An analysis of Sen. Ted Cruz’s tax reform proposal finds that the plan would slash federal revenues so deeply that even if the entire Defense Department budget were eliminated, it would still increase the federal deficit and debt.

The Republican presidential contender’s plan would also deliver the top 0.1 percent of earners in the U.S. average annual tax savings of about $2 million. Meanwhile, the bottom 20 percent of earners would net $46, even as the plan put downward pressure on wages, according to the detailed analysis of the plan conducted by the non-partisan Tax Policy Center, a joint project of the Brookings Institution and the Urban Institute.

Related: The GOP’s Blind Spot on Defense Spending Will Explode the Debt

TPC director Len Burman called the plan “very regressive,” but noted that it does have positive elements. It would vastly simplify tax filing for the majority of taxpayers by removing almost all deductions and collapsing the personal income tax rate structure to a single 10 percent bracket. It would also effectively make all savings tax exempt, reduce many of the tax-related distortions in how capital is allocated across the economy and would generally increase incentive to work, save and invest.

The plan would also eliminate payroll taxes, estate and gift taxes and the corporate income tax.

“The giant caveat is that unless the reduction in revenue were offset by spending cuts, increased government borrowing would push up interest rates and crowd out private investment, negating some or all of the plan’s positive incentive effects,” said Burman in a conference call with reporters.

The TPC analysis estimates that the Cruz plan would result in a net decrease in federal revenues of $8.6 trillion over the first 10 years, and an additional $12.2 trillion over the over the following decade, not including the effect of increased interest rates on government borrowing and possible macroeconomic effects.

“The Cruz plan would require unprecedented spending cuts to avoid adding to the federal debt,” the report concluded. “We estimate that the plan would reduce revenues by $935 billion in 2025 (before considering macroeconomic effects).”

Related: Rubio’s Tax Plan Would Be a Budget-Buster

The report goes on to note that, given Congressional Budget Office estimates of federal spending over the next decade, “Congress would need to cut projected program spending by nearly 18 percent to prevent the plan from adding to the deficit in 2025. If Congress eliminated all defense spending (about $711 billion), it could not meet this goal. It would need to cut discretionary spending by 67 percent, or about 34 percent of all Medicare and Social Security spending, to offset the direct revenue loss.”

A centerpiece of the Cruz plan is replacing the federal corporate income tax with what his campaign calls a “business flat tax,” which many economists recognize as a Value Added Tax. According to TPC, the tax would be “based on the difference between a firm’s sales and its purchases from other businesses, which is equal to the value-added of the business.”

The VAT would be much simpler than the current system. It would have multiple side effects, though — not least of which is that, by making labor costs non-deductible as a business expense, it would drive down wages. Also, by moving to a consumption-based system and eliminating taxes on almost all savings and investment, the plan has a built-in benefit for the wealthy, who typically save more and spend less of their income on a percentage basis than lower-income individuals.

Related: 8 Red Flags that Could Trigger an IRS Tax Audit

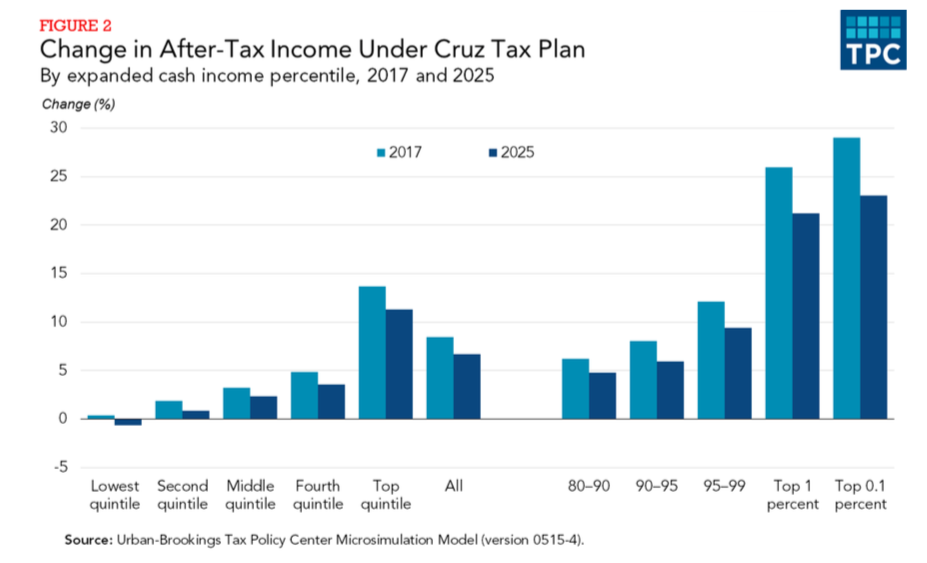

“On average, households at all income levels would receive tax cuts,” TPC found, “but the highest-income households would receive the largest cuts, both in dollars and as a percentage of income.

“The highest-income 1.0 percent would get an average tax cut of over $400,000 (26 percent of after-tax income), and the top 0.1 percent would get an average tax cut worth nearly $2 million, 29 percent of after-tax income. By contrast, the lowest-income households would receive an average tax cut of $46, or 0.4 percent of after-tax income. Middle-income households would receive an average tax cut of nearly $1,800, or about 3 percent of after-tax income.”

Cruz has presented his plan as a revolutionary change that would spark an economic boom while benefiting all Americans, regardless of income level.

“Imagine 4.9 million new jobs,” he has said. “Instead of Obama’s income stagnation, imagine average wages rising 12.2 percent over the next decade. Capital investment rising 43.9 percent. And every income-level seeing double-digit increases in after-tax income. Imagine exports and manufacturing jobs booming. Our trade deficit falling as the tax bias against American-made goods is eliminated. Imagine a 10 percent income tax, with every American filling out his or her taxes on a postcard or iPhone app. And abolishing the IRS as we know it.”

Related: Hacked Again. Can the IRS Protect Your Tax Info This Year?

But the bottom line, according to the TPC’s analysis, is much grimmer.

“[T]he proposal would significantly change the distribution of federal tax burdens by reducing taxes dramatically for households at the very top of the income distribution and by providing little change or even higher taxes for households at the bottom of the distribution,” the report found. “In addition, barring extraordinarily large cuts in government spending or future tax increases, it would yield persistently large, and likely unsustainable, budget deficits.”

Rather than lead to economic boom times, said TPC director Burman, Cruz’s plan would have the exact opposite effect.

“The plan by itself, not considering the unspecified spending cuts, would almost surely depress the economy over the long run,” he said.