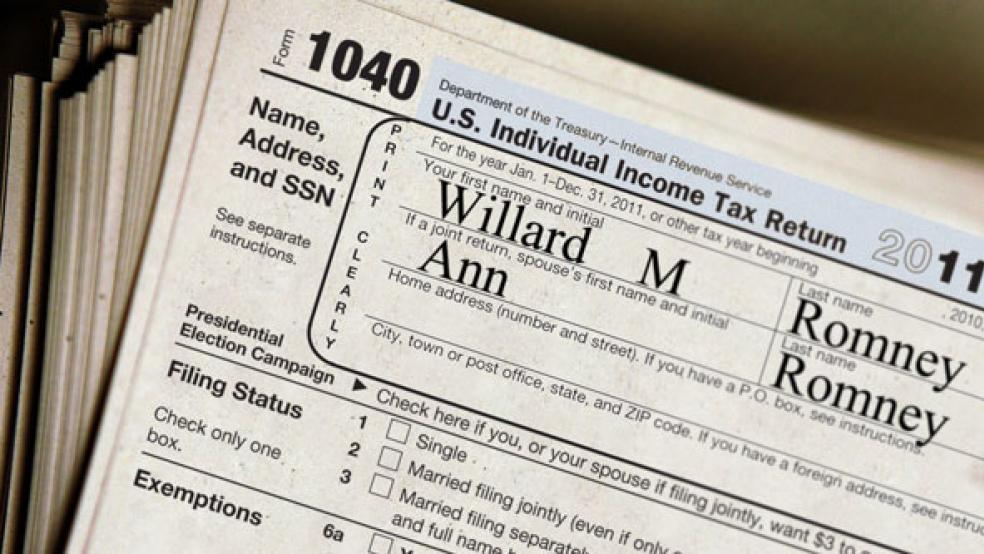

GREER, S.C. — Republican presidential candidate Mitt Romney said Thursday that he has paid a federal income tax rate of at least 13 percent in each of the last 10 years, offering his fullest explanation to date of his tax status.

“I did go back and look at my taxes and over the past 10 years I never paid less than 13 percent. I think the most recent year is 13.6 or something like that. So I paid taxes every single year,” he told reporters Thursday.

Democrats have hit Romney repeatedly on the tax issue, using it as an illustration for their argument that the Republican presidential candidate’s tax policies would favor the wealthy, like himself, over the middle class.They have said he pays a lower effective tax rate than many middle class families. And they’ve said his refusal to publicly release more than two years of records shows he has something to hide about his personal finances.

In response to pressure from his rivals during the Republican primaries, Romney released his 2010 tax return in January, showing he paid 13.9 percent on his $21.7 million in 2010 income. That is the figure he was referring to Thursday, his campaign said, when he mentioned a 13.6 percent tax rate. His campaign later confirmed Romney was referring only to the amount he pays in federal income taxes and not personal property or sales taxes.

Romney’s campaign has been pushing back against accusations from Senate Majority Leader Harry M. Reid (D-Nev.), has claimed that he was told by an investor at Bain Capital, where Romney once worked, that the Republican candidate had paid nothing in taxes for at least 10 years, due to his ability to take advantage of tax breaks.

But Romney said Thursday that Reid’s charge is “totally false” and that he has, in fact, paid taxes every year. He complained the tax issue has been a distraction during a time when the country faces tough challenges. “I just have to say, given the challenges that America faces – 23 million people out of work, Iran about to become nuclear, one out of six Americans in poverty – the fascination with taxes I’ve paid I find to be very small-minded compared to the broad issues that we face,” he said. “I’m sure waiting for Harry to put up who it was that told him what he says they told him. I don’t believe it for a minute, by the way,” he said.

A spokesman for Reid said Romney could prove his statements true by making his records public.“We’ll believe it when we see it,” said Reid spokesman Adam Jentleson. “Until Mitt Romney releases his tax returns, Americans will continue to wonder what he’s hiding.”

Romney’s answer on taxes--which came at the end of a news conference devoted to other issues--appeared to be a follow-up to a response he gave ABC’s David Muir in an interview last month.

Muir asked whether Romney had ever paid less than the 13.9 percent he paid last year.

“I haven’t calculated that,” Romney said then. “I’m happy to go back and look, but my view is I’ve paid all the taxes required by law.”

Democrats have said Romney’s own tax records are an illustration of the ways the wealthy can use looholes and tax shelters to lower their payments to the government. Romney’s tax rate is lowered by the fact that most of his annual income comes from investments, which are taxed at 15 percent, far below what he would pay on ordinary income.

If earned as regular wages, Romney’s income would otherwise put him in the nation’s highest tax bracket and he would pay a marginal rate of 35 percent.

According to a report from the Congresional Budget Office released last month, Americans paid an average ta x rate of 17.4 percent in 2009. That represented the lowest average tax rate paid since 1979 and was a drop from 19.9 percent paid in 2007.

Democrats have pushed him to follow the model of his father, George Romney, who released 12 years worth of tax records while running for president in 1968. In an interview with NBC’s “Rock Center” this week, the candidate’s wife Ann Romney insisted the couple planned to make no additional tax information public, insisting Democrats wants the records for “ammunition” with which to attack her husband. She said they have been “very transparent to what’s legally required of us.” “Mitt is honest. His integrity is just golden,” she said.

On a conference call, Obama campaign spokesman Ben LaBolt said: “He has the ability to prove his claim. This is a candidate who has defied bipartisan precedent. His father put out 12 years of tax returs and Governor Bush put out his returns every year he was governor. But Governor Romney has put out only two years of returns.”

He noted Romney’s tax records and financial disclosure forms show he kept assets in an offshore account and transferred ownership of a Bermuda corporation before he became governor of Massaschusett. “He has the ability to answer all of these questions by releasing several years of tax returns. He simply hasn’t done that. We would say: ‘Prove it, Governor Romney,” LaBolt said.

President Obama’s 2011 tax return showed that he paid an effective rate of 20.5 percent.

Sen. Jim DeMint said Democrats’ focus on the tax issue was a sign they’re “looking for any issue other than the economy” to discuss.

“ Harry Reid has not shown us his taxes, Obama has not shown us his

college records – I mean, there are a lot of things we could all ask about...We need to talk about the economy.”

Romney’s answer on taxes came as he continued to answer questions about how he would change Medicare, now that he’s named House Budget Committee Ryan Paul as his vice presidial running mage. Using a white board and marker, Romney made his case that President Obama had cut $716 billion, not to make the program solvent but to help fund an health coverage expansion as part of his 2010 Affordable Care Act. Romney has promised to restore those dollars if elected, an action that he says is necessary to ensure the program’s stability for current retirees.

But he offered no new specifics on how he would change the program moving forward, other than to promise to bring it to solvency.

Romney has said his own plan would be similar to that put forward by Ryan in budget proposals in Congress.

“Actually, Paul Ryan and my plan for Medicare, I think, is the same, if not identical -- it’s probably close to identical,” he told a Green Bay station Wednesday.

But when he has been pushed on Ryan’s proposal, which would provide seniors capped subsidies with which to buy private insurance, he has simply noted that the ticket is running his ideas and not Ryan’s.

Ryan’s proposal also assumed the $716 billion in cuts already in place from the Democrats’ law in drawing up his budget plan this year. He tried to explain Thursday that he would not have included those cuts if the law had already been repealed.

“It gets a little wonky but it was already in the baseline. We would never have done it in the first place,” he told reporters Thursday.

David Nakamura contributed to this story.