Alabama might not seem like a hub of Defense Department activity. But the Pentagon sends billions of dollars to the Heart of Dixie each year, making the defense industry part of the lifeblood of the state and its 4.8 million residents.

There are 15,500 people working at Redstone Arsenal, the base where the Army develops and tests missiles. There are another 1,900 workers at Maxwell Air Force Base in Montgomery, the state capital; 3,000 at Anniston Army Depot in Bynum; and 2,200 at Fort Rucker. In total, more than 33,000 people work for the Department of Defense in Alabama. In 2010, the last year for which information is available, DOD spent $5.7 billion in the Huntsville area alone.

RELATED: PENTAGON HAS NO IDEA WHAT 108,000 CONTRACTORS ARE DOING

But it’s not just DOD workers who rely on Pentagon largesse. Each of these bases is the epicenter of its individual local economy. Grocery stores, dry cleaners and small businesses that supply the military bases with the widgets it needs to make equipment work all are dependent on the military.

So when furlough notices were handed out across Alabama last week, a sense of dread began to set in, according to Ahmad Ijaz, director of economic forecasting for the University of Alabama’s Center for Business and Economic Research.

The Federal Reserve Bank of Philadelphia recently determined that Alabama has the fourth worst economy in the country. With years of budget cuts and uncertainty in the state’s future, Ijaz said, many fear things will only get worse.

“The federal budget sequester and continuing uncertainty about fiscal policy and cuts in federal spending are clearly dampening Alabama business confidence,” Ijaz told The Fiscal Times. “For the state as a whole, the Alabama Business Confidence Index registered 47.7 on the second quarter 2013 survey. Although up 2.3 points, the index remains below 50 and signals a negative outlook for the third consecutive quarter.”

Ijaz said the state has experienced a $1 billion cut in spending this year, taken from an overall DOD budget reduction of $41 billion this year. These cuts, combined with the $600 billion in cuts coming over the next decade, could devastate Alabama’s economy.

RELATED: YES, VIRGINIA, DEFENSE CUTS WILL HURT YOUR ECONOMY

He reeled off a list of specifics: “A $1 billion cut in military contract spending in Alabama could result in roughly $2 to $2.5 billion of loss in the state’s GDP, a loss of about $500 million in earnings, a loss of about 11,000 to 12,000 jobs, a $20 million decline in income tax revenues, roughly $9 million in sales tax loss – and about a million dollars’ decline in property tax receipts, for about a total drop of about $30 to $35 million in tax revenues,” Ijaz said. “A single job cut from military could result in anywhere from 1.5 jobs to almost 3 or 4 job losses in the overall economy.”

The situation in Alabama is playing out nationwide in communities that depend on Pentagon dollars for economic survival. According to Dan Stohr, spokesperson for the Aerospace Industries Association, states with a large military presence like Alabama, Florida, and Virginia, will feel the pain first. Large contracting companies like Boeing or the Pentagon brass that makes spending decisions.

“The guys who are making widgets that go into a system that goes into a platform – that’s where the damage is being done,” Stohr told The Fiscal Times.

SHORT-TERM PAIN

The long-term fate of these communities, large defense contractors and soldiers is not yet clear. But the impact of sequestration is now beginning to come into sharper focus.

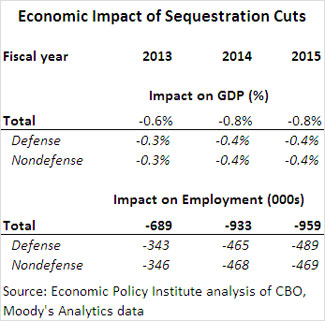

“It’s important to bear in mind that sequestration is more than a blunt instrument that hits in the economy. It’s going to be a gradual drag that will continue to increase,” said Andrew Fieldhouse, a budget policy analyst at the Economic Policy Institute and contributor to The Fiscal Times.

Fieldhouse said the real impact of sequestration won’t be felt until the end of 2013 – and then will drag on the economy into 2014.

According to the Aerospace Industries Association’s Stohr, large contractors are likely to shrug off the short-term impact of sequestration.

“It’s going to flow through the supply chain and into the broader economy,” he said. “The primes [top-level contractors like Boeing and Lockheed] are in a much better position to angle that based on diversity and cash reserves.”

DISRUPTING THE BUSINESS PROCESS

Stohr added that defense cuts could change the way large contractors do business, forcing them to vertically integrate the production process. If small subcontractors cannot produce quality parts at the required pace, prime contractors would be tempted to simply do the job themselves. This makes the process more cumbersome and eliminates a small business niche.

“There is a potential loss of capabilities here. If you cannot control the flow of supplies, you’ll take the job in house,” said Stohr. “When the program is under one umbrella … innovation and creativity are somewhat lessened. That’s what industry is really worried about right now.”