Welcome to the weekend. Authorities in Memphis are about to release video of the police beating that resulted in Tyre Nichols's death.

Here’s what else we’ve been keeping an eye on. As always, send your tips and feedback to yrosenberg@thefiscaltimes.com.

Abolish the IRS and the Income Tax? Republicans Are Split Over New Plan

A group of arch-conservatives in the House is pushing for a vote on a bill that would eliminate federal income taxes and the IRS, but some influential Republicans are pushing back against what appears to be a political loser for the GOP.

The bill, known as the Fair Tax Act, would scrap all individual and corporate income taxes while imposing a 30% national sales tax on goods and services to be collected at the state level, thereby eliminating the need for the IRS.

In a deal to back Speaker Kevin McCarthy (R-CA) in his run for House leadership, conservatives reportedly won a commitment to bring the tax bill to the floor for a vote. However, the bill has virtually no chance of becoming law and meanwhile has provided President Joe Biden and Democrats with new ammunition in their effort to paint Republicans as extremists.

“This ‘Fair Tax Act’ is truly foul stuff,” Senate Majority Leader Charles Schumer (D-NY) said Thursday. “The Republican tax plan would raise the cost of buying a house by $125,000. It would raise the cost of buying a car by $10,000. It would raise your average grocery bill by $3,500 a year at a time when people are already worried about the high price of groceries. How can they do this?”

Schumer failed to note that the bill would also eliminate income and other taxes, but his remarks highlight the difficulty Republicans might face if they push ahead with the bill. Analyses of similar tax plans show that a national sales tax would be regressive, raising taxes on the poor and reducing taxes on the rich, while failing to provide enough revenues to fund the full range of government activities.

Several Republican leaders have come out against the bill. McCarthy said earlier this week that he opposes it, while allowing that it could come up for consideration if it makes it through the committee process. House Majority Leader Steve Scalise (R-LA) has also said he does not support the bill, preferring instead to make the tax cuts included in the 2017 tax law permanent.

Rep. Don Bacon, a relatively moderate Republican from Nebraska, told The Hill he is opposed to the bill. “I don’t think it’s a wise thing,” he said, adding that he doesn’t think “it’s smart politics or policy.”

Rep. Jason Smith (R-MO), the new chairman of the Ways and Means Committee who calls himself a “firebrand,” said he plans to look into the Fair Tax plan but stopped short of backing it. “We’re going to have a public, transparent hearing on that issue and we’ll see where it goes from there,” he said.

GOP House Budget Chair: US Won’t Default on Its Debt

Rep. Jodey Arrington (R-TX), the new chair of the House Budget Committee, insists that the federal government won’t default on its debt — even if the Treasury Department breaches its borrowing limit.

In an interview with Punchbowl News, Arrington downplayed the risk of default and pointed to a constitutional obligation for the United States to pay its creditors.

Among the various ideas that have been discussed for averting a potentially catastrophic debt showdown, some analysts have suggested that the 14th Amendment requires the government to make good on its debts. Section 4 of the amendment reads, in part: “The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.”

Some have proposed that, based on that language, President Joe Biden can instruct the Treasury Department to disregard the debt limit and pay its creditors. Arrington said something similar, arguing that “defaulting is not in the realm of possibility with the constitutional responsibility to pay those folks.”

“Many believe, even constitutionally, that we have to pay the principal and interest on our debt. We have to pay our creditors. Like, you can’t not do that,” Arrington told Punchbowl. “Now that’s a debate. I’ve heard both sides of it, and we haven’t seen it play out. But I think there are many smart people with tremendous historic context and experience who believe that we are constitutionally obligated.”

A Treasury Department spokesperson pushed back on that suggestion, telling Punchbowl that “a failure on the part of the United States to meet any obligation, whether it’s to debt holders, to members of our military, or to Social Security recipients, is effectively a default.” The Biden administration has insisted that it is the responsibility of Congress to raise the debt ceiling without strings attached.

Bloomberg News has more about the House’s new Budget Committee chairman and his plans for cutting spending. Read the story here.

Charts of the Week: The Challenge of Balancing the Budget Through Cuts

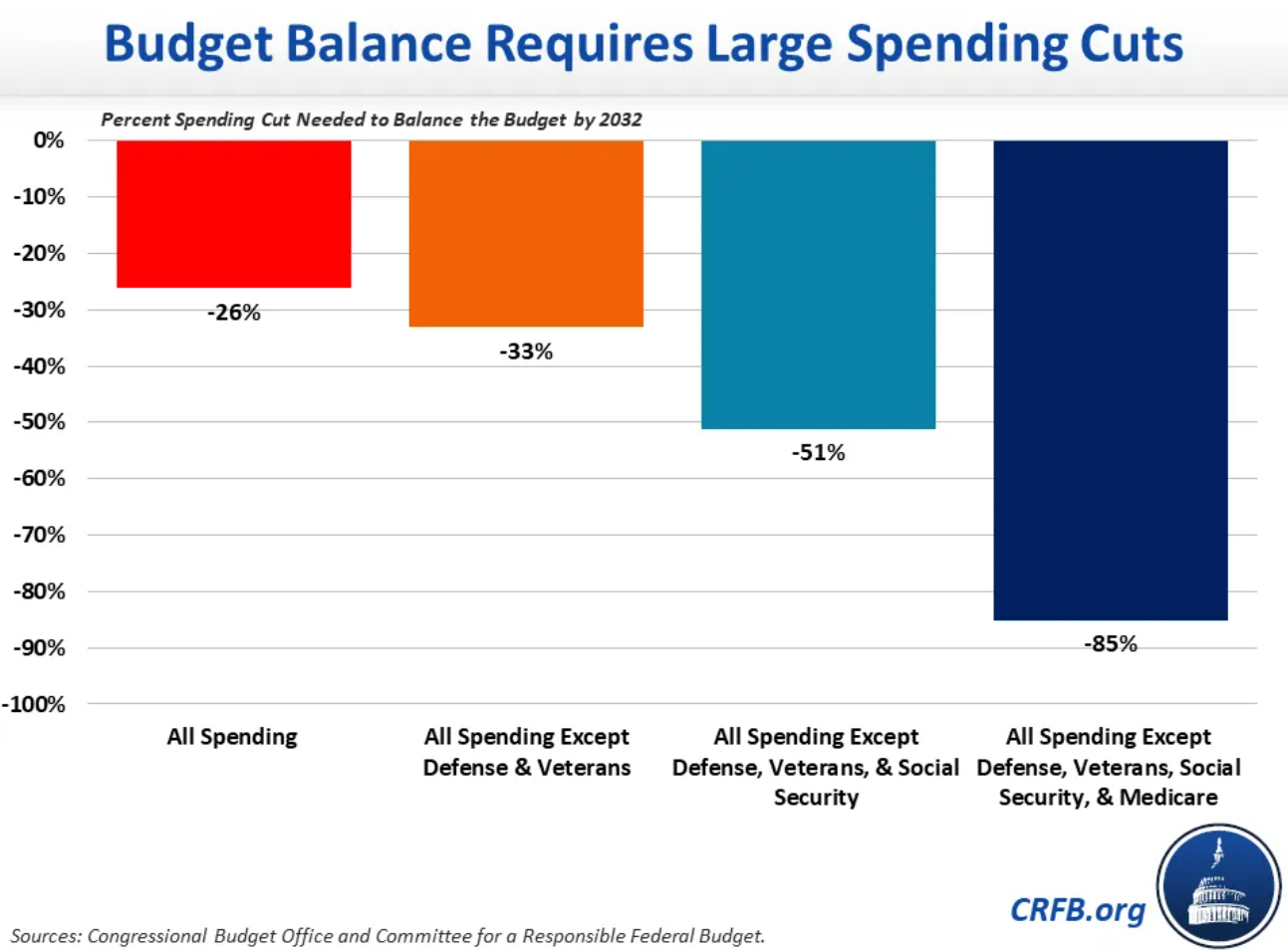

As Republicans press for unspecified spending cuts in exchange for an increase in the debt ceiling and some in the party call for a federal budget that balances in 10 years, the Committee for a Responsible Federal Budget earlier this month illustrated how difficult those fiscal goals are to achieve without raising any additional revenue.

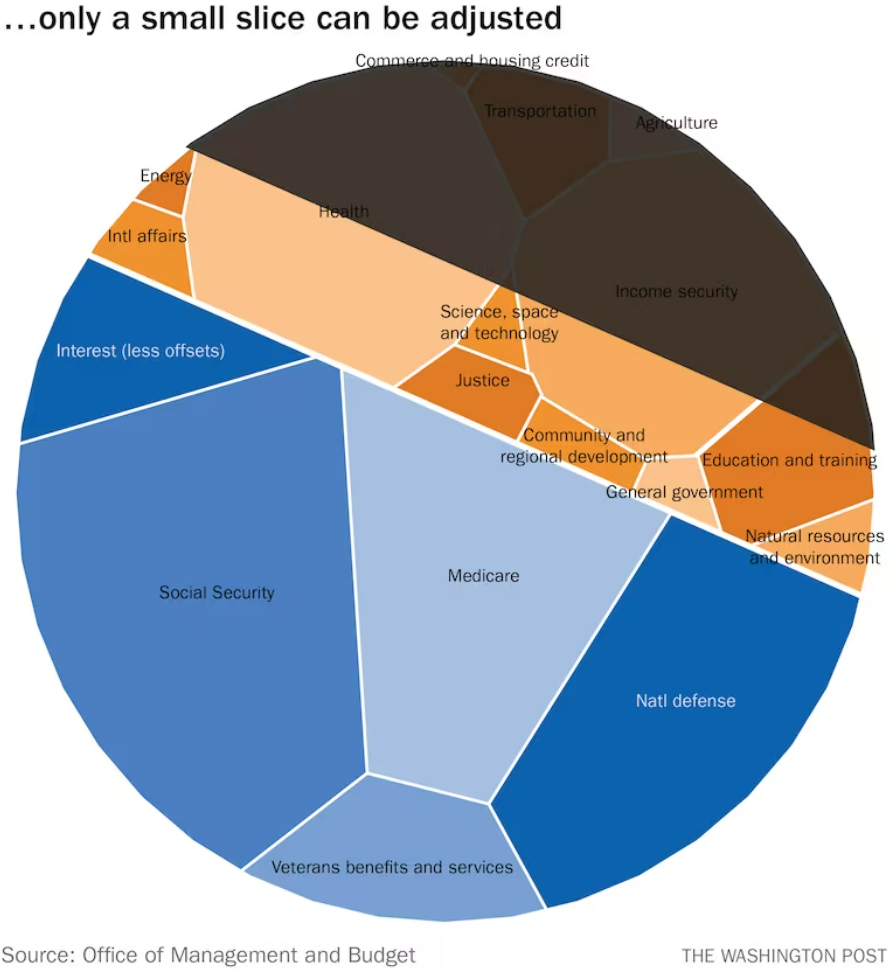

As the chart below shows, the committee’s analysis found that all federal spending would need to be cut by more than quarter in order to reach budget balance within a decade. If Social Security, Medicare, defense and veterans programs were shielded from cuts, the rest of the budget would have to be slashed by 85%. “These cuts would be so large that it would require the equivalent of ending all nondefense appropriations and eliminating the entire Medicaid program just to get to balance,” CRFB said.

The bottom line: Balancing the budget within 10 years through cuts along is highly unlikely — and it’s rendered nearly impossible if major portions of the budget are shielded from cuts. “Instead of shooting for balance within ten years, it would be wise to select a different target or timeline,” CRFB said. Read their post to see some possible alternative goals.

Number of the Day: 5%

A key measure of inflation, the index of personal consumption expenditures (PCE), increased by 5% on an annual basis in December, the Bureau of Economic Analysis announced Friday, continuing a pattern of easing price pressures in the U.S. economy. The index was up 6.3% in September, before dropping to 6.1% in October and 5.5% in November.

The latest reading is still considerably higher than the Federal Reserve’s 2% target rate for inflation, but the PCE index is moving in the right direction.

Core PCE, a measure of inflation closely watched by the Fed that ignores volatile food and fuel prices, also eased on an annual basis, falling to 4.4% in December, down from 4.7% in November, 5.1% in October and 5.2% in September.

“It’s clear, continued progress on the inflation front — which is something we expected, but good to see,” Vanguard’s global chief economist Joe Davis told CNN. “I think you’re seeing continued softening across the entire report.”

Still, not every measure of inflation is pointing in the same direction. On a monthly basis, core PCE edged higher in December, coming in at 0.3% compared to November’s 0.2%. And prices for some services are still rising sharply, raising questions about how aggressive the Federal Reserve will be when it considers another round of interest rate hikes at its meeting next week.

“Despite a soft headline print for December’s personal consumption expenditure deflator, inflation remains heady in core services excluding housing rents,” said Bloomberg economist Ana Wong. “The lack of evidence that the durable inflation component is moderating means [Fed chair Jay] Powell will maintain his hawkish message of holding rates higher for longer.”

News

- Lots of Sound and Fury on US Debt, but Not a Crisis — Yet – Associated Press

- Key Republicans Oppose House GOP Bill to Abolish Tax Code – The Hill

- New MAGA Push: Defund the Government, It’s Too Woke – Rolling Stone

- GOP’s Arrington Urges Calm as Debt Fury Rages: ‘Let’s Be Adults’ – Bloomberg

- Kennedy on GOP Wanting to Cut Social Security: ‘Not Even George Santos Would Make Up a Whopper Like That’ – The Hill

- Nearly Three-Quarters of Americans Think House GOP Leaders Haven’t Paid Enough Attention to Most Important Problems – CNN

- Biden Confirms Jeff Zients to Become New Chief of Staff – Politico

- Biden Admin Breaks Down Student Debt Relief Numbers: California Had the Most Applicants – The Hill

- White House Approves 16 Million People for Contested Student Loan Forgiveness Plan. Whether They See Relief Depends on Supreme Court Decision – CNBC

- Biden Administration Awards $118 Million for Biofuel Projects – The Hill

- FDA Advisers Favor Retiring Original Covid Shot and Using Newer Version – Washington Post

- CVS and Walmart Cut Pharmacy Hours, Close Some Locations Earlier, Citing Staffing Shortage – CNN

Views and Analysis

- Republicans Want to ‘Negotiate’ Over the Debt Ceiling? Bring It On – Paul Waldman, Washington Post

- The GOP’s Strange Budget Strategy – Rich Lowry, Politico

- Biden Needs to Show He’s Serious About the Debt Limit – Jonathan Bernstein, Bloomberg

- Why Senate Democrats Are Playing It Safe With Their Agenda This Year – Alexander Bolton, The Hill

- Republicans Are Already Burying Their Kooky National Sales-Tax Plan – Ed Kilgore, New York

- How Not to Fight Inflation – Joseph E. Stiglitz, Project Syndicate

- Wonking Out: Inflation and the Imputation Game – Paul Krugman, New York Times

- Who Will Head the National Economic Council? – Robert Kuttner, American Prospect

- The Time Has Come for a Major Reset at the CDC – Washington Post Editorial Board