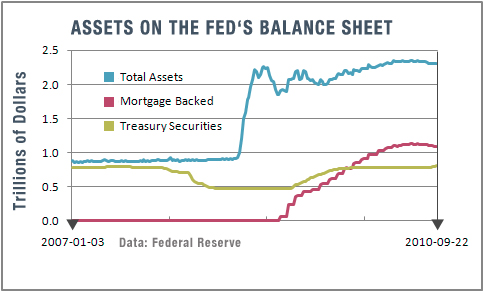

| • The Fed’s preferred measure of inflation stood at 1.3 percent in August • The Fed holds $800 billion in Treasury securities, about a third of its assets • Recent asset purchases cut Treasury yields by 0.5 to 0.7 percentage points |

Only a few months ago, policymakers at the Federal Reserve were laying out plans to return from crisis mode back toward normal. Their so-called exit strategy would drain some $1 trillion in excess funds from the banking system in order to assure tame inflation in coming years. Now, in a sharp reversal, the Fed is seriously considering pumping out even more funds out of fear that inflation is unacceptably low.

This is a major shift in the Fed’s thinking. For the first time, its policy committee released a statement after meeting Sept. 21 that explicitly tied future policy decisions to the inflation outlook, committing “to return inflation, over time, to levels consistent with its mandate.” That means they believe the risk of deflation, or a period of falling prices that would undermine growth and complicate efforts to revive the economy, has risen. This also greatly lowers the bar for new stimulus actions, including additional purchases of Treasury securities.

The Fed’s preferred measure of inflation, which excludes volatile food and energy prices, stood at 1.3 percent in August, below the 1.7 to 2 percent range officials believe to be optimal; and the midpoint of policymakers’ forecasts for 2011, which has been drifting down all year, declined from 1.45 percent in January to 1.1 percent in June.

A More Aggressive Approach

“A stated goal of raising the level of U.S. inflation implies the Fed is moving much more aggressively than just acting against downside risks to growth,” economists at J.P. Morgan Chase said after the release of the statement. In hindsight, Chairman Bernanke alluded to this policy shift in his Aug. 27 speech in Jackson Hole, Wyo., when he said inflation had declined to a level that isn’t conducive to a healthy economy in the long run.

To reduce the risk that slow growth and high unemployment will lead to a further unwelcome decline in inflation, the Fed will have to feel certain its actions can deliver economic growth well above the economy’s long-term trend of about 2.5 percent for several quarters. That prospect seems increasingly doubtful right now. The policy committee will update its forecast at its November meeting, amid speculation that projections for growth and inflation in both 2010 and 2011 will be lowered, and that the decline in the unemployment rate will be smaller than expected.

In one of the strongest calls yet from a Fed official, New York Fed President Bill Dudley believes that current levels of unemployment and inflation and the time needed to return them to normal levels are unacceptable. “The longer this situation prevails and the U.S. economy is stuck with the current levels of slack and disinflationary pressure, the greater the likelihood that a further shock could push us still further from our dual mandate objectives and closer to outright deflation,” Dudley said in a speech Friday.

A new round of asset purchases would have two goals. One would be to lower long-term borrowing rates for businesses and consumers by reducing the supply of low-risk Treasurys on the market. This would make higher risk private-sector debt a more attractive investment, ultimately pushing down those yields as well. A study by the St. Louis Fed concludes that the last year’s large-scale purchases of Treasurys and mortgage-backed securities cut market yields on Treasury notes by 0.5 to 0.7 percentage points. The other goal would be to maintain a healthy level of inflation expectations, which is crucial in holding down the real — or inflation-adjusted — cost of borrowing.

Although new action is still no sure thing, the Fed’s Aug. 10 decision to buy Treasury debt with the proceeds from its $1.1 trillion in holdings of mortgage-backed securities, along with Bernanke’s focus at Jackson Hole on purchases of Treasurys and the policy committee’s Sept. 21 statement, strongly suggest the Fed will initiate a new asset purchase program by the end of the year. Recent economic reports have looked encouraging, but the economy will have to accelerate significantly to imply no further action.

Some economists believe this new focus on inflation will buy the Fed some time before acting. Inflation tends to turn up well after the economy turns, and it may already be bottoming out. Analysts at UBS believe that rents, which determine housing costs in the consumer price index, and vehicle prices have been temporarily depressed, as have airfares and prices for apparel and lodging. Also, the politically charged climate surrounding the midterm elections may lead policymakers to postpone action until after the Fed’s early November meeting.

If the Fed does act, odds have risen that it will choose a meeting-to-meeting approach on deciding the dollar amount of securities to buy. That would be a change from announcing one big target purchase as it did last year, when it committed to buy $1.7 trillion in mortgage backed securities and federal agency debt over a period of several months. The incremental strategy has its pluses and minuses. On Sept. 29, assets on the Fed’s balance sheet totaled more than $2.2 trillion, of which $800 billion were Treasury securities. Economists believe it would take between $500 billion and $1 trillion in one up-front commitment to have a meaningful impact on interest rates. So a stepwise strategy would be less effective.

On the plus side, an incremental approach would help to maintain a consensus on a divided policy committee. One member, Kansas City Fed President Thomas Hoenig, has already dissented for six meetings in a row, fearing current policy will fuel inflation. Another, Boston Fed President Eric Rosengen, on Sept. 29 called the recovery “anemic” and said the Fed should respond “vigorously.” More middle-of-the-road members, along with newly confirmed Vice-Chairman Janet Yellen and Governor Sarah Bloom Raskin, will be more likely to follow Bernanke’s lead, which appears slanted toward more action sooner rather than later.

What’s clear is that a growing number of policymakers are becoming impatient with the economy’s lack of progress, and their new focus on undesirably low inflation strongly suggests the Fed is ready to take out some deflation insurance.