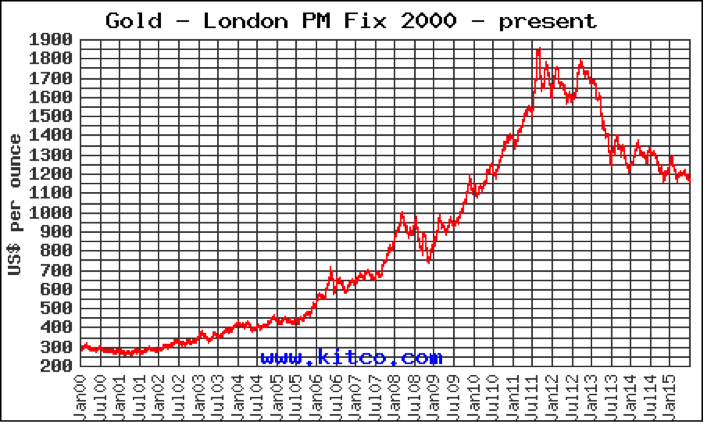

As the price of gold continues to tumble, even the gold bulls are having second thoughts about their precious metal. Gold was selling for $1,108 an ounce in New York on Monday, down 2 percent on the day. The metal is down 6.4 percent year-to-date, and down 15.7 percent over the last 12 months. Since a peak price near $1,900 an ounce in 2011, gold has fallen about 43 percent.

The slide seems to be gathering strength, with many analysts calling for a continued decline in the weeks ahead. Here are five reasons gold is heading lower:

1. Chinese Gold. On Friday, the People’s Bank of China reported a smaller stockpile of gold than some analysts had expected. The bank owns 1,658 tons of the shiny stuff, implying purchases of about 100 tons per year. While this suggests that China is still interested in buying gold to diversify its national holdings, the smaller-than-expected number spooked some investors, who were hoping to see larger holdings and plans for future purchases.

2. China Slowing. China’s slowing growth is weighing on the global economy. Slower growth means China will consume less of all commodities, including gold, and less consumption by China means lower prices.

Related: Oil Markets Have Nothing to Fear from Iran

3. Dollar Strength. The dollar continues to strengthen as the U.S. economy keeps chugging along. With impressively robust financial markets and moderate interest rate hikes on the horizon, more international investors are heading to the U.S. The more the U.S. looks like a safe bet, the less interest there is in safe havens like gold. Indeed, the long-term argument against gold is that it serves only as an emergency store of value during financial crises. When the chance of panic is low, gold’s price falls.

4. Greek Deal. The announcement of a deal to address Greece’s debt problem seems to have reduced the threat of financial crisis in Europe. And even if the debt deal falls apart, there’s a growing consensus that Europe can handle Greece without going all to pieces. Less panic about Greece means lower gold prices.

5. Technical Trading. Gold has just fallen through the $1,100 per ounce level, so it’s a good bet that numerous computer-driven trading programs kicked in with automatic sell orders. That may explain why gold has seen such a big fall over the last few days. But the trading algorithms are simply pushing on an already negative trend, and as yet there’s no bottom in sight for gold investors.