Tax reform may have moved to the back burner for the Trump administration, but that doesn’t mean that people in the executive branch aren’t thinking about it. One of the big ideas reportedly getting its turn in the sun is repeal of the federal income tax deduction for state and local taxes.

According to Axios, the idea is gaining currency with Gary Cohn, the former head of Goldman Sachs who now serves as President Trump’s top economic adviser.

Related: The Best and Worst States for Taxes in 2017

One of the reasons it is looking attractive is that the Trump administration and its allies in Congress are determined to slash income tax rates on both businesses and individuals but need to find a way to replace lost revenue. A way to do that is to go after “tax expenditures” -- exceptions and allowances that reduce taxes that individuals and businesses would otherwise owe.

The state and local tax deduction is one of the largest tax expenditures on the books. It allows taxpayers to deduct taxes paid to states and municipalities -- primarily income and personal property taxes, but also sales tax in some cases -- from their federal tax bills. It will cost the Treasury an estimated $97 billion in 2017 and $1.3 trillion over the next 10 years.

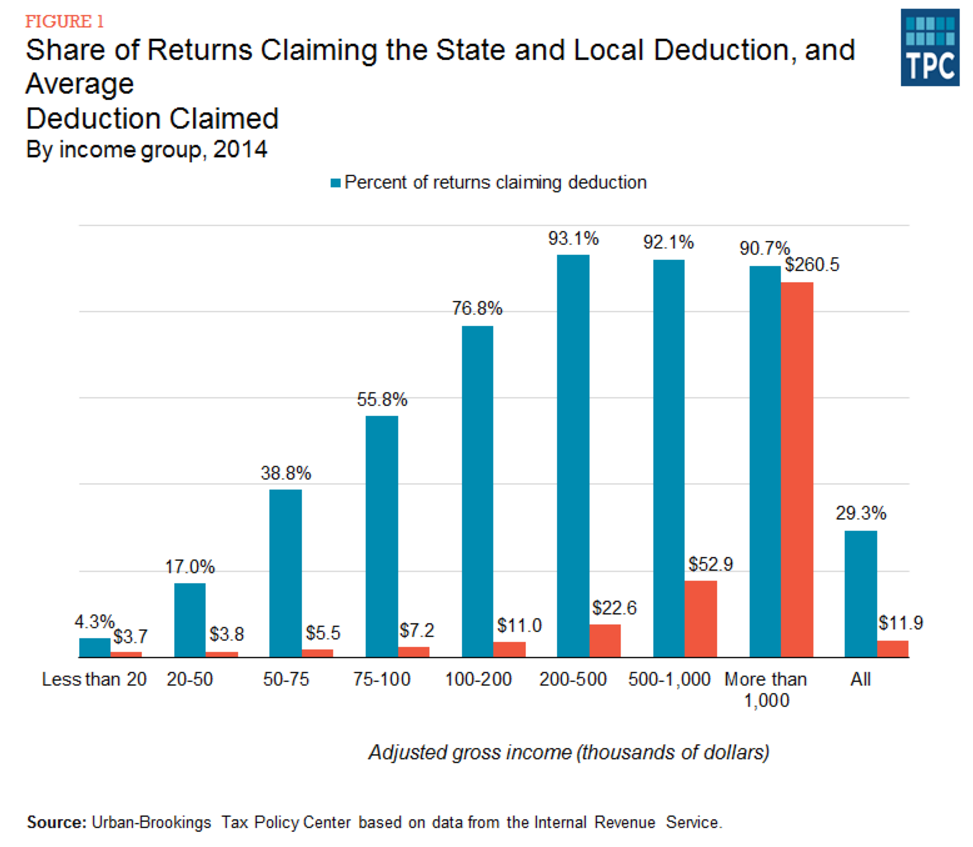

Eliminating any major tax expenditure is politically fraught, but there are reasons to believe that the state and local tax deduction is a more viable target than many because it primarily benefits higher-income earners.

Related: Behind the Campaign to Kill the Trillion-Dollar Border-Adjustment Tax

The deduction can only be claimed by taxpayers who itemize their returns, something only about one-third of Americans do in the first place. The overwhelming majority of itemized filers take the state and local deduction, and the benefit of the deduction accrues disproportionately to Americans who earn more than $100,000 per year, about twice the median income in the U.S.

According to the Tax Policy Center in Washington, the top 16 percent of households by income account for 75 percent of the state and local tax deductions claimed every year, with an average claim of $12,300. For the very wealthy, that deduction rises dramatically. People earning a million dollars a year claim an average deduction of $261,000.

One point worth noting is that while the pain of eliminating the deduction would not be spread evenly across income levels, it also won’t be spread evenly by geography. Individuals in states with relatively high income taxes and relatively high levels of per capita income would lose much more than residents of low-tax, low-income states.

In Maryland, New Jersey and Connecticut, for example, more than 40 percent of taxpayers claim the state and local deduction, with average claims of $12,400, $17,200 and $18,900 respectively. Other high tax states would also be disproportionately affected. In New York, more than 30 percent of filers take the deduction, claiming an average $21,000, the highest in the country.

The pain would be much lower in states like Texas, where fewer than 30 percent of taxpayers claim the deduction, with an average claim of $7,600, or South Dakota, where fewer than 20 percent claim it, with an average claim of $5,800.

Related: Trump’s Wall, By One Estimate, Could Cost $70 Billion

Interestingly, the elimination of the deduction would also increase the disparity between so-called “donor” states, which send more in taxes to Washington than they receive in federal benefits, and “dependent” states, which take in more federal funding than they pay for in taxes.

Of the 18 states in which 30 percent or more of taxpayers take the state and local deduction on their federal taxes, all but four are donor states. And it won’t be lost on Trump that the majority of those states also tend to vote Democratic in presidential elections.