If a deal struck last year to delay implementation of three new taxes associated with the Affordable Care Act turns permanent, either through legislation explicitly repealing them or repeated deals to delay them, the cost to the Treasury Department’s bottom line will be high in the relative near term, but enormous in the long term.

An analysis by economist Paul Van de Water, of the Center on Budget and Policy Priorities, finds that over ten years, failure to implement the so-called Cadillac Tax on high-value employer-provided health care plans, a tax on medical devices, and a tax on health insurance providers would cost the government $256 billion.

Related: Obamacare Enrollment Stalls as Projections Are Slashed by 8 Million

Over a second decade, though, the cost would jump to $850 billion, for a 20-year total, including interest on the resulting increase to the national debt, of about $1.4 trillion.

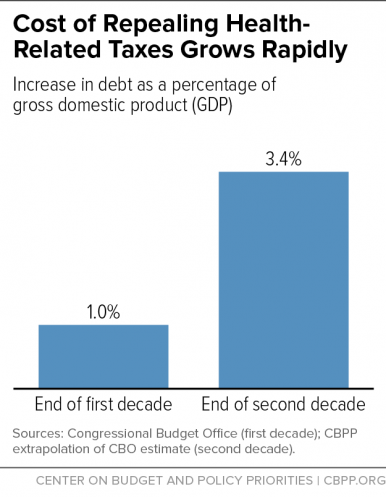

Van de Water notes that those numbers have a serious impact on the relationship between the federal debt and Gross Domestic Product. Over the first ten years, failing to implement the taxes can be expected to add a full percentage point to the ratio of federal debt to GDP. Over the second ten years, though, it would add 3.4 percentage points to that ratio.

Of the three taxes, it’s the Cadillac tax that raises the lion’s share of the revenue.

“There’s a particularly strong policy rationale for retaining the excise tax on high-cost plans (while modifying it to address various concerns), as it raises the most revenue of the three taxes in the long run and has the potential to help slow the rate of growth of health care costs,” writes Van de Water. “The tax preserves but limits the tax exclusion for employer-sponsored health insurance. Initially, the excise tax won’t affect most workers and health plans, since its thresholds for imposing the tax substantially exceed the value of the typical plan.”