- Employment income grew 3.4% last quarter.

- Consumer debt payments take 12.5% of income.

- More than 6% of households’ income is going to savings.

Consumers have been knocked around in recent months. Their confidence in the future has been shattered by disappointing job growth, worries about Europe, and swooning stock prices. The fear is that without consumers, whose spending makes up 70 percent of the economy, the chatter about dipping back into recession could lead to the real thing.

Or maybe not. The Commerce Department's report on second quarter gross domestic product released July 30 included major revisions going back to 2007 that offer new ammunition against a consumer-led double dip. The data show the recent trend in income growth is stronger than first thought and that households have made far more progress in realigning their finances than previous reports suggested. Also, business outlays for new equipment continue to boom, a pattern that in past recoveries has always gone hand in hand with faster job growth.

The labor markets are still the main focus in the consumer outlook. The Labor Department's employment report for July, while showing a 131,000 decline in nonfarm payrolls as Census workers were laid off, showed a 71,000 increase in private sector payrolls and a stable jobless rate at June’s 9.5 percent. But while private sector job gains have averaged only 90,000 per month this year, income growth is picking up. Commerce Deptartment data show that employment income in the second quarter grew at a 3.4 percent annual rate. That gain, well ahead of inflation, is a sharp step up from previous quarters and the strongest increase in more than two years. The July jobs report, while disappointing, was at least mildly reassuring that businesses are not cutting back in a way that would threaten income growth and consumer spending.

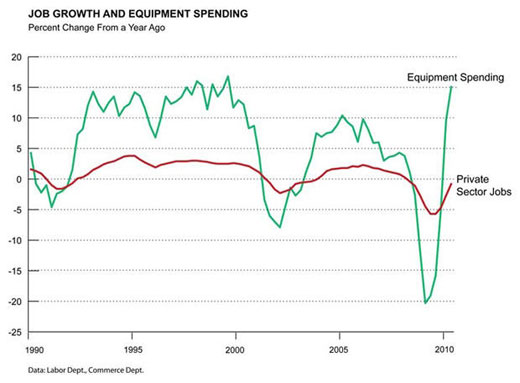

Companies are plowing ahead with expansion plans, suggesting faster job growth in coming months. The latest GDP data show that outlays for new machinery, high-tech gear, and other equipment soared 22 percent in the second quarter after rising 20 percent in the first quarter. That’s the largest two-quarter increase in 15 years. Throughout past recessions and recoveries, capital spending and job growth have been tightly correlated. “We view the acceleration in business capital spending as inconsistent with the fear that corporations are set to cut employment, which would be the hallmark of a double dip,” says Barclays Capital economist Dean Maki.

Maki points out that in all recoveries since the 1960s, when equipment spending has picked up at a double-digit pace, payrolls have grown solidly in the following year, in most cases better than 2 percent annually. That pace would be equivalent to more than 200,000 jobs per month in today’s labor market. Moreover, businesses have plenty of incentive to continue to expand. Corporations cut their spending so drastically in the recession that outlays as a share of GDP are still close to their lowest level in nearly half a century. Plus, companies can afford to expand, given the strong recovery in profits that Commerce’s revised data show to be more rapid than first thought.

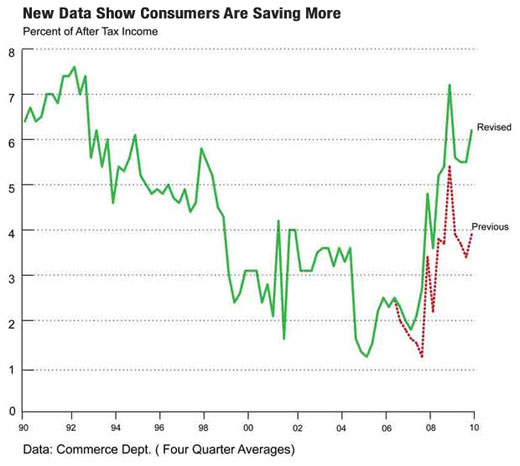

As corporate expansion generates more job and income growth, consumers will be more apt to spend than they were over the past year. Households have been struggling to pay off debt and rebuild savings in an effort to make up for the wealth lost as the recession ravaged home values and stock prices. Although their debt load remains heavy, households are having an easier time carrying that debt. Through the first quarter, debt service payments fell to 12.5 percent of after-tax income, the lowest level in a decade, according to Federal Reserve data. Plus, Commerce’s large upward revisions to the personal saving rate in 2008, 2009, and the first half of 2010 suggests that consumers have made much more progress toward replenishing their skimpy pre-recession savings than previous data implied.

The new numbers show that households saved 6.2 percent of their after-tax income in this year’s second quarter, more than two percentage points higher than previously thought and up sharply from 1.8 percent about three years ago, just before the recession. The saving rate is now hovering around levels not seen since the early 1990s. “Consumers are getting into better shape to raise upcoming spending growth than earlier perceived,” says UBS economist Maury Harris. He says historical trends show that consumers are now saving at a rate more consistent with their lower levels of wealth and current low interest rates, and that further increases in the saving rate are less likely.

A more stable saving rate would be important for future gains in consumer spending; the rise in the rate — not its level — exerts a drag on spending growth. The increase to 6.2 percent from 1.8 percent drained away 58 percent of the $891 billion increase in after-tax income during that same three-year period, leaving only 42 percent of the income gain available to spend. If the saving rate were to hold at its current level in the coming year, then 6.2 percent of any gain in income would go to into savings with the rest available for shopping.

Most of the attention in the latest GDP report was on the slowdown in economic growth and the downward revisions to consumer spending. That fed the double dippers’ argument that consumers will ultimately succumb to weak labor markets and a dearth of income. However, the improving trends in consumer finances and business expansion argue otherwise. Economists at J.P. Morgan Chase say that, with the 1.6 percent growth in real consumer spending in the second quarter running far below the 4.4 percent gain in overall after-tax income, “the next turn in spending growth may well be up.”