|

Few things can darken the economic outlook quicker than an oil shock. This time it’s courtesy of pro-democracy revolts in North Africa and the Middle East. Violence in Tunisia, then Egypt, and now Libya has jacked up crude prices and fueled worries about unrest in Bahrain and Oman, attacks on oil refineries in Iraq, and possible new upheaval accompanying upcoming elections in Nigeria. The question: How much damage will the 2011 oil shock do to the U.S. and global recoveries?

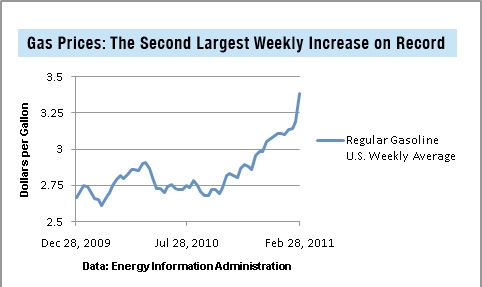

Ultimately, that will depend on how much oil goes missing and for how long. Already, the market price of West Texas Intermediate crude, up 12 percent since the end of last year, pushed through $104 per barrel on Friday, while Brent crude, the North Sea benchmark for two-thirds of the world’s oil trading, has jumped 26 percent to nearly $116 per barrel. U.S. gasoline prices are up 13 percent over the same period, to an average of $3.38 per gallon in the week ended Feb. 28. It was the most prices have risen in a week since Hurricane Katrina in 2005, and further increases are on the way.

So far, the impact looks small. Economists are shaving two or three tenths of a percentage point from their 2011 forecasts for both U.S. and global growth. Globally, crude inventories are high by historical standards, and spare production capacity, while not abundant and mainly in Saudi Arabia, is at least sufficient to ease immediate concerns and more than enough to make up for Libya’s oil exports of 1.5 million barrels per day.

Global economic policies broadly support growth, especially in developed nations, where both inflation pressures and interest rates are low. In a severe disruption, the U.S. can tap its Strategic Petroleum Reserve, which holds 727 million barrels of crude, enough to cover a 50 percent loss of imported oil for about five months.

In the U.S., consumers’ purchasing power is getting a boost from the 2 percent cut in payroll taxes as of Jan. 1, helping to offset the impact of costlier fuel. The tax deal was expected to add some $50 billion to spending power early this year, but J.P. Morgan economist Michael Feroli says that higher gas prices this quarter could subtract up to $45 billion in buying power. “The fiscal policy and energy price influences now look to be about a wash,” he says. J.P. Morgan has cut its forecast for first-quarter economic growth to 3.5 percent, from 4 percent, with all the impact from oil in the first three months of the year.

Improving U.S. labor markets help. Despite the jump in gas prices, consumer confidence in February hit a three-year high, likely reflecting stronger job markets. The Labor Dept.’s report on Friday showed that payrolls increased by a solid 192,000 last month, and the jobless rate continued to fall, to 8.9 percent, from 9 percent in January. Over the past three months, job gains in the private sector have averaged 152,000 per month, the most in four years, and the February gains were the broadest across industry groups in almost 13 years.

But even in this favorable climate, the risks are significant. The fear factor can hammer the economy via the financial markets, as geopolitical events raise anxiety over the possibility of broader supply disruptions. Heightened business uncertainty and reduced investor appetite for risk can slam stock prices and cut into household wealth. The stock market is now fully under the spell of oil prices, with the Standard & Poor’s 500 stock index taking another hit on Friday and down about 2 percent since the spike began on Feb. 18, although it is still up about 5 percent this year.

The harm from an oil shock also can be abetted by the suddenness of the increase. For now, the spurt hasn’t been large enough to cause great worry about the recovery’s viability. Economists believe it would take up to a 50 percent surge in crude prices over a single quarter to cause a sharp pullback in consumer spending, mainly on high-priced discretionary items such as cars and home goods, and generate ripple effects throughout the economy.

Economists at Barclays Capital conclude that a sustained rise in the price of U.S. crude to $130 per barrel by year-end would slice annual growth in consumer spending by three-tenths of a percentage point and real GDP growth by two-tenths of a point. In the past, they say, the risk to the economy was greatest when the three-month increase in the consumer price index exceeded 9 percent, measured at an annual rate. That happened twice in the past decade, after Katrina in 2005 and the oil spike in 2008. Right now, it looks like the first-quarter increase in CPI will be about half that.

Some of the jump in energy prices will pass through into prices of non-energy items, but the inflation impact isn’t likely to be widespread. Economists at J.P. Morgan note that commodity prices generally, including oil, don’t have a statistically significant impact on consumer prices beyond energy and food. That’s because commodities account for a progressively smaller share of a product’s value as it moves through the production chain to the final retail product, whereas labor costs account for a progressively larger share. Costs at each stage of production tend to get absorbed through lower profit margins.

In addition, the U.S. has become increasingly energy efficient, now requiring half the energy used in the 1970s to produce a dollar’s worth of real GDP, according to the Energy Information Administration. Even so, some pass-through is inevitable. Oil consumption in the transportation sector, which accounts for 71 percent of U.S. oil demand, is especially insensitive to oil price movements, increasing the likelihood of higher airfares and shipping costs. Still, it took a tripling of oil prices from 2004 to 2007 to add one percentage point to the inflation rate excluding energy.

Longer-term, the 2011 oil shock is a reminder of the increased risk of a supply disruption. It was surging demand, boosted by booming emerging market economies, that sent oil to near $150 per barrel in 2008. The same forces are waiting in the wings. As the global recovery gains speed and breadth, oil demand is set to pick up at a time when global supply is still barely growing. Under that scenario, triple-digit crude could eventually become a fact of life.

Related Links:

Stocks Hit Oil Stick But Economy to Trump (Reuters)

Geithner Says Oil Reserves Can Be Tapped If Needed (The Hill)

Rise in Oil Prices Threatens Economic Recovery (Miami Herald)