There have been numerous reports in the news lately that health care costs may actually be slowing, while others report that they may not be. The trend is clear—over the past 5 years (2007 to 2011), national health expenditures grew at an average rate of 4.5 percent, whereas during the previous five years (2002 to 2006) health expenditures grew at an average rate of 7.7 percent, according to data from the Centers for Medicare & Medicaid Services (CMS). As a result, as of last week, the CBO reduced its estimates of Medicare spending on benefits by 1 percent over the period from 2014–2023, thereby lowering the US budget deficit projection by $85 billion through 2023.

The problem is that economists don’t know if the slow down is permanent, the result of structural changes in the health care market brought about by the Affordable Care Act (ACA) or merely a temporary consequence of the economic recession that slowed down growth in just about every sector and continues to depress the economy, as reported by the Congressional Budget Office.

Recently, the Kaiser Family Foundation worked with Charles Roehrig at the Altarum Institute’s Center for Sustainable Health Spending to create a model that can, at least partially, explain and predict health care spending growth. Their analysis, “Assesing the Effects of the Economy on the Recent Slowdown in Health Spending,” found that health care cost growth could largely be explained by just two factors: growth in inflation, as measured by the Gross Domestic Product (GDP) deflator; and growth in the economy (GDP) over a five-year time span.

These findings suggest that the slowdown in health care spending is primarily due to the economic recession and that the slowdown is therefore largely temporary, meaning that health care cost growth will increase once the economy rebounds. This is significant for health care policymakers because, as the study notes, “If we believe health spending growth will remain low, we may be satisfied letting current cost containment strategies play out; if we do not, there may be greater impetus to consider new efforts to address health care costs.”

For Medicare, however, the distinction may not matter that much.

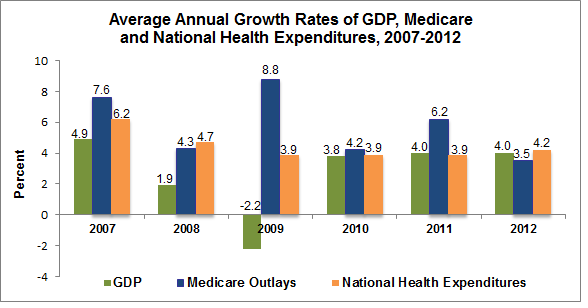

Graphs 1, 2 and 3, below, illustrate that Medicare spending has generally increased at a rate faster than growth in the economy and national health expenditures, and it is expected to continue to do so according to the Medicare Board of Trustees 2012 report.

From 2007 to 2011, a timespan that includes the U.S economic recession, the GDP grew at an average of 1.8 percent, national health expenditures grew at an average of 4.1 percent and aggregate Medicare spending grew at an average rate of more than 6 percent. In recent years, Medicare spending has occasionally grown slower than the GDP and national health expenditures, but that appears to be the exception and has not occurred for enough consecutive years to declare the potential slowdown in cost growth a trend for Medicare.

The Medicare Trustees have estimated that aggregate Medicare spending is also expected to increase faster, on average, than the economy and total national health expenditures from 2016 onward. And Medicare spending growth will increase at a rate that is greater than 7 percent, on average, from 2020 to 2036, while the GDP is only expected to grow at an average rate of 4.6 percent over the same period.

Graph 1. Average Annual Growth Rates of GDP, Medicare & National Health Expenditures, 2007–2012

Sources: GDP data from the Bureau of Economic Analysis, Medicare data from CBO Medicare Baseline and National Health Expenditure from the CMS, NHEA .

Graph 2. Average Annual Growth Rates of GDP, Medicare & National Health Expenditures, 2012–2021

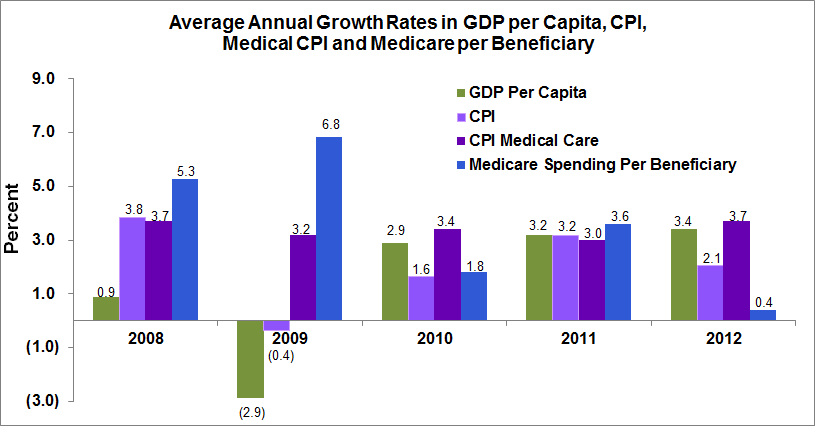

Finally, since the recession began at the start of 2008, Medicare spending per beneficiary has grown faster than the growth in per capita GDP, the Consumer Price Index (CPI) and the CPI for Medical Care—which measures prices of professional medical services including hospitals, medical equipment and health insurance—in three out of the last five years. While growth in Medicare spending per beneficiary has been low recently, the data is quite variable, making it difficult to declare the slowdown permanent.

Graph 3. Average Annual Growth Rates in GDP Per Capita, Medicare Per Beneficiary, CPI and CPI Medical Care, 2008–2012

Source: GDP per capita calculated from Bureau Economic Analysis; Medicare spending per beneficiary 2007–2009 from 2012 Trustees Report; 2010–2012 from ASPE Issue Brief, January 2013; CPI and CPI Medical Care BLS.

Nevertheless, the low growth rate has led some, including the Assistant Secretary for Planning and Evaluation (ASPE) for the Department of Health and Human Services, to conclude that the ACA may be effectively reining in health care costs.

As a result, health care experts have begun to estimate the benefits of savings of slowed health care cost growth for government health programs. A new study by Harvard economists David Cutler and Nikhil Sahni estimates that the slowed cost growth could mean that the public-sector spends as much as $770 billion less than predicted on health care, if the trend of the past four years continues from 2013 to 2022.

In an op-ed in The Washington Post, authors of the Kaiser Family Foundation’s cost growth study Drew Altman and Larry Levitt note that public- and private-sector efforts to contain health care costs would lower the growth in Medicare and Medicaid spending, as well as lower premium increases for people and employers. Altman and Levitt write, “In fact, once the effect is removed of more people turning 65 as the baby-boomer generation ages, spending per person in Medicare is already expected to grow more slowly than private insurance costs over the next decade, and slightly slower than the growth in gross domestic product.”

The key here, however, is the caveat: “once the effect is removed of more people turning 65.”

The problem with this is that more people will be turning 65; in fact, a lot more. The ASPE issue brief that lauds the progress that has been made in reducing Medicare spending growth still emphasizes that an aging US population will put a strain on Medicare financing. Over the next 15 years, 30 million people will enroll in the program, so that by 2030 there will be more than 80 million beneficiaries on Medicare.

Meanwhile, as the number of people enrolled in Medicare increases, the number of workers that will be paying taxes to finance each Medicare beneficiary will decrease substantially. By 2030, the Board of Trustees predicts that there will be an average of only 2.4 tax-paying workers for each Medicare beneficiary, down from nearly 4 workers per beneficiary in 2000. As a result, the ASPE emphasizes: “Further reducing per beneficiary cost growth below the projected level of GDP + 0 is an important component of responding to fiscal pressure.”

An Urban Institute report published last year came to the same conclusion: “Spending growth in (the Medicare) program on a per enrollee basis is not ‘out of control’ and is close to the target often advocated by those concerned with the nation’s deficit. But part of the budget problem the nation faces is the combined effect of growth in enrollment and spending per enrollee.”

Even if per person health care cost growth is slowing down, it will not be enough to compensate for the rapid increase in the number of Medicare beneficiaries, which the Congressional Budget Office estimates is responsible for more than half, and in some scenarios as much as 70 percent, of Medicare’s rapid spending increase.

No matter how you look at it, even if health care cost growth is slowing slightly, Medicare will face a spending growth sustainability problem and will continue to be a contentious component of the national debate on entitlement reform.