Trump’s Big Tax Bill Hangs in the Balance in Senate Vote-a-Rama

The fate of President Trump's "big, beautiful bill" remains uncertain this evening, but the process to pass it is unquestionably ugly.

The Senate began a lengthy vote-a-rama Monday morning, considering a series of dozens of amendments before it can move on to a final vote on the package of tax and spending cuts. It's been slow going, as Republicans reportedly continue to work to win over potential holdouts while Democrats blast the legislation, its huge cuts to Medicaid and food aid programs and the route Republicans have chosen to try to pass it.

"Having started votes just past 9:30 a.m., senators had completed just 14 roll call votes in about seven hours, with little sign of urgency from Republicans to get things moving," The Washington Post's Paul Kane noted. "At the current pace, the Senate would not reach a final vote till 5:30 a.m. Tuesday if there are at least 40 roll call votes."

Republican leaders still face concerns and divisions within their conference on some key issues. Those divisions were visible Saturday night, when it took hours for GOOP leaders to round up the necessary votes to begin debate. The legislative process was also extended by Democrats who, as a protest against the bill, required the entire text, nearly 1,000 pages, to be read aloud on the Senate floor, a process that took nearly 16 hours.

Here's a look at some of the most controversial aspect of the bill.

Disputes Drag On as Senate Republicans Try to Power Trump's Big Bill to Passage

The fate of President Trump's "big, beautiful bill" remains uncertain this evening, but the process to pass it is unquestionably ugly.

The Senate began a lengthy vote-a-rama Monday morning, considering a series of dozens of amendments before it can move on to a final vote on the package of tax and spending cuts. It's been slow going, as Republicans reportedly continue to work to win over potential holdouts while Democrats blast the legislation, its huge cuts to Medicaid and food aid programs and the route Republicans have chosen to try to pass it.

"Having started votes just past 9:30 a.m., senators had completed just 14 roll call votes in about seven hours, with little sign of urgency from Republicans to get things moving," The Washington Post's Paul Kane noted. "At the current pace, the Senate would not reach a final vote till 5:30 a.m. Tuesday if there are at least 40 roll call votes."

Republican leaders still face concerns and divisions within their conference on some key issues. Those divisions were visible Saturday night, when it took hours for GOOP leaders to round up the necessary votes to begin debate. The legislative process was also extended by Democrats who, as a protest against the bill, required the entire text, nearly 1,000 pages, to be read aloud on the Senate floor, a process that took nearly 16 hours.

Here's a look at some of the most controversial aspect of the bill.

Baseline battle: The Senate voted 53-47 to adopt a "current policy" baseline for consideration of the bill, treating nearly $4 trillion in extended tax cuts as having no cost because they maintain the status quo. Republicans had refused a Democratic request for a bipartisan meeting with the Senate parliamentarian on the issue, arguing that Budget Committee Chairman Lindsey Graham has the authority to set the baseline.

A Congressional Budget Office analysis using the current policy baseline found that the GOP legislation would reduce the deficit by $508 billion. Another CBO analysis using traditional scoring assumptions calculated a $3.3 trillion deficit increase (see more below).

Democrats decried the Republican move, warning that the numbers being used are fake - "as fake as Donald Trump's tan," Sen. Ron Wyden said - but the coming deficits will be very real.

"This means that reconciliation-for the first time ever-can now be used to increase the deficit in perpetuity. That's never been the case before," Michael Linden, a Democratic budget expert and former official in the White House Office of Management and Budget, wrote on X. "Any Republican who is ok with this should never be allowed to claim they care about the deficit ever again."

Policy wonks warned that Republicans were embracing an accounting gimmick that would reverberate for years, opening the door to more accounting games and policy maneuvers. "A political system that is looking for every opportunity not to cover the bills will use and abuse this going forward," said Maya MacGuineas, president of the Committee for a Responsible Federal Budget, which advocates for deficit reduction.

Experts also complained that Republicans are playing games by setting expiration dates at the end of 2028 for a series of new tax breaks, including deductions for tipped workers, overtime pay, senior citizens and interest on car loans. Those expiration dates helped keep down the official cost of the tax provisions - but assuming they are extended, their true cost could be $1 trillion higher.

More Medicaid cuts? Republican Sen. Thom Tillis of North Carolina warned his party against cutting Medicaid. On Saturday, he voted against moving ahead with the bill. Then, faced with the threat of a GOP primary challenge backed by Trump, on Sunday he stunned lawmakers by announcing he won't seek another term. "Republicans are about to make a mistake on health care and betray a promise," Tillis warned.

But Tillis's misgivings about Medicaid cuts have gone unheeded in other corners of his party. Republican Sen. Rick Scott of Florida has proposed an amendment that would change the federal government's 90% cost chare for Medicaid enrollees who became eligible for the program under the Affordable Care Act. Enrollees who sign up starting in 2031 would have their Medicaid costs reimbursed at lower rates, placing additional burdens on states. The Scott amendment would reportedly result in another $313 billion in Medicaid cuts, and it would strip healthcare coverage from millions more beneficiaries. In some states, the change would trigger an automatic end or review of the Medicaid expansion. Democrats warned that these trigger laws could mean that millions more people across nine states would lose their coverage, bringing the total coverage losses to nearly 20 million people.

Several Republican senators have criticized the Medicaid cuts already in the bill, which would seemingly make it unlikely that Scott's amendment is approved

Cutting tax incentives for wind and solar power: The updated Senate bill includes a surprise: it slashes tax incentives for wind and solar energy and would levy a new tax on those projects in the future.

The sweeping changes to clean energy policies would save an estimated $516 billion over 10 years. But the proposals have led to warnings that Republicans are undercutting key parts of the energy sector and that the tax changes will lead to higher prices for consumers and a greater struggle to meet increased energy needs.

"These new taxes will strand hundreds of billions of dollars in current investments, threaten energy security, and undermine growth in domestic manufacturing and land hardest on rural communities who would have been the greatest beneficiaries of clean energy investment," Jason Grumet, CEO of the American Clean Power Association, said in a statement.

Elon Musk, the CEO of electric vehicle maker Tesla, who over the weekend called the GOP bill "insane," also warned that the clean energy provisions are "a massive strategic error" that "will leave America extremely vulnerable in the future."

A number of Republicans are fighting to preserve the wind and solar incentives, pushing an amendment to undo the harsher approach to clean energy tax credits in the revised Senate bill. The fate of that amendment could determine the fate of the overall bill.

The bottom line: The White House has urged congressional Republicans to unite behind the bill and get it to Trump's desk by July 4, but the package still faces some uncertainty in the Senate, where Sens. Tillis and Rand Paul of Kentucky are firmly in the "no" column, meaning that GOP leaders can afford to lose only one more vote. The package may be met with even more uncertainty if or when it is sent back to the House, where lawmakers have been upset by the Senate's changes to the version they narrowly passed last month.

Senate Bill Would Cost $3.3 Trillion and Leave 11.8 Million People Uninsured: CBO

The Senate version of the One Big Beautiful Bill Act, the massive reconciliation package that would deliver on much of President Donald Trump's domestic policy agenda, would add at least $3.3 trillion to budget deficits over the next 10 years, the Congressional Budget Office said in an analysis released over the weekend.

That cost jumps closer to $4 trillion once rising interest payment costs are taken into account, according to fiscal experts. At the same time, spending reductions in the bill would slash funding for healthcare by about $1.1 trillion, resulting in a loss of health insurance for 11.8 million people by 2034.

A dark day for deficit hawks: The CBO's cost estimate for the Senate bill is significantly higher than its estimate for the House version, which came in at $2.4 trillion, or $2.8 trillion when scored on a dynamic basis.

Tax cuts are the largest single contributor to the cost of both versions of the bill. Extending the 2017 tax cuts, many of which were scheduled to expire at the end of the year, would cost about $3.8 trillion in lost revenue. New tax provisions, including no taxes on tips and overtime pay, push total cost of tax cuts in the bill to about $4.5 trillion.

In terms of offsets, the Senate bill seeks to cut Medicaid, Medicare and Affordable Care Act-related spending by $1.1 trillion, with the vast majority of the cuts falling on Medicaid.

The New York Times's Margot Sanger-Katz reports that the roughly $1 trillion in cuts for Medicaid are unprecedented going back to the beginning of the program in 1965, and are produced largely through two provisions.

The first would create nationwide work requirements for beneficiaries, focused on childless adults of working age, as well as parents whose children are more than 14 years old. That provision is projected to reduce Medicaid spending by $325 billion over 10 years.

The second major provision would save $375 billion over a decade by cracking down on a strategy many states use that involves taxing medical providers to increase federal payouts. States would have to start lowering those taxes starting in 2027, a more aggressive approach than the House version, which requires states to just freeze those taxes. Concerns about how that provision would affect rural hospitals led lawmakers to add a provision that increases the size of a dedicated relief fund to $25 billion.

The bottom line: The One Big Beautiful Bill Act is still developing, and the final numbers could and likely will change. But the CBO's score of the bill as of this weekend suggests that it will raise deficits by trillions of dollars, while reducing healthcare coverage for millions of people over time.

Chart of the Day

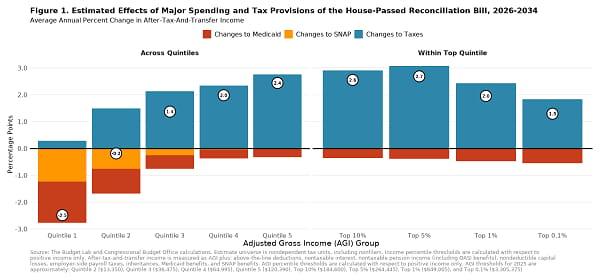

The Republican reconciliation bill will have markedly different effects on different income groups. The chart below from a distributional analysis of the bill by the Yale Budget Lab indicates that the benefits of the bill come from tax cuts (in blue), which flow disproportionately to high-income households. The savings, meanwhile, provided through cuts to Medicaid (in red) and food assistance (in yellow), come largely from low-income households.

"Changes to taxes and Medicaid and SNAP spending proposed by the Senate budget reconciliation bill would result in a decline of 2.9 percent (about $700) in income for the bottom quintile, but an increase of 1.9 percent (about $30,000) for the top 1 percent," the Yale analysts write. "The Senate version of the bill is broadly similar in its regressivity to the version passed by the House of Representatives, with deeper cuts to Medicaid partly offset by shallower cuts to SNAP."

Trump Attacks Fed's Powell Again, Says He's Costing US 'a Fortune'

President Trump on Monday stepped up his attacks on the Federal Reserve and Chairman Jerome Powell. Trump sent a letter to Powell showing interest rates around the world and urging him to lower U.S. rates, the White House said.

"Jerome, you are, as usual, 'Too Late.' You have cost the USA a fortune and continue to do so," Trump wrote. "You should lower the rate - by a lot. Hundreds of billions of dollars being lost! No inflation."

In a post on his social media site, the president shared the same letter and said that Powell and the Fed board of governors "should be ashamed of themselves" and called for U.S. interest rates to be 1% or lower. "If they were doing their job properly, our Country would be saving Trillions of Dollars in Interest Cost," Trump said of Fed bankers.

Trump has flirted with the idea of firing Powell, though he backed off that move, which was likely to rattle markets. He is instead reportedly considered naming Powell's replacement months before the Fed chair's term expires next May.

Treasury Secretary Scott Bessent told Bloomberg TV Monday that the president may use the next expected opening on the Fed's board of governors to appoint Powell's eventual successor.

"There's a seat opening up, a 14-year seat opening up in January. So we've given thought to the idea that perhaps that person would go on to become the chair when Jay Powell leaves in May, or we could appoint the new chair in May," Bessent said. "Unfortunately, that's just a two-year seat."

In testimony before Congress last week, Powell made clear that the Fed paused its rate-cutting campaign to wait and see what kind of inflation emerges as a result of Trump's tariff policy. "If you just look at the basic data and don't look at the forecast, you would say that we would've continued cutting," Powell acknowledged.

Fiscal News Roundup

- Trump, Republicans Rush to Overcome Internal Clashes on Tax Bill - Bloomberg

- Deficit Hawks Hate the Latest Version of the "Big, Beautiful Bill" - Axios

- Senate GOP Tax Bill Includes Largest Cut to U.S. Safety Net in Decades - Washington Post

- In a First, Trump and GOP-Led Congress Prepare to Swell Ranks of U.S. Uninsured - KFF Health News

- GOP Declares Tax-Cut Extensions 'Free' to Obscure Megabill's Cost - Wall Street Journal

- Anxious House Republicans Scramble to Forestall Senate's Medicaid Cuts - Politico

- Senate Version of Trump's Policy Bill Would Slash Medicaid Spending Even More - New York Times

- G.O.P. Bill Adds Surprise Tax That Could Cripple Wind and Solar Power - New York Times

- Senate GOP Scrambles to Save Alaska SNAP Carveout - Politico

- Donald Trump's Fiscal Policy and Fed Attacks Imperil US Haven Status, Say Economists - Financial Times

- US Dollar Suffers Worst Start to Year Since 1973 - Financial Times

- Trump Admin Customs Revenue Tops $100 Billion, Boosted by Tariffs - Axios

- Canada Axes Digital Services Tax in Push to Advance Trade Talks With U.S. - Axios

- Bush, Obama and a Tearful Bono Fault Trump's Gutting of USAID on Agency's Last Day - Associated Press

- More Than 300 Charged in $14.6 Billion Health Care Fraud Schemes Takedown, Justice Department Says - Associated Press

- Cities Lose Hope for Restarting Disaster Projects Killed by Trump - Politico

- A Texas Boy Needed Protection From Measles. The Vaccine Cost $1,400 - KFF Health News

Views and Analysis

- A List of Nearly Everything in the Senate G.O.P. Bill, and How Much It Would Cost or Save - Alicia Parlapiano, Margot Sanger-Katz, Aatish Bhatia and Josh Katz, New York Times

- How the G.O.P. Bill Saves Money: Paperwork, Paperwork, Paperwork - Margot Sanger-Katz and Emily Badger, New York Times

- The Worst Bill in Modern History - Jennifer Rubin, The Contrarian

- The Pending Senate Budget Bill Is Even More Regressive Than the Finance Panel's Version - Howard Gleckman, Tax Policy Center

- The Republican Shell Game on Tax Cuts - Ramesh Ponnuru, Washington Post

- The Most Uselessly Expensive Part of the GOP Budget Bill - Justin Fox, Bloomberg

- A 'Revenge Tax' Victory for Congress - Wall Street Journal Editorial Board

- This Is What ICE Is Doing With the Tax Dollars You Already Provide It - Philip Bump, Washington Post

- A Signature GOP Issue Is Omitted From Trump's 'Big' Tax Bill. Weird - Ray D. Madoff, Washington Post

- Distributional Effects of Selected Provisions of the House and Senate Reconciliation Bills - Yale Budget Lab

- Analysis: Senate Reconciliation Bill, One Big Beautiful Bill Act (OBBBA) - Tax Policy Center

- Want to Lead in AI? Then Don't Kill Wind and Solar - Matt Eggers, Washington Post

- The GOP Tax Bill Will Destabilize Tomorrow's Power Grid - Liam Denning, Bloomberg

- Trump Won't Let Other Countries Score Big 'Wins' in Trade Talks. Both Sides Could Lose - Daniel Desrochers and Megan Messerly, Politico

- The Independent Federal Reserve Is on Death Row - Clive Crook, Bloomberg

- How to Wreck the Nation's Health, by the Numbers - Steven H. Woolf, New York Times

Fiscal News Roundup

- Trump, Republicans Rush to Overcome Internal Clashes on Tax Bill – Bloomberg

- Deficit Hawks Hate the Latest Version of the "Big, Beautiful Bill" – Axios

- Senate GOP Tax Bill Includes Largest Cut to U.S. Safety Net in Decades – Washington Post

- In a First, Trump and GOP-Led Congress Prepare to Swell Ranks of U.S. Uninsured – KFF Health News

- GOP Declares Tax-Cut Extensions 'Free' to Obscure Megabill's Cost – Wall Street Journal

- Anxious House Republicans Scramble to Forestall Senate's Medicaid Cuts – Politico

- Senate Version of Trump's Policy Bill Would Slash Medicaid Spending Even More – New York Times

- G.O.P. Bill Adds Surprise Tax That Could Cripple Wind and Solar Power – New York Times

- Senate GOP Scrambles to Save Alaska SNAP Carveout – Politico

- Donald Trump's Fiscal Policy and Fed Attacks Imperil US Haven Status, Say Economists – Financial Times

- US Dollar Suffers Worst Start to Year Since 1973 – Financial Times

- Trump Admin Customs Revenue Tops $100 Billion, Boosted by Tariffs – Axios

- Canada Axes Digital Services Tax in Push to Advance Trade Talks With U.S. – Axios

- Bush, Obama and a Tearful Bono Fault Trump's Gutting of USAID on Agency's Last Day – Associated Press

- More Than 300 Charged in $14.6 Billion Health Care Fraud Schemes Takedown, Justice Department Says – Associated Press

- Cities Lose Hope for Restarting Disaster Projects Killed by Trump – Politico

- A Texas Boy Needed Protection From Measles. The Vaccine Cost $1,400 – KFF Health News

Views and Analysis

- A List of Nearly Everything in the Senate G.O.P. Bill, and How Much It Would Cost or Save – Alicia Parlapiano, Margot Sanger-Katz, Aatish Bhatia and Josh Katz, New York Times

- How the G.O.P. Bill Saves Money: Paperwork, Paperwork, Paperwork – Margot Sanger-Katz and Emily Badger, New York Times

- The Worst Bill in Modern History – Jennifer Rubin, The Contrarian

- The Pending Senate Budget Bill Is Even More Regressive Than the Finance Panel's Version – Howard Gleckman, Tax Policy Center

- The Republican Shell Game on Tax Cuts – Ramesh Ponnuru, Washington Post

- The Most Uselessly Expensive Part of the GOP Budget Bill – Justin Fox, Bloomberg

- A 'Revenge Tax' Victory for Congress – Wall Street Journal Editorial Board

- This Is What ICE Is Doing With the Tax Dollars You Already Provide It – Philip Bump, Washington Post

- A Signature GOP Issue Is Omitted From Trump's 'Big' Tax Bill. Weird – Ray D. Madoff, Washington Post

- Distributional Effects of Selected Provisions of the House and Senate Reconciliation Bills – Yale Budget Lab

- Analysis: Senate Reconciliation Bill, One Big Beautiful Bill Act (OBBBA) – Tax Policy Center

- Want to Lead in AI? Then Don't Kill Wind and Solar – Matt Eggers, Washington Post

- The GOP Tax Bill Will Destabilize Tomorrow's Power Grid – Liam Denning, Bloomberg

- Trump Won't Let Other Countries Score Big 'Wins' in Trade Talks. Both Sides Could Lose – Daniel Desrochers and Megan Messerly, Politico

- The Independent Federal Reserve Is on Death Row – Clive Crook, Bloomberg

- How to Wreck the Nation's Health, by the Numbers – Steven H. Woolf, New York Times