On Tuesday, the Federal Reserve announced new measures to stimulate the economy. The stock market was not impressed and has fallen subsequently. Analysts point mainly to continuing debt problems in Europe and a growing belief that the U.S. economy may weaken further. I believe that another factor is concern that improving prospects for a Republican victory next year is strengthening the hand of so-called inflation hawks at the Fed, meaning that there will be less monetary stimulus than markets had anticipated.

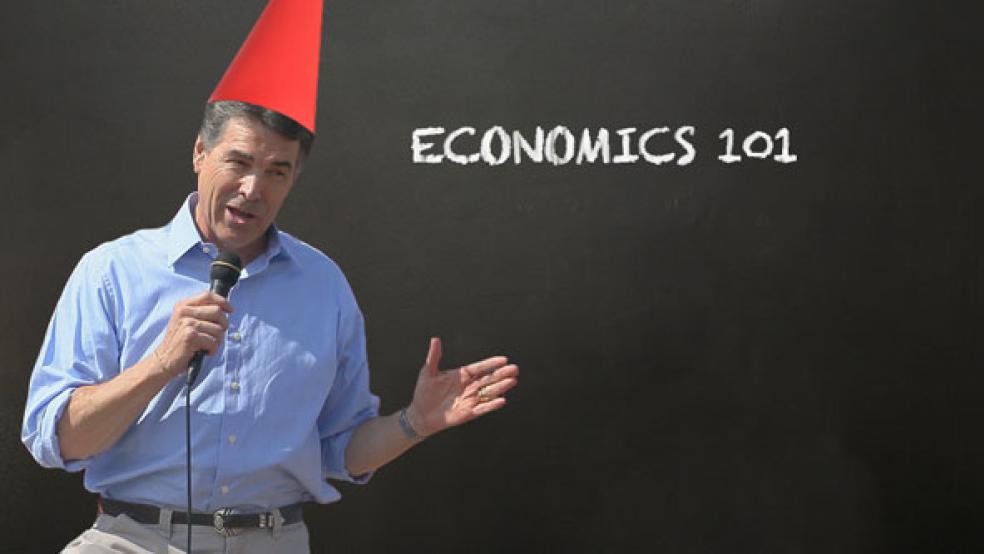

The leading candidate for the GOP nomination is Texas Gov. Rick Perry, who has repeatedly accused Fed chairman Ben Bernanke of “treasonous” actions for trying to stimulate the economy by increasing the money supply – “printing money” as Perry calls it. Perry even threatened Bernanke personally, saying, “We would treat him pretty ugly down in Texas.” Coming from the governor of the state in which John F. Kennedy was assassinated, such remarks are irresponsible.

While Gov. Perry’s view may be extreme, it is well within the Republican mainstream. A September 15 CNN/ORC poll found that more than a third of Republicans and almost half of Tea Party members blame the Federal Reserve very much or almost completely for current economic conditions. This is actually not an unreasonable position. What is peculiar is that Republicans blame the Fed for doing too much to stimulate the economy, rather than too little, as most economists believe.

This fact was made clear on Tuesday, when the entire Republican congressional leadership sent a letter to Bernanke warning him against taking additional stimulative actions. The leaders said, “We have serious concerns that further intervention by the Federal Reserve would exacerbate current problems or further harm the U.S. economy.” They specifically warned that the dollar would fall on foreign exchange markets and promote borrowing by overleveraged consumers.

Both arguments are ill informed. The fact is that the trade-weighted value of the dollar is exactly where it was at the beginning of the recession. While the dollar is down sharply over the last decade, virtually the entire decline occurred during the George W. Bush administration. Moreover, most economists believe that the fall in the dollar has been a good thing because it made U.S. exports more competitive in terms of foreign currencies. This is the key reason why exports are up and one of the few bright spots in the U.S. economy.

Secondly, it’s frankly ludicrous to worry about consumers borrowing too much since a lack of borrowing is a key factor holding back growth. Commenting on the Republican letter, former Bush speechwriter David Frum said, “Are they serious? We are living through the most rapid deleveraging of the American consumer since the 1930s.”

standard, Paul has long

opposed the Fed in

principle, believing that it

should in fact be abolished.

Frum is right. Consumers and businesses are paying down their debts and increasing saving as fast as they can. The personal saving rate has more than doubled since 2007 and businesses are sitting on close to $2 trillion of liquid assets. Banks have $1.6 trillion in excess reserves that they cannot lend because no one is borrowing. Before the crisis, banks had less than $2 billion in excess reserves, which are idle funds on which banks earn virtually nothing.

The current Republican position appears to be the result of decades of Fed-bashing by Rep. Ron Paul of Texas, who is also seeking the Republican presidential nomination. As a devotee of the gold standard, Paul has long opposed the Fed in principle, believing that it should in fact be abolished. For many years, this was considered an extremely eccentric position even among conservatives, but the continuing economic crisis and sharp rise in the price of gold has given him credibility.

gold standard was nuts

and that the Fed’s greatest

failure was not providing enough

money during the Great Depression.

From the 1960s through his death in 2006, the dominant intellectual figure in Republican economic policy was University of Chicago economist Milton Friedman. He thought that the gold standard was nuts and that the Fed’s greatest failure was that it didn’t provide enough money to the economy during the Great Depression. While we don’t know what Friedman would be saying today, there is reason to believe that his views would be the opposite of Paul, Perry and many other Republicans.

We know this because Friedman commented often on Japan’s stagnation in the 1990s, that was very similar to the U.S. situation now. In a December 17, 1997, article in the Wall Street Journal, he gave this prescription for Japan’s problem:

“The surest road to a healthy economic recovery is to increase the rate of monetary growth, to shift from tight money to easier money…. Defenders of the Bank of Japan will say, ‘How? The Bank has already cut its discount rate to 0.5 percent. What more can it do to increase the quantity of money?’ The answer is straightforward: The Bank of Japan can buy government bonds on the open market, paying for them with either currency or deposits at the Bank of Japan, what economists call high-powered money.”

With the Federal Reserve’s discount rate at zero, monetary conditions in the U.S. are parallel to those in Japan. Unfortunately, the low level of interest rates has blinded many economists to the necessity of further Fed action. As Friedman explained in his article, it is “misleading” to judge monetary policy by interest rates. “Low interest rates are generally a sign that money has been tight…high interest rates, that money has been easy,” he wrote.

I believe that if Friedman were still alive, he would be among the sharpest critics of Republicans’ attacks on the Fed. Perhaps his great stature would have been enough to keep them from going off in the wrong direction. Bernanke, who has long considered himself to be a follower of Friedman, should not be afraid to counter his GOP critics in Friedman’s name.