The Medicare and Social Security trust fund trustees reported on the long-term solvency of the country’s two largest entitlement programs on Wednesday, and as usual, provided projected insolvency dates for the various funds under their supervision. Then, they asked everyone to try not to pay very much attention to those insolvency dates.

The dates have become a sort of touchstone for how people think about the programs. Medicare, it turns out, has enough in its Hospital Insurance Trust Fund to continue paying benefits at current levels until 2030, when it will run dry. After that, dedicated tax revenues under current law would allow the program to pay out only 86 percent of scheduled benefits. Its other major funds, which cover Part B and Part D, are projected to remain solvent indefinitely because they are funded automatically, but they are becoming increasingly costly.

Related: Billion Dollar Drugs – America’s Top 10 Selling Medicines

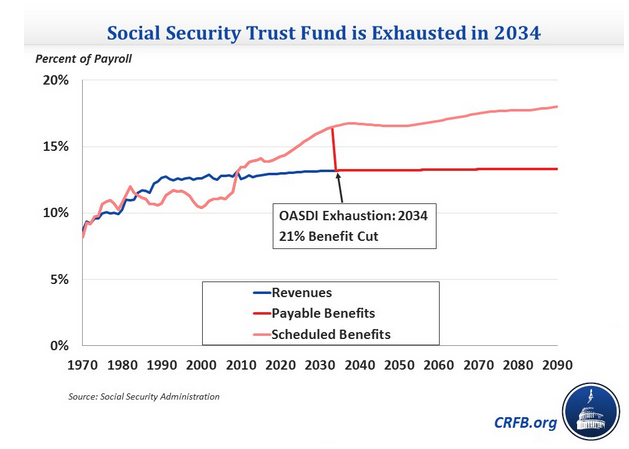

Social Security, by contrast, faces a more immediate threat. The program has two trust funds, one for its Disability Insurance benefit and one for retirement benefits. Combined, they have enough money to guarantee benefit payments until 2034, but they are drastically out of balance. The DI fund will run out of money in 2016, unless Congress OKs a transfer of money between the two funds, and will be forced to cut benefits to 81 percent of what beneficiaries are due under current law.

But again, with the possible exception of the looming threat to the SSDI program, the trustees said they would prefer that the public not focus too much on the insolvency dates.

Trustee Charles Blahous, of Stanford University’s Hoover Institution tried to explain why. Imagine, he said, that the goal of fixing Social Security’s finances is to be achieved by maintaining benefit levels for current retirees, but constraining the growth of benefits going to new enrollees.

“If you employed that strategy, you would have to reduce benefits by roughly 19.6 percent for everyone becoming newly eligible,” Blahous said. “But if instead we delayed action, and applied that same strategy when the combined trust funds were nearly depleted in 2034, by then even a complete cutoff in benefits – 100 percent to those newly eligible – would not be enough to avoid trust fund depletion.

Related: Major Welfare Reform Effort Flying Under the Radar

“We can see that the last thing we need is continued delay,” he said, calling for “prompt enactment of legislation to address Security’s imbalances before they grow too large to fix.”

Trustee Robert Reischauer, the president of the Urban Institute and former head of the Congressional Budget Office, reinforced Blahous’ point. “Don’t focus on the date of trust fund depletion,” he said. “Focus on a more nuanced analysis of these reports.”

The bottom line, he said, is that “under current law both of these vitally important programs are on a fiscally unsustainable path if one looks out several decades.

“The sooner lawmakers act, the less disruptive these unavoidable policy changes will be. Similarly, the sooner that lawmakers act, the broader will be the array of policy options that can be considered.”

Related: Democrats Call for Major Change in Social Security

If the prescriptions and pleas for legislative attention sounded familiar Wednesday, it’s because they were.

“All that has really changed is that it’s one year since the last trustees report,” said Kathy Ruffing, a senior fellow at the Center on Budget and Policy Priorities who studies the Social Security Program. “Nothing else is much different.”

The trustees report identifies a problem that is “challenging but manageable,” she said, “…if policymakers crafted a sensible policy package reasonably soon.”

The longer they wait, the more challenging, and less manageable it will become, especially if an idea to increase benefits, currently making the rounds of Democratic lawmakers, including presidential candidate Bernie Sanders, were to find legislative purchase. However, that might require a Democratic takeover of both Houses of Congress, and the trust funds could both be bankrupt by the time that happens, anyway.