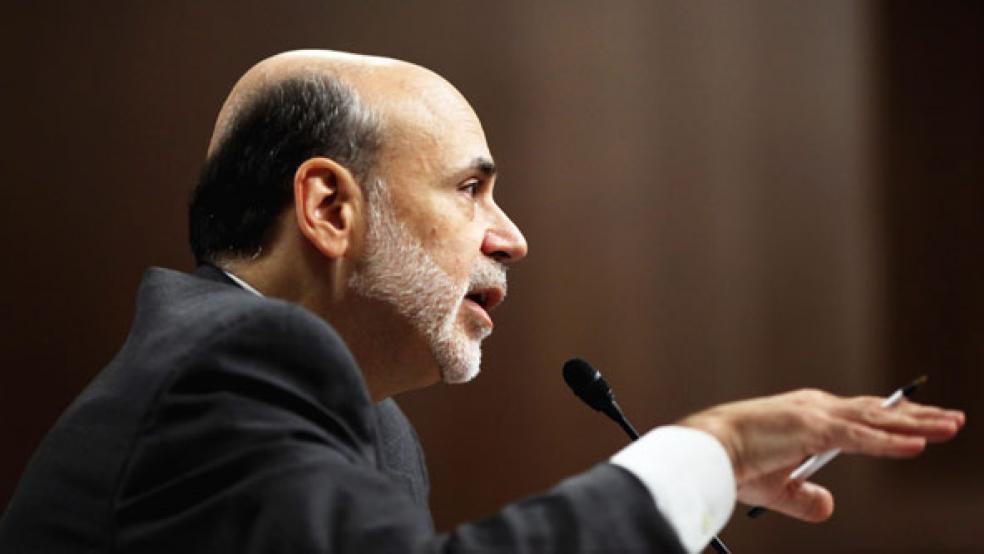

Federal Reserve Chairman Ben Bernanke just blew two big holes in the political argument about the $85 billion in automatic across-the-board spending cuts slated to begin this Friday.

Testifying before the Senate Banking Committee morning, Bernanke made a simple argument: The sequestration cuts are ill-timed in the middle of a sluggish recovery and changing the composition of those cuts does little to mute their overall drag on the economy.

“It was done to be ‘Dr. Strangelove,’” said Bernanke, referring to the Stanley Kubrick film about mutually assured nuclear destruction.

All of this matters because the political debate has largely been about cuts to the programs, not the timing of those cuts. President Obama has warned of teachers and civilian Pentagon employees being fired—a danger he’ll repeat in a speech this afternoon at a shipyard in Newport News, Va. Obama has suggested that revenue increases from eliminating tax breaks on wealthier Americans and closing loopholes on companies should replace some of the cuts. GOP congressmen say the tax hikes would choke off growth.

Either way, it’s just shuffling numbers across the federal ledger, Bernanke essentially said. The economy would still suffer a projected 0.6 percent hit to Gross Domestic Product.

“The near-term effect on growth would probably not be substantially different,” Bernanke said. “It would be about the same.” On Tuesday, Bernanke said it’s the difference between a tottering 2 percent economic uptick and a more robust 2.6 percent increase that would in theory ramp up hiring.

In an era of staggering gridlock, the Fed chairman’s framework for explaining the policies outside his realm—those set by Congress and Obama—have been remarkably prescient.

For the better part of the past two years, Bernanke has warned Congress about how their policies have injured growth. The Fed chairman popularized theterm “fiscal cliff” in testimony last year, the metaphor that defined the political struggle over tax rates at the end of last year by the White House and Capitol Hill.

The Fed Chairman’s testimony also dwelled on financial regulation, the Fed’s huge balance sheet, inflation risks, and a 30,000-foot perspective on the global economy. Yet those issues pale, for the moment, in comparison to the economic difficulties caused by the recent political stalemate.

Bernanke can’t and doesn’t tell Congress what fiscal policies to adopt, but he has noted how the gridlock has undermined the Fed’s low interest rates and attempts at monetary stimulus. His line of thinking is that stronger economic growth produces more jobs and income—which in turn lead to more revenues and less demand on government social programs. Our fiscal and monetary policy should be working in concert.

All told, government policies to reduce the deficit this year are forecast to hurt growth by 1.5 percent. This includes spending reductions besides the sequester, the end of the two-year payroll tax holiday, the 3.8 percent investment tax on high income earners, and to a lesser extent the fiscal cliff compromise that charges higher tax rates on household incomes above $450,000.

The Fed cannot offset that hit to the economy, Bernanke said this morning.

The flaw in the urgency to cut the deficit is that it stifles growth and the real deficit problems mount exponentially after 2022, when the Baby Boomer generation segues onto Medicare and Social Security, causing entitlement expenses to surge.

“To some extent, the fiscal policy decisions being made are mismatched with the timing of the problem,” Bernanke said.