We’ve already seen evidence that consumers have largely shrugged off this year’s expiration of the payroll tax holiday. A new survey from Bankrate.com suggests one reason, beyond the housing rebound and stock market rally: many simply haven’t seen the hit to their paychecks. Tax hike? What tax hike?

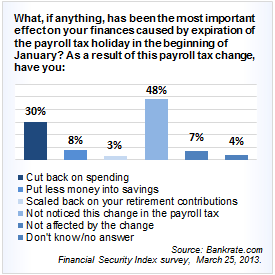

The payroll tax rate reverted to 6.2 percent this year after two years at 4.2 percent. Yet nearly half of working Americans surveyed (48 percent) said they haven’t noticed the higher taxes. Another 7 percent said they haven’t been affected.

“Even more of a surprise was who it was that hadn’t noticed,” says Greg McBride, senior financial analyst at Bankrate. While conventional wisdom held that lowest-income households would be hit hardest by the tax increase and would be most likely to scale back their spending, Bankrate survey of 1,006 workers, which was conducted by Princeton Survey Research Associates International, found the opposite.

“The lowest income households – that’s incomes below $30,000 a year – were least likely to have cut back on their spending relative to other income groups,” says McBride, “and more likely, relative to other income groups, not to have noticed the change.” Nearly 60 percent of households earning less than $30,000 said they hadn’t noticed the tax increase.

How could that be? McBride suggests that workers at those low income levels tend not to have salaried jobs – they may work on an hourly basis – and their paychecks tend to fluctuate anyway, making it easier to not notice the tax withholding changes. Also, McBride says, some workers simply aren’t dialed in to the details of their finances. A worker making $30,000 a year would pay an added $600 a year with the higher payroll tax rate – less than $12 out of a weekly paycheck.

That’s not to say the payroll tax hike hasn’t had any effect; 30 percent of those surveyed for Bankrate said they have cut their spending, 8 percent said they have saved less money, and 3 percent said they cut back on their retirement contributions.

The households most likely to have noticed the payroll tax increase and most inclined to cut back on their spending are those with incomes of $50,000 to $75,000 a year, Bankrate found. Those households would see their payroll tax increase by $1,000 to $1,500 a year. Even among that group, though, 39 percent said they hadn’t noticed the change.

Noticed or not, the payroll tax hike hasn’t prevented consumers from becoming more upbeat, at least according to some surveys. Bankrate’s Financial Security Index for March was the highest since the monthly polls began in December 2010. This month also marked just the third time in the past 28 months that consumers overall felt better about their financial security than they had 12 months earlier. (Consumers making $75,000 or more a year, by contrast, have felt better about their financial security in 25 of those 28 months, according to Bankrate.) Similarly, the Conference Board’s Consumer Confidence Index jumped in February, but the University of Michigan's Consumer Sentiment Index fell to a 14-month low.

“As far as the payroll tax hike is concerned, it certainly pales relative to the things that we’ve seen in years past that do have a more pronounced effect on consumer spending, such as rising gasoline prices and, as we saw in the third quarter of 2011 with the debt rating downgrade and stock market volatility, 40 percent of consumers cut back their spending as a result of that,” McBride says. “We’re seeing that things like rebounding home prices, consistent job growth and the strong stock market are outweighing the shenanigans in Washington.”