This year’s tax filing season will be a frustrating one for taxpayers, officials warned Monday.

The IRS will begin accepting 2021 returns on January 24 and the filing deadline for most taxpayers will be April 18 rather than April 15 because of the Emancipation Day holiday in Washington, the agency announced. But IRS Commissioner Chuck Rettig said that the pandemic continues to present challenges and again called for more resources for the agency, which has been hurt by years of budget cuts and plagued by worker shortages, all leading to a backlog of returns last year several times greater than usual. On top of that, lawmakers piled on new responsibilities, tasking the agency with sending out payments for pandemic aid programs and the expanded Child Tax Credit.

That all added up to an extraordinary logjam and exasperating service levels.

“Typically, IRS officials enter filing season with an unaddressed backlog of roughly 1 million returns,” The Washington Post’s Jeff Stein reports. “This year, however, the IRS will enter the filing season facing ‘several times’ that, Treasury officials said, although they declined to give a more precise estimate. The IRS website says that as of Dec. 23, 2021, it still had 6 million unprocessed individual returns, and as of the start of this month it still had more than 2 million unprocessed amended tax returns, a separate category.”

The agency said that from January 1 through May 17 last year it received more than 145 million calls from taxpayers with questions, more than four times higher than in an average year. Treasury Department officials reportedly warned Monday that the IRS would struggle to handle the volume of calls and blamed Republican lawmakers who have stymied efforts to increase funding for the agency.

"In many areas, we are unable to deliver the amount of service and enforcement that our taxpayers and tax system deserves and needs. This is frustrating for taxpayers, for IRS employees and for me," Rettig said in a statement. "IRS employees want to do more, and we will continue in 2022 to do everything possible with the resources available to us. And we will continue to look for ways to improve. We want to deliver as much as possible while also protecting the health and safety of our employees and taxpayers. Additional resources are essential to helping our employees do more in 2022 – and beyond."

The IRS budget is about $12 billion, and the agency asked lawmakers for an increase of 10.4% to nearly $13.2 billion for fiscal year 2022. But progress on the 2022 budget has stalled out in Congress. The Biden administration has proposed boosting IRS funding by $80 billion over 10 years as part of a plan to step up enforcement and improve the agency’s technology and customer service. But that proposal is part of the Build Back Better Act, which also faces an uncertain path forward in Congress.

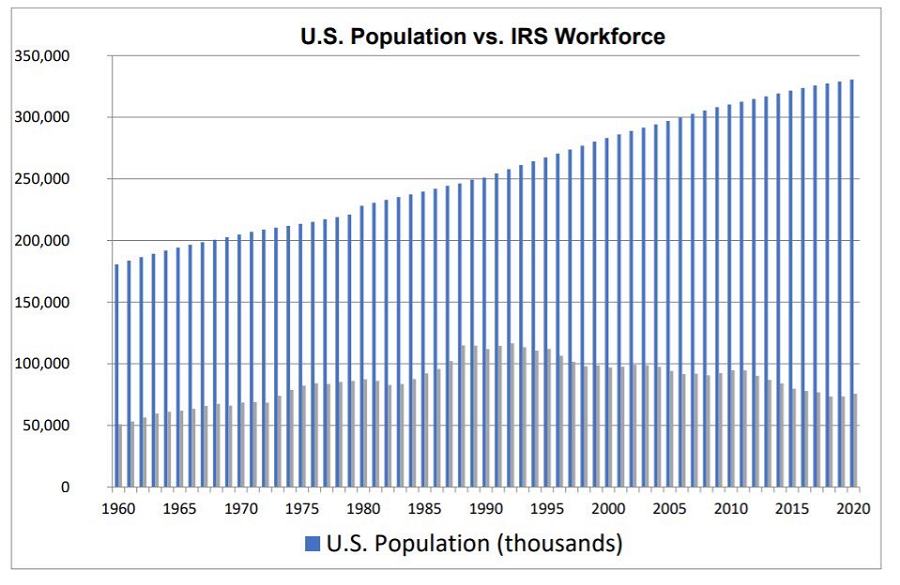

“Even if the IRS budget is increased, it would likely not be in time to allow the agency to hire for this filing season,” The Post’s Stein notes. “As a result, the IRS heads into its busiest time of year with a workforce that is now the same size as it was in 1970 — even though the U.S. population has grown by 60 percent since that time, according to Treasury officials.” The officials also told reporters that there are fewer IRS auditors now than at any time since World War II.

To avoid delays in processing, the IRS urged taxpayers to file electronically. It said it expects most taxpayers will get their refund within 21 days of filing electronically if they use direct deposit and there are no issues with their return. It also urged taxpayers to look for information online before calling an IRS helpline.

Natasha Sarin, deputy assistant secretary for economic policy at the U.S. Treasury Department, tweeted this chart Monday, highlighting the decline in the size of the IRS relative to the U.S. population. “Providing the IRS with the resources it needs is *only* way to ensure the agency can provide the services taxpayers deserve and collect owed taxes from high-end evaders,” Sarin says.

Sen. Joe Manchin’s opposition to the Build Back Better legislative package has stopped President Joe Biden’s domestic agenda in its tracks, and now it looks like the West Virginia Democrat has no interest in trying to get the bill moving forward again, even on the terms he offered the White House in December.

Manchin said last week that there are no active negotiations on the spending package, and over the weekend sources told The Washington Post that Manchin no longer wants to pursue the $1.8 trillion counteroffer he discussed with Biden shortly before Christmas — a counteroffer that included hundreds of billions of dollars for programs focused on major parts of Biden’s domestic agenda, including education, health care and climate change.

Nearly a month later, Manchin has reportedly backed away from the counteroffer, which excluded funding for the enhanced child tax credit that progressives want, and he believes that Democrats need to start over with a new approach.

Growing doubt among Democrats: The White House continues to express confidence that the president can make a deal with Manchin, and House Speaker Nancy Pelosi (D-CA) told CBS’s “Face the Nation” this weekend that she thinks the Build Back Better bill is still viable. “I do think there’s an agreement to be reached,” she said. “It’s so important for our country.”

But some Democratic senators are losing faith that there is a way forward. Senate Majority Whip Dick Durbin (D-IL) told The Hill that he has “no idea” whether Manchin wants to make a deal.

Another Democratic senator said there’s no indication that Manchin wants to get to yes. “I have no reason to think that he does, literally no reason to think that he does,” the senator said, adding that Manchin’s lack of interest suggests he has no plan to help Democrats pass either the Build Back Better package or the voting rights bill currently under consideration: “All the evidence is to the contrary.”

Still, some Democratic senators think Manchin is still open to a deal, but one that would likely bear little resemblance to the current bill. “What he has conveyed directly and indirectly to the president and to a number of us is that we got to cut this thing down and it’s got to look like what I support. But what came out of the House? Forget it,” said a third senator.

Republicans maintain pressure: Manchin has reportedly discussed the pros and cons of the Build Back Better bill with a wide range of officials, including Republican Sen. Mitt Romney (UT) and President Donald Trump’s former White House economic adviser, Larry Kudlow.

In an op-ed in The New York Sun last week, Kudlow said he has faith that Manchin will reject the Democrats’ bill, which he characterized as a “high tax, high spend, woke monstrosity.”

“The guy is not going to cave,” Kudlow wrote. “I fully expect him in the next couple days to tell us all that he intends to save America and kill the bill.”

Miners throw a wild card: Although Manchin appears to be listening to critics to his right who say that the Build Back Better plan is too big and too progressive, one key group in West Virginia that could influence the senator’s stance strongly supports the legislation: coal miners.

The New York Times’ Jonathan Weisman reports that the United Mine Workers and the West Virginia A.F.L.-C.I.O. are backing the bill, which includes provisions on health care, economic development and green energy investment of interest to the miners, who remain a political force in the state despite their dwindling numbers.

“We urge Senator Manchin to revisit his opposition to this legislation and work with his colleagues to pass something that will help keep coal miners working and have a meaningful impact on our members, their families and their communities,” the president of the United Mine Workers of America said in a statement in December.

Still, although miners in his home state may be more persuasive with Manchin than progressive Democrats from New York or California, Weisman notes that the bill represents a clash of interests between mining and energy company owners, who oppose its proposed investments in green energy, and workers, who are embracing a more environmentally friendly approach to energy production.

We’ll have to wait to see how that behind-the-scenes struggle plays out, but the miners’ decision to back the bill could end up being a significant factor in Manchin’s decision on whether to renew negotiations with the White House.

“Indeed, now that this fundamental conflict between mine workers and owners has been exposed, it should be harder for Manchin to sink BBB in the end, even under another pretext, without being perceived as operating in owners’ interests,” The Washington Post’s Greg Sargent wrote Monday. “That might not be enough to persuade Manchin. But if it isn’t, what would be?”

The federal budget deficit was $377 billion over the first three months of fiscal year 2022, which started in October, according to Congressional Budget Office estimates published Monday. The deficit is $196 billion less than over the same period last year, and slightly larger than the deficit for the same months two years ago.

News

- Biden Comes Out Swinging Against Republicans as His Agenda Stalls – New York Times

- Manchin’s $1.8 Trillion Spending Offer Appears No Longer to Be on the Table – Washington Post

- Senate Democrats Grow Less Confident in Manchin – The Hill

- Manchin’s Choice on Build Back Better: Mine Workers or Mine Owners – New York Times

- Sanders Calls for Stand-Alone Votes on Parts of Democrats' Agenda – The Hill

- SALT Change on Ice in the Senate – The Hill

- Biden Administration Wants Medicare to Reconsider Premium Hike – Axios

- Biden Regulators Take Action on Hidden Pharma Monopolies – American Prospect

- New York Business Owners Sidestep Billions in Federal Taxes With State’s Help – Wall Street Journal

- Treasury Warns Taxpayers to Brace for a Turbulent Tax Filing Season – Politico

- Boon for ‘Dynamic Glass’ Offers Window Into Budget Bill Lobbying – Roll Call

- States Carve Out Billions in Budgets for Electric Vehicle Surge – The Hill

- Four Fed Hikes May Be Just the Start as Traders Lift Rate Bets – Bloomberg

- U.S. Insurers Must Cover Eight At-Home COVID Tests per Person Monthly, White House Says – Reuters

- Health Care Workers Are Panicked as Desperate Hospitals Ask Infected Staff to Return – Politico

- House Republicans Call for Oversight Into Biden's 'Failed COVID Response' – The Hill

Views and Analysis

- West Virginia’s Coal Miners Just Made Joe Manchin’s Life a Lot Harder – Greg Sargent, Washington Post

- Bigger Child Tax Credits Can Pay Dividends for U.S. – Justin Fox, Bloomberg

- Fed’s Powell Pumped Trillions Into the Economy. Now, He May Be the Party Killer – Victoria Guida, Politico

- The Democrats Are Running Out of Time – Alex Shephard, New Republic

- As an E.R. Doctor, I Fear Health Care Collapse More Than Omicron – Craig Spencer, New York Times

- Biden's 500 Million COVID Tests Do Not Go Far Enough – Sheldon H. Jacobson, The Hill

- Take a Good Look at What Dr. Oz Is Selling Us Now – Annaliese Griffin, New York Times