Here’s what else is going on.

Lawmakers don't have much time to avoid a U.S. debt default — and the deep recession that could follow.

Echoing recent warnings from Treasury Secretary Janet Yellen, the Congressional Budget Office said Tuesday that the U.S. Treasury faces the risk of default in a matter of weeks if Congress fails to raise or suspend the federal debt ceiling.

The Treasury has already bumped up against the current debt limit of $28.9 trillion and is taking what it calls extraordinary measures to continue to meet the country’s financial obligations. As required by the infrastructure legislation recently signed into law, the Treasury must make a payment of $118 billion to the Highway Trust Fund by December 15, CBO noted, and that payment could soon force the Treasury to delay or default on other payment.

“If the debt limit remained unchanged and if the Treasury made that transfer in full, the government’s ability to borrow using extraordinary measures would be exhausted soon after it made the transfer,” the CBO said. “In that case, the Treasury would most likely run out of cash before the end of December.”

Yellen warns again: Appearing before the Senate Banking Committee on Tuesday, Yellen said that while the economic recovery from the Covid-19 crisis is “on track,” failing to raise the debt limit could be disastrous.

“I cannot overstate how critical it is that Congress address this issue. America must pay its bills on time and in full. If we do not, we will eviscerate our current recovery,” Yellen said in prepared remarks. “In a matter of days, the majority of Americans would suffer financial pain as critical payments, like Social Security checks and military paychecks, would not reach their bank accounts, and that would likely be followed by a deep recession.”

Talks in the Senate: The main obstacle to dealing quickly with the debt ceiling is the block of Republicans in the Senate, who have vowed to filibuster any attempt by Democrats to raise the limit on their own. Instead, Republicans want Democrats to use the reconciliation process to raise the limit, which Democrats says is just a strategy to eat up valuable floor time while generating plenty of material for negative GOP ads to be used in the 2022 midterm elections.

Although Senate Minority Leader Mitch McConnell (R-KY) has taken a hard line on the matter in the past, his position may be softening. Punchbowl News reports that McConnell seemed less confrontational when discussing the debt ceiling on Monday. “We’re still talking about that,” McConnell said when asked about his recent conversations with Senate Majority Leader Chuck Schumer (D-NY) on the issue.

Schumer also spoke in relatively positive terms, saying he had a “good conversation” with McConnell about raising the debt ceiling. “The talks between Schumer and McConnell are a notable shift from October, where the two regularly traded fire as they dug into their positions,” said The Hill’s Jordain Carney.

One possible compromise: An option that appears to be gaining momentum is for Democrats to raise the debt ceiling in a standalone reconciliation bill, Punchbowl reports, with Republicans agreeing to limit their delaying tactics and messaging votes. All 50 Republican senators would have to agree to that approach, however, and it’s not clear that McConnell can produce that level of cooperation.

One notable Republican is pushing hard against any cooperation on the matter. Former President Donald Trump released a statement Tuesday calling on Republican senators to use the debt ceiling to wage war on the Democrats’ agenda.

“Old Crow Mitch McConnell, who is getting beaten on every front by the Radical Left Democrats since giving them a two-month delay which allowed them to 'get their act together,' must be fully prepared to use the DEBT CEILING in order to totally kill the Democrat’s new Social Spending (Wasting!) Bill, which will change our Country forever,” Trump said.

“Use the Debt Ceiling, Mitch, show strength and courage,” Trump added. “Our Country is being destroyed.”

Quote of the Day: Fed May Withdraw Pandemic Support ‘a Few Months Sooner’

“At this point, the economy is very strong, and inflationary pressures are high and it is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at the November meeting, perhaps a few months sooner.”

– Federal Reserve Chairman Jerome Powell, indicating in testimony before the Senate Banking Committee on Tuesday that the central bank may speed up its plan to withdraw the economic support it has been providing via $120 billion in monthly purchases of Treasury bonds and mortgage-backed securities.

Powell said that the threat of persistently higher inflation has grown and that the price gains seen recently are now likely to linger at least into the middle of next year. He noted, though, that Fed policymakers will be monitoring new labor market and inflation data as well as updates about the omicron variant before their next meeting, scheduled for December 14 and 15.

Earlier this month, Powell stressed that Fed tapering should not be interpreted as a signal that interest rate hikes will quickly follow, saying that the central bank still wanted to see the labor market heal further. Still, the prospect that the Fed may act more aggressively than previously indicated as it focuses more closely on fighting inflation — combined with growing concern about the omicron variant — was enough to rattle markets again Tuesday. Major stock indexes fell close to 2% on the day, and market expectations for an accelerated pace of Fed rate hikes jumped.

Biden Officials Studying Whether More Money Will Be Needed to Fight Omicron Variant: Report

The White House Office of Management and Budget and other Biden administration officials are looking into how much funding they have available to redirect to respond to needs that may arise as a result of the new omicron variant of the coronavirus, The Washington Post reports:

The bottom line: Any White House push for a new round of emergency funding could lead to some political sparring and debate about what existing funding to shift toward omicron response, but G. William Hoagland, a budget expert with the Bipartisan Policy Center, told the Post that Congress would likely move quickly and avoid messy fights if it becomes clear that more money is needed. “I think it’s far too early to determine ‘what is needed for omicron,’ but given our history if this becomes an issue I doubt there’s any question that the resources will be there,” he said. “I don’t see a domestic political fight happening over omicron.”

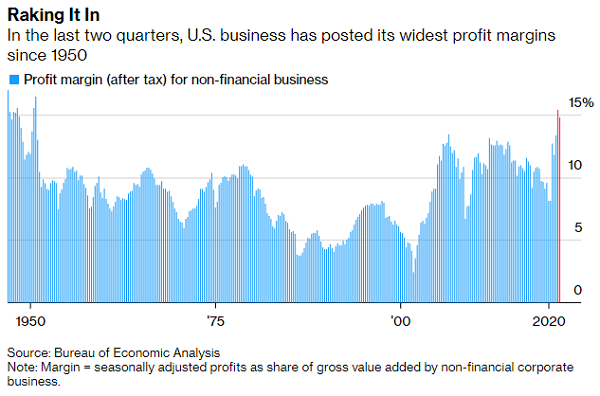

Chart of the Day: Surging Corporate Profits

Over the last two quarters, U.S. non-financial businesses have posted the largest profit margins since 1950, according to Bloomberg News. Those results indicate that the economy is strong and that inflation isn’t yet a threat to the recovery, Robert C. King, director of research at the Jerome Levy Forecasting Center, told Bloomberg.

The record profits also suggest that complaints from business owners and executives about the soaring cost of labor and materials need to be taken with a grain of salt. While individual firms may struggle to provide higher pay, “businesses in the aggregate can safely say that when they spend more money on workers, that’s going to be a situation where there is more revenue coming back to them” as workers spend their paychecks, King said.

Still, the race between higher costs and higher profits isn’t over. Over the past year and a half, worker incomes have been boosted by fiscal policies that provided an increase in aggregate income and a big jump in savings during the Covid-19 crisis, but many of those policies have come to an end, which could cool consumer spending. And if the Federal Reserve takes steps to reduce inflation by raising interest rates, the surge in both incomes and profits could come to a screeching halt while producing a new round of conflict between worker demands for higher pay and business efforts to maintain fat profit margins.

News

- Leaders Point Fingers as Defense Bill Remains Stalled in the Senate – Roll Call

- Democrats' December Dread Builds After Defense Stumble – Politico

- Schumer Eyeing Build Back Better Vote as Soon as Week of Dec. 13 – The Hill

- Manchin Holds Off on Committing to Moving Biden Agenda This Year – Bloomberg

- Biden Reconciliation Bill Faces Senate Land Mines – The Hill

- GOP Courts Anti-Vaxxers With Jobless Aid – Axios

- Janet Yellen Still Supports a Plan to Make Banks Give the I.R.S. New Customer Data – New York Times

- As Biden Pushes to End the Pandemic, Omicron’s Emergence Points to a Longer Struggle – Washington Post

- Omicron Mutations Alarm Scientists, but New Variant First Must Prove It Can Outcompete Delta – Washington Post

- Vaccine Mandates Are in Limbo While Employers Wait Out Biden Rules – Bloomberg

- Moderna Chief Predicts Existing Vaccines Will Struggle With Omicron – Financial Times

- FDA Panel Narrowly Endorses Merck’s Covid Pill, Despite Reduced Efficacy and Safety Questions – CNBC

- Biden Names Former Air Force Acquisition Head as Top Pentagon Weapons Buyer – The Hill

Views and Analysis

- Red States Are Now Paying People Not to Get Vaccinated – Catherine Rampell, Washington Post

- Is McConnell Going Soft on the Debt Limit? There’s a Lesson Here for Democrats –Paul Waldman and Greg Sargent, Washington Post

- Health Funding Is on the Line on Capitol Hill – Rachel Roubein, Washington Post

- What Europe Can Teach Us About Jobs – Paul Krugman, New York Times

- The Republicans’ Sweeping Plan to Sabotage Biden’s Presidency – Paul Waldman, Washington Post

- On the Trans-Atlantic Price Gap – Paul Krugman, New York Times

- Only Winning Over Skeptics Can Avoid Shocks Like Omicron – David Fickling, Bloomberg

- Omicron Should Push Retailers to Deploy Vaccine Mandates – Timothy L. O’Brien, Bloomberg

- How Democrats Learned to Expect the Worst – Jonathan Bernstein, Bloomberg

- How Biden and Trump Actually Compare on Coronavirus Deaths – Aaron Blake, Washington Post

- South Africa Deserves a Big, Fat Prize – Peter Coy, New York Times