Cavity Watch: 7-Eleven To Host 'Bring Your Own Cup' Slurpee Day

If, for some reason, you’ve ever wanted to induce a diabetic coma, tomorrow might be the time to do it.

7-Eleven, the chain of convenience stores most favored by packs of high-school layabouts who aren’t yet old enough to hang out in bars, is holding a promotion called “Bring Your Own Cup Day” tomorrow, April 11.

What is it? Glad you asked. Bring Your Own Cup Day (or #BYOC if you’re on the Twitters) is a Bacchanalian feast of excess where customers bring a watertight vessel to their nearest 7-Eleven, smack $1.50 on the counter, and fill said vessel with the Slurpee of their choosing.

Related: 10 Best Fast Food Restaurants in America

There are limitations though, so hold your hedonistic horses. Whatever container you choose to use must be non-porous, so no baseball caps or fedoras. Also, whatever container you bring must be able to fit through a 10-inch diameter hole – so put that oil drum back in the basement. Even with the size limitations, you could still be getting a deal – USA Today posits that a cup that just makes the cut could hold a gallon of 7-Eleven’s finest sugar water.

According to 7-Eleven’s VP of marketing, Laura Gordon, the event is being presented as a “Summer Kickoff,” which seems a little optimistic considering the fact that it’s foggy, 48 degrees Fahrenheit, and drizzling right now in New York City. Still, who am I to judge? Maybe the gods will look favorably upon 7-Eleven’s offering, and bring a day of sunshine, Slurpees, and nothing but syrup:

Top Reads From The Fiscal Times:

- The Long, Slow Death of Cable Just Reached a Tipping Point

- The App-Selling Power of Kate Upton’s Cleavage

- 10 Biggest Tech Flops of the Century

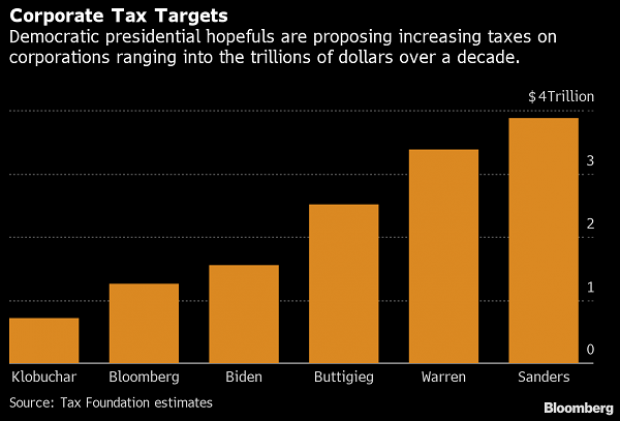

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

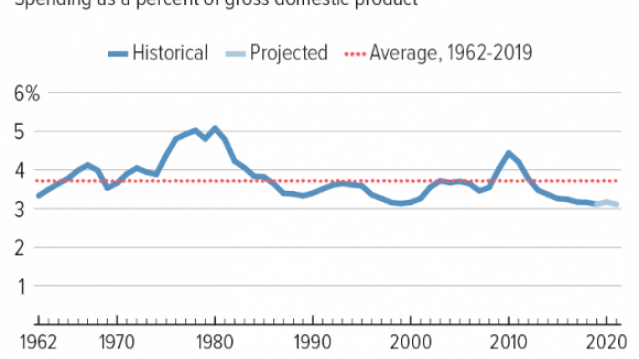

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

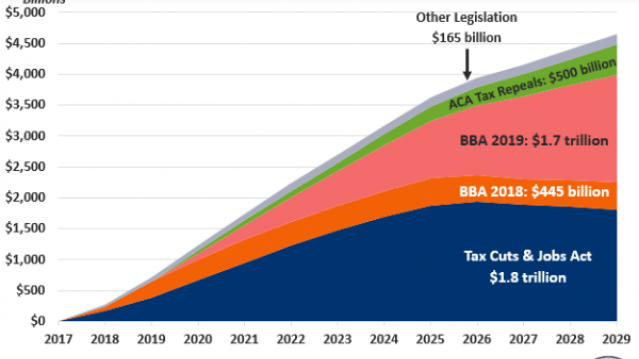

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

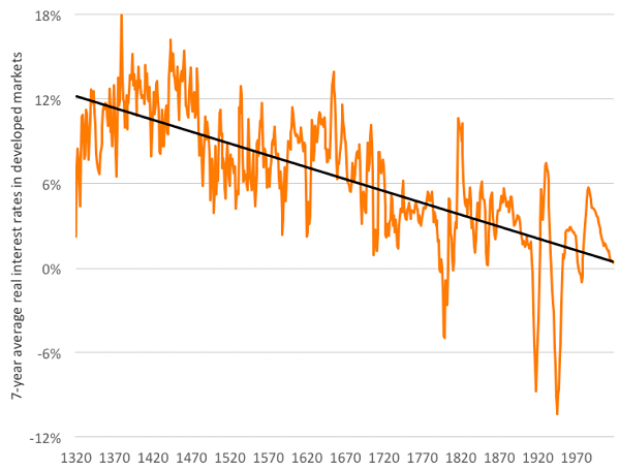

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

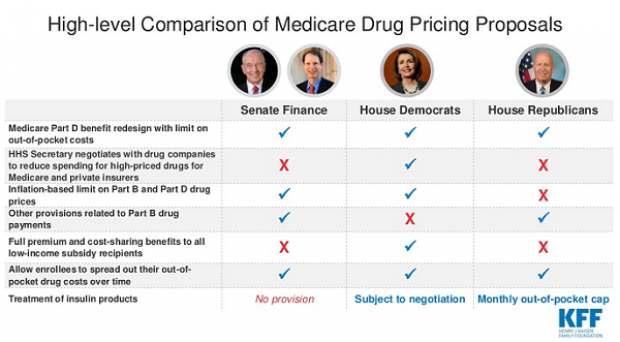

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.