The stock market can’t vote in November, but an analysis of how investors reacted in real time to the first presidential debate last month and to the release of tapes damaging to the Donald Trump campaign suggest that if it could, it would be backing Democrat Hillary Clinton. That’s according to a new paper from economists Justin Wolfers of the University of Michigan and Eric Zitzewitz of Dartmouth which looked at real-time reaction to the first presidential debate, held late last month.

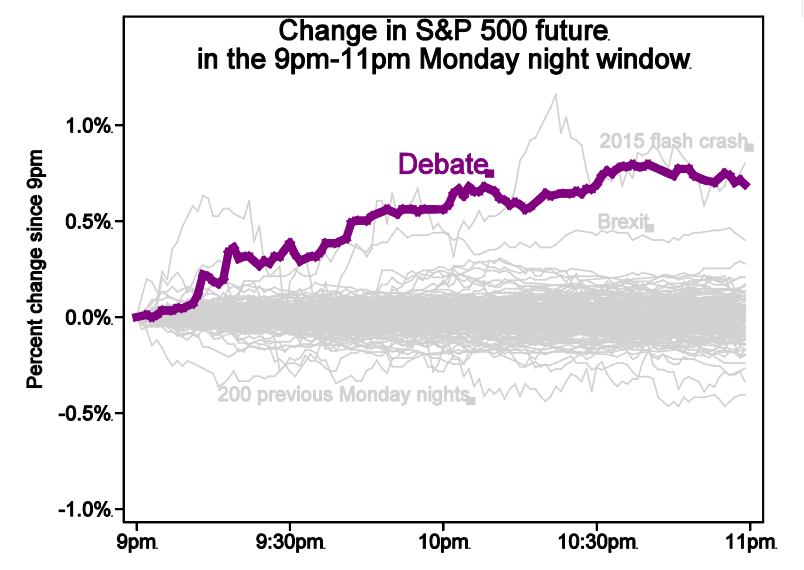

The authors, both member of the National Bureau of Economic Research, looked at movement in the Standard & Poor’s 500 index during the hours from 9 p.m. to 11 p.m. on September 26, the night of the debate and found that the price of futures contracts went significantly higher, by 0.71 percent, as the contest went on and Clinton was increasingly seen as the hands-down winner.

Related: Trump’s Terrible, Horrible, No-Good, Very Bad Electoral Map

“Given that most financial markets are typically quiet during that time, movements in asset prices likely reflect market participants’ collective view of the impact of the 2016 election,” the authors write.

But the S&P was not the only indicator that reacted positively to the increased likelihood of a Clinton presidency.

“During the debate event window, U.S., UK and Asian stock markets rose, crude oil rose, the currencies of trading partners such as Mexico, South Korea, and Canada rose against the dollar, and expected future U.S. stock market volatility dropped sharply,” they continue.

“Given the magnitude of the price movements, we estimate that market participants believe that a Trump victory would reduce the value of the S&P 500, the UK, and Asian stock markets by 10-15%, would reduce the oil price by $4, would lead to a 25% decline in the Mexican Peso, and would significantly increase expected future stock market volatility.”

Related: Trump Will Lose This Election, but Guess Who Destroyed the GOP?

Wolfers and Zitzewitz also looked at the market reaction over the weekend of October 7-9, after a tape on which Trump was shown bragging about sexually assaulting women with impunity rocked his campaign.

Market movements over that weekend “tell a largely consistent story,” they write. “Clinton's probability of election rose, stocks rose, volatility fell, and the currencies of Mexico and Canada rose against the dollar.”

One of the bedrock claims of the Trump campaign has been that the former reality television star and real estate mogul is the best qualified candidate to spur economic growth and job creation. However, the message doesn’t appear to have resonated with investors.