Christie for President? New Jersey Says ‘Fuhgetaboutit!’

If Governor Chris Christie is looking for a boost to his flagging presidential ambitions, he’s probably not going to get it from the folks back home.

A Quinnipiac University Poll released Monday shows that many New Jersey voters are turned off by Christie and his presidential ambitions, with 56 percent saying they disapprove of his job performance. More than half of those interviewed say that their shoot-from-the-hip Republican governor isn’t trustworthy and that he doesn’t care about their needs. Christie’s 38 percent approval rating is the lowest he has registered since becoming governor in January 2010.

Related: Christie’s Presidential Prospects on a Steady Slide

But it gets worse: 65 percent of Garden State voters say Christie would not make a good president (vs. 29 percent who think he would do a good job), and by similar margins voters say he shouldn’t run.

Meanwhile, more than a third of those interviewed said Christie should be removed from office if it is ultimately determined that he ordered or knew about the infamous closing of traffic lanes in Fort Lee, N.J., that led to massive traffic jams on the George Washington Bridge in early September 2013.

Recently, two reports, commissioned by the state legislature and Christie’s office, failed to turn up any evidence that Christie participated in the scheme – said to be political retaliation against the Democratic mayor of Fort Lee – or knew about it as it happened. However, the U.S. attorney’s office is conducting a criminal investigation of the bridge scheme; there is no indication of when that will be concluded.

Related: Rubio Lashes Out at Clinton on Foreign Policy

The new telephone survey was conducted April 9 to 14 and involved 1,428 New Jersey voters. The findings have a margin of error of +/- 2.6 percentage points.

More Quick Hits from The Fiscal Times:

- 100-Year-Old Coke Bottle Is About to Become a Movie Star

- More Americans Have Health Insurance (Whether They Want it or Not)

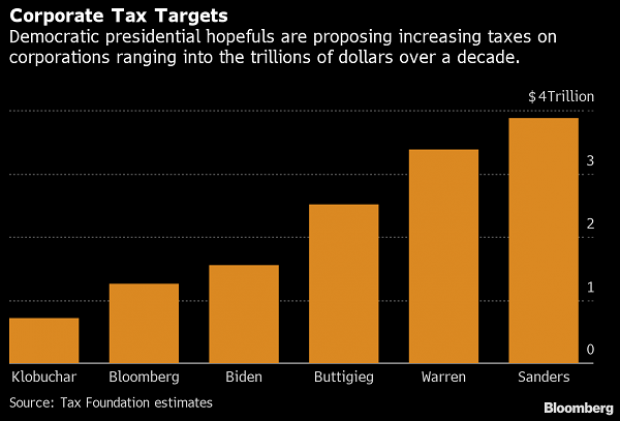

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

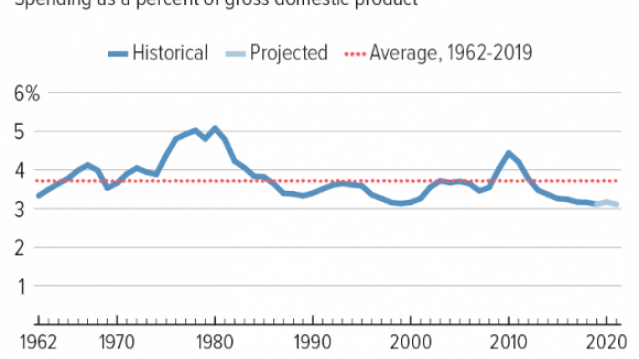

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

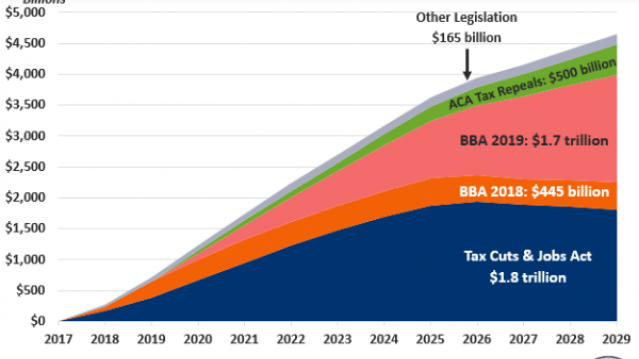

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

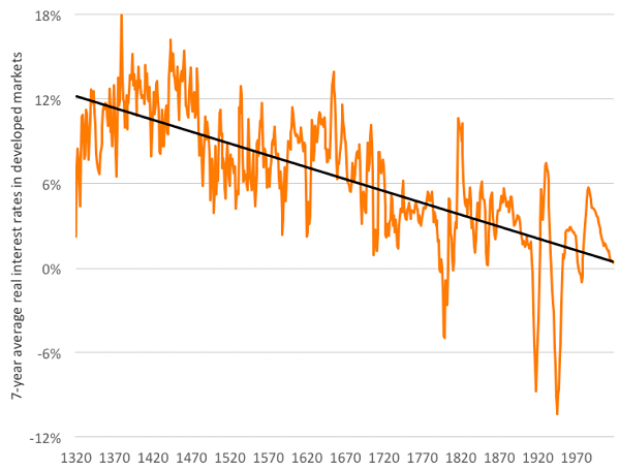

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

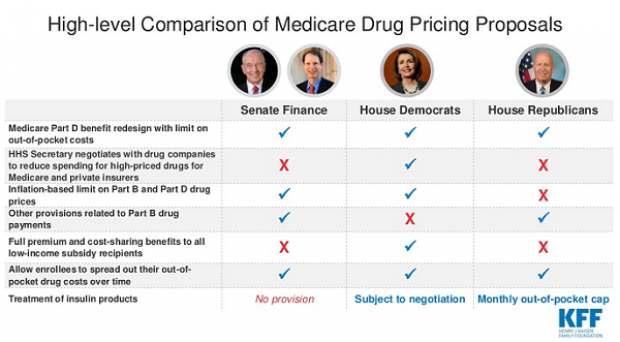

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.