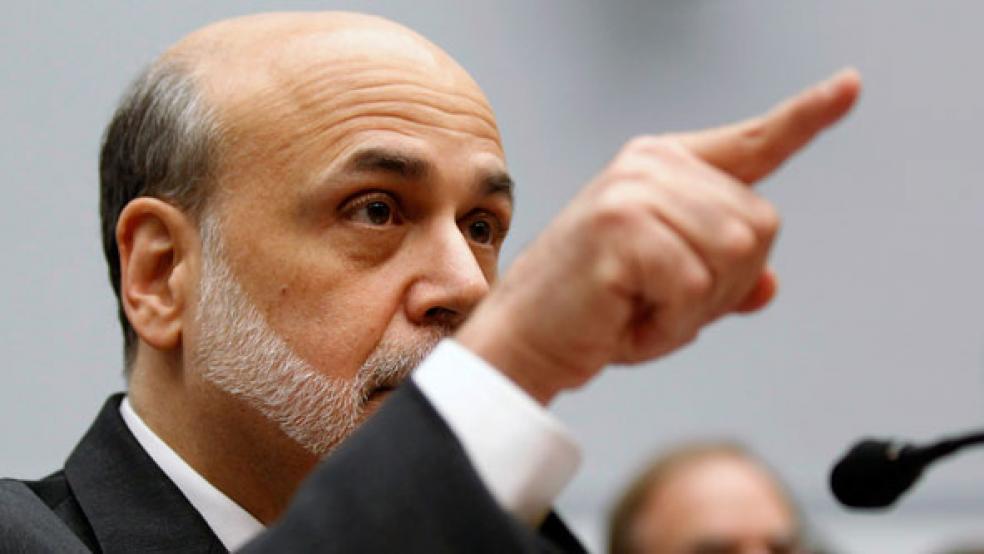

In what will likely be one of his final public statements before his successor is confirmed by the Senate, Federal Reserve Board Chairman Ben Bernanke looked back on his tumultuous eight-year tenure as central bank chief on Monday, and called for the continuation of a policy of transparency that he himself has come to symbolize.

In the years ahead, he said, “We must do all that we can to explain our actions and to show how they serve the public interest. That's why we must welcome communication, broadly defined. Of course, we will continue to talk to economists and market participants, but that is not enough. Ultimately, the legitimacy of our policies rests on the understanding and support of the broader American public, whose interests we are working to serve.”

Related: Ben Bernanke’s 6 Secrets for a Happy Life

Bernanke’s remarks came during a commemoration of the 100th anniversary of the signing of the Federal Reserve Act, the law that created the central bank. He was flanked by his two immediate predecessors in office, former Fed chairmen Paul Volcker (1979-1987) and Alan Greenspan (1987-2006.)

In his term as Fed chair, Bernanke’s insistence that the Federal Reserve step out of the shadows and begin speaking directly to the public stood in stark contrast to his immediate predecessor, Greenspan, who once described his own style of public speaking as rooted in “purposeful obfuscation.”

In 2009, in the wake of the financial crisis, Bernanke’s Fed conducted “stress tests” of U.S. banks and, in an effort to re-establish consumers’ confidence in the strength of major financial institutions, released the results to the public.

Bernanke pioneered the practice of holding quarterly press conferences following meetings of the Federal Open Market Committee, at which interest rates are set. It was also under his watch that the Fed began openly setting its inflation targets, and explaining openly its best understanding of the level of employment that the economy could support at any given time.

At times, Bernanke’s efforts at transparency have come back to bite him. This summer, when the markets believed, based on Bernanke’s own statements, that the Fed was about to start reducing the amount of bonds it purchases each month, interest rates spiked. Many in the markets were also taken aback by the Fed's September decision to keep the pace of its asset purchases unchanged.

Related: Bernanke Protects U.S. from a Contentious Congress

During his assessment of his tenure, Bernanke hit on numerous other issues, including the challenges the Fed faced, and continues to face, using monetary policy to stimulate the economy with interest rates already close to zero.

“[W]e've had to find other ways to bring monetary policy to bear, notably including techniques designed to influence longer-term interest rates, he said, describing what came to be known as “Operation Twist.” For instance, the Fed, like several other central banks, has purchased longer-term securities to put downward pressure on longer-term interest rates, help ease financial conditions, and promote a stronger recovery.”

But throughout his remarks, Bernanke repeatedly returned to increased openness in the central bank’s communications.

“One of my personal objectives since I became Chairman has been to increase the transparency of the Fed - to more clearly explain how our policies are intended to work and the thinking behind our decisions,” he said.

“Ultimately…the most important reason for transparency and clear communication is to help ensure the accountability of our independent institution to the American people and their elected representatives. Clarity, transparency and accountability help build public confidence in the Federal Reserve, which is essential if it is to be successful in fostering stability and prosperity.”

Follow Rob Garver on Twitter: @rrgarver

Top Reads from The Fiscal Times: