President Obama wants to raise the top marginal income tax rate on salaries and other ordinary income from 35 percent to 39.6 percent by letting the extended temporary Bush tax cuts expire at year-end.

Mitt Romney wants to drop the top rate by a fifth to 28 percent (and his running mate, Paul Ryan, the Wisconsin congressman, has called for a top rate of 25 percent).

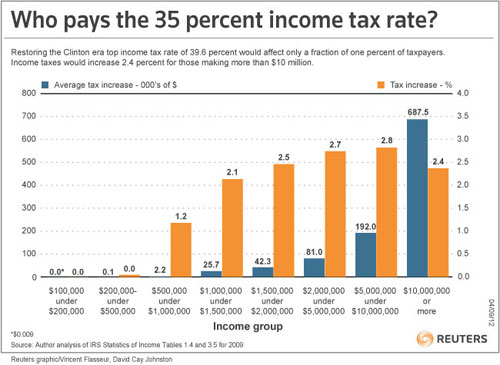

So who pays the 35 percent rate? How much do they pay?

And how much more would they pay if the Clinton-era rate of 39.6 percent were restored?

As this graphic shows, had the 39.6 percent rate been in effect in 2009, a few people making as little as $100,000 to $200,000 would have been affected. The total increase per taxpayer in that large group would be less than a penny each.

The tiny group of 8,274 taxpayers who made more than $10 million in 2009, and collectively reported 3.1 percent of all the adjusted gross income that year, would each pay, on average, $687,500 more if the permanent Clinton rates return.

That is 2.4 percent of their average $29 million adjusted gross income. (Taxpayers can be single persons or married couples.)

RELATED: Dems Deal: Entitlement Cuts for Tax Increases

The reason the increase is not 4.6 percentage points (the difference between 35 and 39.6) is that only about half of their money is ordinary income, while much of it is long-term capital gains and qualified dividends taxed at 15 percent.

And why do 715 of the 13.5 million taxpayers in the $100,000 to $200,000 group pay the 35 percent rate, which formally starts at $372,950?

Blame it on the complexities of the tax code.

(The author is a Reuters columnist.)