."

“Since the crisis, post-bursting of the bubble, we have seen our borrower profile improve, actually,” Galante said. “The average credit score [for FHA borrowers] is about 700. Pre-crisis it was more in the 640 range.” Galante said that borrowers with credit scores as low as 500 are eligible for FHA loans, given that they meet a number of other conditions. She said FHA accounts for risk in its mortgage portfolio by deep examinations of potential borrowers.

“The main thing is and always has been taking a full look at each of these borrowers,” Galante said. “It’s fully documenting their employment history. How long have they been employed, how stable is their employment, how much down payment they are putting down, their income-to-payment ratio.”

Galante also said that there are vast differences between FHA loans and the subprime loans that caused the housing bubble. “These are fully underwritten … to be a sustainable mortgage in a way that subprime never was,” she said. “One of the things that happened in the buildup to the crisis, FHA’s market share went from 15 percent to 2 to 3 percent of the market. Private subprime lenders siphoned off FHA borrowers.”

According to Galante, these mistakes have caused the private lending industry to pass over borrowers who have the ability to maintain payments over the life of a loan. “They have become so risk averse because they got hit so bad by the crisis. They’re perhaps overpricing the risk today to compensate for earlier losses,” Galante said. People who say we’re under pricing risk? Factually, that doesn’t add up.”

Economic Shock Could Lead to Disaster

Pinto said that some of the borrowers who qualify for FHA loans – those with credit scores near 500, for instance -- have slim margins for economic failure. If the U.S. economy was to take a turn for the worse, many would be unable to keep up payments, leading to a situation similar to when mortgage rates adjusted higher prior to the real estate bubble’s implosion.

“If you’re meeting the qualifications for these kind of loans, chances are you’re on thin ice and might not able to take the shocks,” Pinto said.