When Congress returns next month, one of the pressing issues it will face is how to deal with the looming sequester — the automatic cuts to defense and non-defense spending put in place as part of the Budget Control Act of 2011. The cuts will slash tens of billions of dollars from both the Department of Defense and the various agencies, including social services and other assistance programs, unless Congress reaches some sort of deal to lift the spending caps.

The cuts to defense, given the rise of ISIS and the increasingly belligerent stance of the Russian government, have caused a lot of alarm in national security circles, where warnings about damage to U.S. readiness abound.

Related: How the Pentagon Cooks the Books to Hide Massive Waste

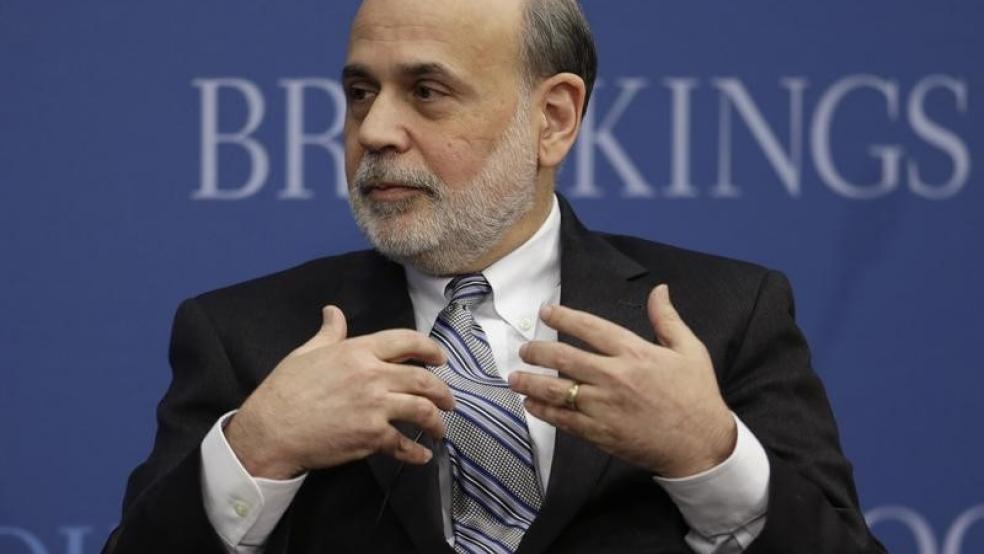

On Monday, another prominent voice raised objections to slashing defense spending, but did so from the perspective of an economist. Former Federal Reserve Board Chairman Ben Bernanke, in an event sponsored by the Brookings Institution, said that the sequester is, simply, bad economic policy.

The sequestration cuts were ostensibly put in place out of concern over the increasing national debt and annual budget deficits. The cuts were never intended to go into effect — they were considered so draconian that they would force members of Congress to agree on an alternative plan to address federal spending.

Bernanke, now a distinguished fellow in residence at Brookings, said it was “wrong” to slash near-term military spending to address long-term debt and deficits. “It’s a mistake,” he said. “There is nothing in our deficit prospect that should make us distort our defense planning in the near term. We should be making our decisions based on medium-term considerations, based on what make the most sense for efficiency, in terms of achieving our objectives. There’s no reason for draconian steps right now that will have long run costly implications for our defense posture just for deficit reasons.”

Related: The $1 Trillion Question for the F-35 – Is the U.S. Buying an Inferior Plane?

Bernanke added that there has always been a fundamental mismatch between short-term spending cuts and long-term management of the federal debt and deficit. “While there is a lot of talk about the long run problems of the deficit, they’re really long run; they’re not short run,” Bernanke said. The debt-to-GDP ratio is now about 75 percent, he said, and the Congressional Budget Office projects that it will rise to 77 percent in 10 years. “So it’s pretty flat,” Bernanke said. “The next few years, deficits are down to about 2.5 percent of GDP, which is pretty low. So we’re not looking at a big increase in the deficit over the next 10 years or so.”

Ten years out, he said, deficits start to rise again, but not primarily due to defense spending. So slashing military spending now wouldn’t really address the long-term drivers of the national debt, anyway. “One of the great aphorisms about the federal government is that the federal government is basically an insurance company with an army,” Bernanke said, referring to social insurance programs such as Medicaid and Medicare. “It’s the insurance part that’s the costly part.”

Related: Marine Corps Declares Its Problem-Plagued F-35 Ready for Combat

Asked about the interplay between the federal debt and deficit and national defense during a question and answer session, Bernanke said concerns are justified — but only over the long term.

“Short run, I think we’re fine,” he said. “But over the longer term we do need to think about resource constraints on our economy and make sure that we are not undertaking on commitments globally and militarily that our economy can’t sustain in the long term.”

Bernanke’s assessment makes sense in the short run. But how will Congress keep a lid on defense spending in the long-run when over the last 19 years, it can’t account for the more than $8.5 trillion it spent?